- 4 September 2023

- 2 Comments

- 1120

Decoding Credit Scores: A Comprehensive Guide for Every Consumer

Greetings, I’m Nabeel Shaikh, a seasoned Chartered Accountant with over 17 years of diverse experience in investment banking, management consulting, and entrepreneurship. In this blog post, I’ll explain the mysteries of Credit Scores, exploring why they matter more than you might think. You’ll find everything you need to know about credit scores and their profound importance in your financial journey.

Have you ever peeked at your credit score? If not, you’re in good company! Surprisingly, about 54% of Americans have never bothered to check their credit score, as revealed by a 2020 study conducted by Javelin and sponsored by TransUnion.

Nearly 50% percent of US consumers regularly keep an eye on their credit scores, often checking them monthly through various channels like credit monitoring services, credit card issuers, financial institutions, identity protection services, and credit score agencies.

If your entire financial story could be summed up in just one number – that’s your Credit Score. This three-digit number paints a picture of your borrowing and repayment history. The higher your score, the more dependable you appear to lenders.

What Does Credit Score Mean

A credit score numerically represents an individual’s creditworthiness, indicating their ability to manage and repay debts responsibly. It’s a standardized assessment generated by various credit scoring models, with the most common ones being the FICO score and the VantageScore.

Here’s how a credit score works and why it’s important:

Numeric Representation

Credit scores typically range from 300 to 850, although the specific scale can vary depending on the scoring model. A higher score indicates better creditworthiness, while a lower score suggests higher risk to lenders.

Based on the Credit Report

Credit scores are calculated based on the information in an individual’s credit report. The credit report provides a detailed history of an individual’s credit accounts, payment history, outstanding balances, and other financial behaviors.

Key Factors

Credit scores are influenced by various factors, with specific weightings varying between scoring models.

Lender Decision Tool

Lenders, such as banks, credit card companies, and mortgage lenders, use credit scores to assess the risk associated with lending money to an individual. A higher credit score often leads to more favorable lending terms, such as lower interest rates and higher credit limits, while a lower score may result in less favorable terms or loan denials.

Financial Opportunities

Credit scores extend beyond lending decisions. Landlords may use them to evaluate rental applications, insurance companies may use them to determine premiums, and even some employers consider credit history when making hiring decisions.

Monitor and Improve

It’s crucial for individuals to monitor their credit scores regularly and take steps to improve them if necessary. A good credit score opens doors to better financial opportunities and can save money through lower interest rates.

In short, a credit score is a number that tells the world how responsible you are with your money. A higher score opens doors to better financial opportunities, so it’s important to take care of it. Whether you need a loan, open a utility account, or rent an apartment, people need to trust you’ll pay your bills on time. But they can’t contact all your past credit card companies. Instead, they check your credit score.

What is a Credit Report

A credit report is a comprehensive record of an individual’s or business’s credit history and financial behavior, compiled by credit reporting agencies, also known as credit bureaus, using information provided by lenders, creditors, and public records.

Here’s what a credit report typically includes:

Personal Information

This section contains your name, current and previous addresses, date of birth, Social Security number, and sometimes, employment history.

Credit Accounts

Your credit report lists all your open and closed credit accounts, including credit cards, loans (such as mortgages, auto loans, and personal loans), and lines of credit. Each account will show the date it was opened, the credit limit or loan amount, current balance, and payment history.

Payment History

Your payment history for each credit account is described in this section. It indicates whether you’ve made payments on time, had late payments, or missed payments altogether. Your credit score may be negatively impacted by late payments.

Public Records

If you have any financial-related public records, such as bankruptcies, tax liens, or civil judgments, they will be listed here. These items can significantly lower your credit score.

Inquiries

Whenever someone requests a copy of your credit report (like a lender when you apply for a loan or credit card), it’s recorded as an inquiry. There are two types of inquiries: hard inquiries (initiated by lenders when you apply for credit) and soft inquiries (initiated by you or companies for non-lending purposes). Your credit score may be somewhat lowered by hard queries.

Collections

If you have accounts that have been sent to collections due to non-payment, these will be listed in this section.

It’s important to note that a credit score and a credit report, while closely related, are distinct elements in your financial profile.

Using the data from your credit reports, companies calculate your credit score, which is then shared with banks, lenders, and various organizations. Keep in mind that because there are multiple credit bureaus, you’ll have more than one credit report and credit score to consider.

