- 9 September 2023

- No Comment

- 200

A Comprehensive Guide For Individuals On Secured And Unsecured Loans

Are you caught in the web of secured and unsecured loan confusion, unsure of which path to take? If so, you’re in the right place. Hey there, I’m Nabeel — a seasoned Chartered Accountant with a remarkable 17-year journey through the worlds of investment banking, management consulting, and entrepreneurship. In this blog post, I’m your guide on a loan-explaining adventure. Instead of diving into the loan web blindly, join me as I uncover the mysteries of lending, empowering you with knowledge and confidence every step of the way.

Individuals often find themselves in need of financial assistance for various reasons. Whether it’s for covering unexpected medical bills, financing a home renovation project, or pursuing higher education, loans can be a valuable tool to help bridge the gap between expenses and available funds.

Different Financial Institutions offer a wide range of loan options, catering to diverse needs and financial situations. In this comprehensive guide, we will explore the various loan options available to individuals, focusing on secured and unsecured loans.

Secured And Unsecured Loans

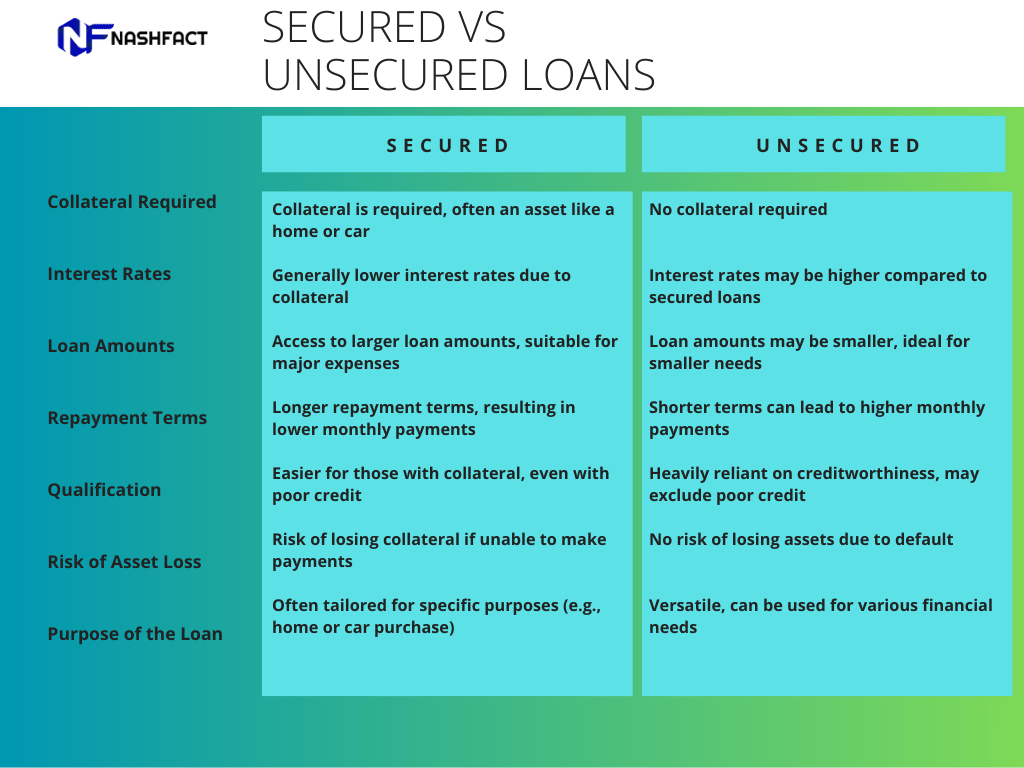

Before we jump into the specific loan options, it’s important to understand the fundamental difference between Secured and Unsecured Loans.

Secured Loans

Secured loans are loans backed by collateral, which is an asset you pledge to the lender. If you fail to repay the loan, the lender can seize the collateral to recover their losses. The collateral can be a valuable asset, such as your home, car, or savings account. Secured loans typically have lower interest rates compared to unsecured loans because the lender has a form of security in case of default.