The big three credit bureaus—Experian, Equifax, and TransUnion—are responsible for collecting and consolidating your personal and financial data to create your credit report. These reports contain information on open and closed credit card accounts, loans, outstanding bills, any collections, liens, and bankruptcies.

You have the right to access a credit report from each of these major bureaus, and the only authorized source for this is AnnualCreditReport.com.

Major Credit Scoring Systems

When it comes to credit scoring, FICO and VantageScore are the two heavyweight champions.

FICO

Its credit scores are the most used by lenders according to data analysis. FICO derives these credit scores from the information contained within your credit reports. However, since each credit bureau independently collects and reports your data, your FICO score can vary slightly between them.

VantageScore

Three major credit bureaus joined forces to create VantageScore in 2006, a competing model to challenge FICO scores. Lyn Alden, founder of Lyn Alden Investment Strategy, notes that VantageScore has steadily gained market share, but FICO remains the dominant model in the credit scoring landscape.

Factors That Influence Credit Scores

Furthermore, it’s important to understand the factors that influence your credit score. Although the precise formula is confidential, the FICO and VantageScore models relies on these primary credit score components:

FICO Credit Score Factors:

- Payment History (35%): Timely bill payments are crucial for a good FICO score. Even a couple of missed payments can significantly lower your score.

- Amounts Owed (30%): Your debt compared to available credit, known as credit utilization, affects your score. Lower utilization is better.

- Length of Credit History (15%): A longer credit history improves your FICO score.

- Credit Mix (10%): Having diverse types of accounts (credit cards, loans, mortgages) helps your score, but they must be in good standing.

- New Credit (10%): Opening too many accounts or making numerous inquiries in a short time can lower your FICO score.

VantageScore Credit Score Factors:

- Payment History: Holds the most weight.

- Depth of Credit (Age and Mix): Considered in terms of the age and variety of your credit accounts.

- Credit Utilization: Like FICO, lower utilization is better.

- Recent Credit: The timing of your credit inquiries and new accounts.

- Balances and Available Credit: Your current balances and available credit limits.

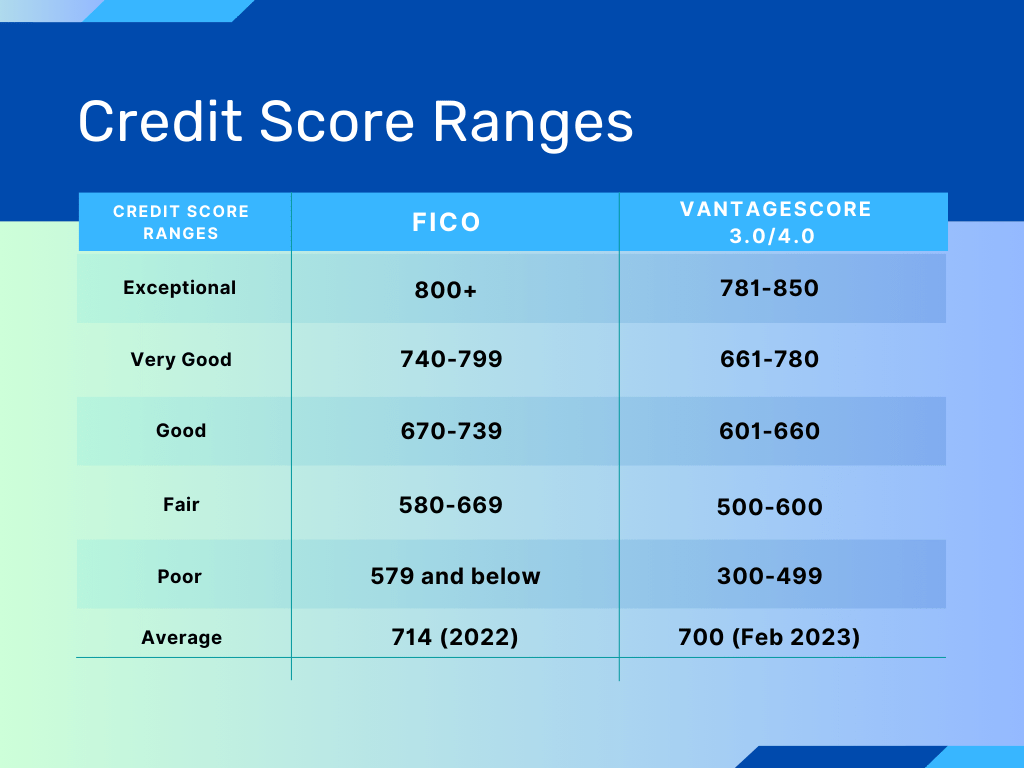

Understanding Credit Score Ranges

Credit scores can vary between creditors, but they generally fall within specific ranges that show your trustworthiness with credit. Here is the data laid down in a table format for easier reading:

You don’t need a perfect score. For example, a FICO score above 760, considered a “good credit score” often qualifies you for the best rates and terms.