Unsecured Loans

Unsecured loans, on the other hand, do not require collateral. Lenders approve these loans based on your credit report, income, and other factors, which can differ from one lender to another. Unsecured loans are riskier for lenders, which is why they often come with higher interest rates compared to secured loans.

Now that we have a basic understanding of these two loan types, let’s explore the various loan options available to individuals.

Unsecured Loans – A Versatile Loan Option

Unsecured loans, as the name implies, don’t need collateral and can be used for various purposes, making them versatile. Unlike secured loans that require collateral, unsecured loans rely primarily on the borrower’s creditworthiness and ability to repay the loan. Here are some common types of unsecured loans:

Personal Loans

Personal loans are offered by banks, credit unions, and online lenders. They are generally unsecured loans with fixed interest rates and monthly installment payments. Borrowers can use them for a wide range of purposes, including debt consolidation, home improvements, medical expenses, or even a dream vacation.

Payday Loans and Cash Loans

Payday loans and cash loans are short-term, high-interest loans typically due on the borrower’s next payday. These loans are often used for emergency expenses but come with higher interest rates and fees. It’s important to exercise caution when considering these options.

Student Loans

Student loans are specialized personal loans designed to finance higher education expenses. They can be obtained from the federal government or private lenders. Federal student loans usually offer more favorable terms, such as lower interest rates and income-driven repayment options.

Credit Cards

Credit cards provide borrowers with a revolving line of credit that can be used for everyday purchases, emergencies, or larger expenses.

Key Aspects of Unsecured Loans

Now, let’s shift our focus to the key aspects of unsecured loans.

Credit Scores

Qualifying for an unsecured loan typically depends on your credit score, income, and financial history. Lenders assess your creditworthiness to determine the interest rate and terms they can offer. A higher credit score often results in low-interest rates, making unsecured loans an attractive option for those with good credit.

Interest Rates and Terms

Interest rates on unsecured loans can vary widely depending on the lender, your credit profile, and the loan amount. These loans usually come with fixed interest rates, meaning your monthly payments remain consistent throughout the loan term. Loan terms can range from one to five years, providing flexibility to borrowers.

Loan Amounts

The loan amounts for unsecured loans can vary from a few hundred dollars to tens of thousands of dollars, depending on the lender and your creditworthiness. Borrowers can choose the loan amount that aligns with their specific financial needs.

Unsecured Loan Application Process

Since no kind of security must be presented and verified, applying for an unsecured loan is frequently simpler and quicker.

- Check Your Credit: Assess your credit score as it plays a pivotal role in unsecured loan eligibility.

- Compare Lenders: Obtain quotes from various lenders to gauge potential loan options. Keep in mind that quotes don’t guarantee approval.

- Prepare Documents: Collect necessary documents, including personal, contact, employment, income, and debt information, such as pay stubs and proof of debts.

- Complete Application: Fill out the loan application online or in person, depending on the lender.

- Review & Accept Offer: If approved, carefully review loan terms and ensure monthly payments are manageable before accepting any offers.

- Sign & Receive Funds: Sign the loan agreement and receive funds through direct deposit, payment to creditors, or a check, depending on the lender and loan type.

Secured Loans: Collateral-Backed Borrowings

Moving on, let’s discuss secured loans, which are backed by collateral. Secured loans are a type of borrowing that requires collateral, which serves as an asset pledged by the borrower to secure the loan. This collateral provides the lender with a guarantee that they will recoup their funds if the borrower defaults on the loan. Here are some common types of secured loans:

Mortgage Loans

A mortgage loan is one of the most common and substantial types of secured loans available in the USA. It is primarily used for purchasing real estate properties, such as homes and commercial buildings. The property itself serves as collateral, and if the borrower fails to make payments, the lender can foreclose on the property to recover the investment.

Auto Loans

Auto loans are another prevalent form of secured lending. As the name suggests, these loans are used to finance the purchase of vehicles, whether new or used. The automobile serves as collateral for the loan, and if the borrower defaults, the lender can repossess the vehicle to cover their losses.

Home Equity Loans and HELOCs

Homeowners can tap into the equity they have built in their homes through home equity loans and Home Equity Lines of Credit (HELOCs). These loans allow individuals to borrow against the value of their homes while using their property as collateral.

Secured Loan Application Process

The application process for secured loans involves some additional steps related to collateral. Here’s a breakdown:

- Prequalification Check: Start by determining if you prequalify. Fill out an online available form to connect with potential personal loan lenders based on your creditworthiness.

- Gather Personal Information: Have your personal and contact details ready, including your Social Security number, employment and income information, and a government-issued ID.

- Prepare Collateral Documents: If you’re using an asset as collateral, gather documentation related to that asset.

- Complete Application: Apply online or in person, depending on the lender’s requirements.

- Wait for Decision: Some lenders provide instant decisions, while others may take a few days to process your application.

- Additional Documentation: Upon approval, you might need to verify the information you provided and details about the collateral.

- Sign Closing Documents: If you accept the loan offer, sign the necessary closing documents to access your funds.

Choosing Between Secured and Unsecured Loans

Deciding between secured and unsecured loans depends on individual circumstances, financial goals, and risk tolerance. Here are some factors to consider when making your choice:

Risk Tolerance and Collateral

If you are risk-averse and want to minimize the potential loss of assets, unsecured loans, including personal loans, maybe the better option since they do not require collateral.

Loan Amount and Purpose

The amount you need to borrow and the specific purpose of the loan can influence your choice of loan type. Secured loans often allow access to larger loan amounts, making them suitable for significant expenses like home purchases or major renovations.

Creditworthiness

Your credit score and financial history play a crucial role in determining your eligibility for unsecured loans. If you have a strong credit profile, you may qualify for lower interest rates on unsecured loans.

Repayment Ability

Assess your ability to make regular payments before taking out any loan. Defaulting on a secured loan can result in the loss of collateral, while unsecured loans can lead to damage to your credit score.

Crucial Pre-Borrowing Steps to Ensure Financial Wellness

Before borrowing a loan, whether secured or unsecured, there are several important steps and considerations to keep in mind. These steps can help you make informed financial decisions and ensure that taking out a loan aligns with your overall financial goals:

Assess Your Financial Situation

Take a close look at your current financial standing. Evaluate your income, expenses, and existing debts. Understand your monthly budget to determine how much you can comfortably allocate toward loan payments.

Budget and Repayment Plan

Create a detailed budget that accounts for the new loan payments. Ensure that you have a solid repayment plan in place and that adding a new loan to your financial responsibilities won’t strain your budget.

Check Your Credit Score

Obtain a copy of your credit report and check your credit score. Your credit score plays a significant role in determining your eligibility for loans and the interest rates you’ll receive. If your credit score is less than ideal, consider steps to improve it before applying for a loan.

Research Lenders

Compare loan offers from various lenders, including banks, credit unions, and online lenders. Look at interest rates, terms, fees, and customer reviews. Choose a reputable lender with favorable terms that meet your needs.

Understand Loan Terms

Carefully read and understand the terms and conditions of the loan agreement. Pay attention to the interest rate, repayment schedule, any prepayment penalties, and other relevant terms. Don’t hesitate to ask the lender for clarification if you have questions.

Calculate Total Loan Cost

Calculate the total cost of the loan over its entire term, including interest and any fees. This will give you a clear picture of how much you’ll actually pay for borrowing the money.

Seek Professional Advice

If you’re uncertain about the loan terms or how it fits into your overall financial plan, consider seeking advice from a financial advisor or credit counselor. They can provide personalized guidance based on your specific circumstances.

By taking these steps and thoroughly evaluating your financial situation and loan options, you can make a well-informed decision when it comes to borrowing money.

Both secured and unsecured, offer versatile solutions for various expenses, from home improvements to education. Secured loans provide lower interest rates and access to larger loan amounts but come with the risk of losing assets in case of default. Unsecured loans offer flexibility and quick approval but may have higher interest rates and creditworthiness requirements.

Knowing the differences between secured and unsecured loans can help you make informed financial decisions that align with your goals.