Steps to Improve Credit Scores

Improving your credit score doesn’t have to be complicated. By focusing on the basics and the factors that affect your FICO score, you can boost your credit over time:

- Pay Bills on Time: Timely bill payments are the most crucial factor for your credit score.

- Keep Low Credit Card Balances: Use your credit cards but try to keep your balance below 10% of your credit limit. Pay off the full balance each month to avoid interest.

- Start Building Credit Early: You can begin building credit at 18, even with a small monthly charge on a credit card.

- Diversify Your Credit: Consider other credit options like car financing or personal loans when it makes financial sense. Your credit score can be raised by having a variety of credit types.

- Limit New Credit Accounts: While tempting, opening too many accounts in a short time it can make you seem desperate for credit. Take your time between applications.

In essence, good credit doesn’t have to be complicated. Pay your bills on time, manage your credit wisely, and borrow only what you need to watch your credit score rise.

FICO Case Study: Overcoming Credit Score Challenges to Secure a Student Loan

Background

Sarah Johnson, a diligent undergraduate student, was determined to pursue her dream of higher education. She had been accepted into a prestigious university and was thrilled to embark on this academic journey. However, there was a significant obstacle in her path – her credit score.

Challenge

Due to a series of financial setbacks, Sarah’s credit history was far from ideal during her teenage years, she had accumulated some debt and missed payments on her credit cards. As a result, her FICO credit score was in the “poor” range.

Importance of Credit Scores

Having a low credit score was a substantial concern for Sarah. She needed a student loan to cover her tuition fees, as her part-time job income was insufficient to meet the expenses. A low FICO credit score could potentially jeopardize her ability to secure a loan at a reasonable interest rate or even get approval for one.

Solution

Sarah knew that improving her credit score was essential to her educational aspirations. She embarked on a journey to address her credit issues systematically:

Credit Report Review

Sarah obtained her credit reports from all three major credit bureaus: Experian, Equifax, and TransUnion. She carefully reviewed the reports to identify any errors or inaccuracies.

Debt Reduction

Sarah created a budget to manage her finances effectively. She allocated a portion of her income to pay down existing debts, focusing on high-interest accounts first.

Timely Payments

Sarah made a commitment to never miss another payment on her credit cards or other financial obligations. She set up reminders and automated payments to ensure punctuality.

Financial Education

Sarah sought financial counseling and attended workshops to improve her financial literacy. She learned about responsible credit card usage and budgeting techniques.

Building Positive Credit

Sarah applied for a secured credit card, which required a cash deposit as collateral. She used the secured card responsibly, making small purchases and paying the balance in full each month.

Monitoring Progress

Sarah regularly monitored her credit score (FICO score) and credit reports to track improvements. She celebrated small victories, such as score increases and successfully disputing inaccuracies.

Outcome

Over time, Sarah’s diligent efforts paid off. Her FICO Credit Score gradually increased from “poor” to “fair” and eventually reached the “good” range. As a result:

- As a result of her efforts, Sarah was able to secure a student loan with a reasonable interest rate to fund her education.

- Her improved FICO credit score also allowed her to qualify for better financial products and lower interest rates on future loans.

- Sarah gained valuable financial knowledge and habits that would serve her well throughout her life.

Sarah’s determination and commitment to addressing her credit score challenges, particularly her FICO score, proved that it is possible to overcome past financial setbacks. Through responsible financial management, timely payments, and a focus on building a positive FICO credit score.

Like What You Read?

- Connect with us, Here.

- Have a question? Ask us.

- Read more, check out: Learn from the Rise of Nvidia: A Story of GPU and AI

2 Comments

[…] which is a crucial component in assessing your risk profile. These factors are derived from your credit report and are assigned different weights, as indicated above. Understanding how each factor contributes […]

[…] A Brand Story For An Online Business An Unusual Set of Circumstances Led to a Memorable Day Decoding Credit Scores: A Comprehensive Guide for Every Consumer ESG Investing: Bridging Financial and Social Goals Salicylic Acid in Skincare Gain […]