- 13 September 2023

- No Comment

- 144

Pandemic to Peak: UK Housing Market Shift in 2023

In recent times, the UK housing market has become a focal point of discussion, attracting attention from economists, investors, and homeowners alike. The year 2023 has been particularly noteworthy, with housing prices soaring to unprecedented levels. But what has led to this surge? Is it merely a result of market dynamics, or are there underlying factors at play?

As we delve deeper into this blog, I’d like to share a bit about myself. My name is Nabeel Shaikh, a seasoned Chartered Accountant. My 17-year journey spans investment banking, management consulting, and guiding startups. With the knowledge I’ve accumulated over these years, let’s explore today’s topic in depth. Let’s dive in!

This blog delves deep into the intricacies of the UK housing landscape, examining the key drivers behind the price escalation and its ripple effects on the rental market. From the impact of the COVID-19 pandemic to government policies and changing consumer behaviours, we’ll explore the multifaceted reasons behind the market’s transformation. Whether you’re an investor seeking insights or simply curious about the state of UK housing, this comprehensive analysis promises to shed light on the complexities of the current scenario.

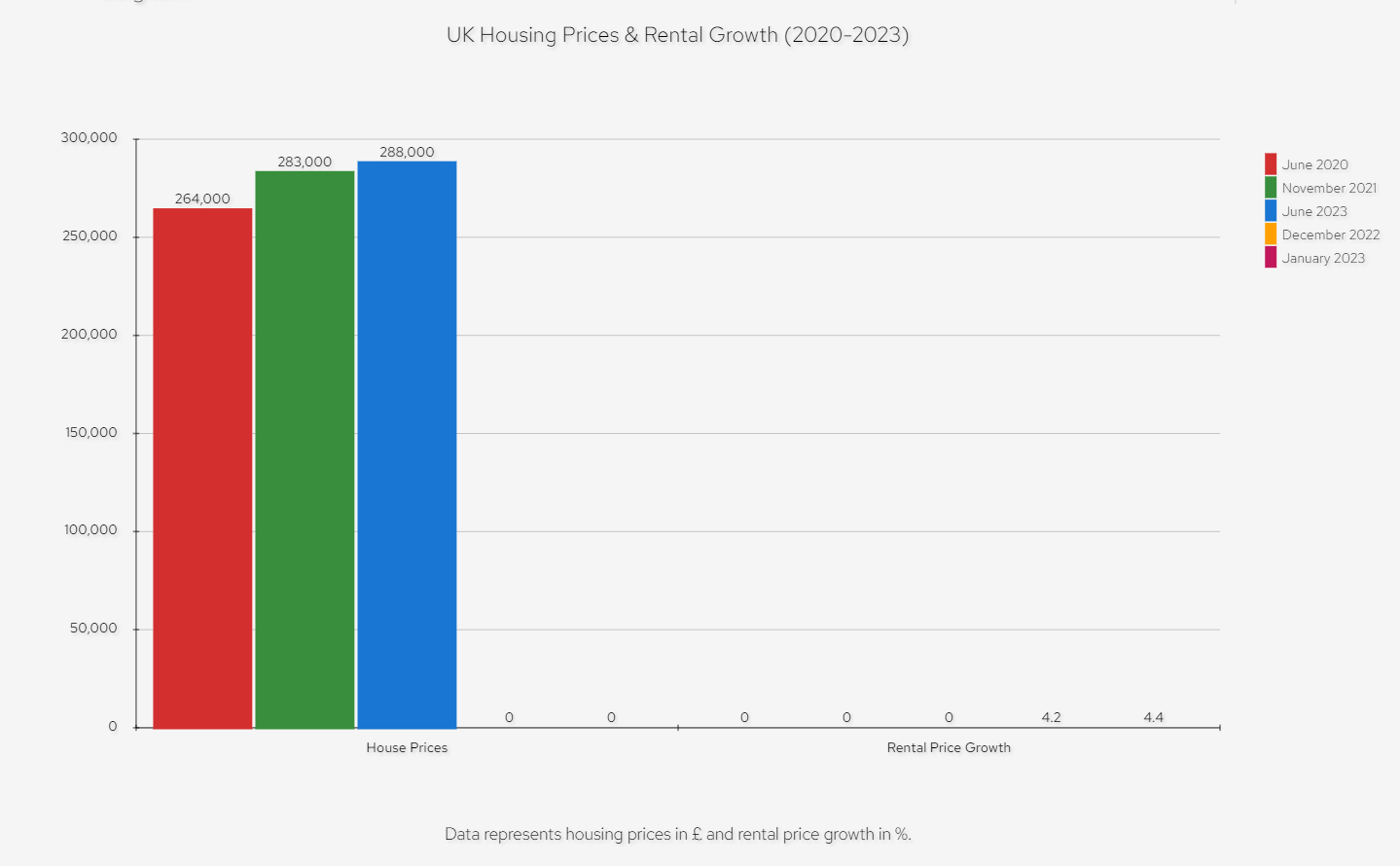

UK housing prices have increased significantly in the past year, reaching a record high of £288,000 in June 2023. This is £24,000 higher than in June 2020, and £5,000 higher than in November 2022, which was the previous peak. The annual house price inflation was 1.7% in June 2023, down from a revised 1.8% in May 2023.

The main drivers of the high house price growth are the supply shortage, the low interest rates, the property transaction tax holiday, and the changing consumer preferences due to the coronavirus (COVID-19) pandemic. Some other factors are:

Supply shortage

UK house prices have stayed relatively high because of a shortage of supply. There is a lack of new housing construction, especially in London and the South East, where demand is highest. Housing starts and completions fell sharply in Q2 2020 because of the lockdown measures, and have not fully recovered since then.

Low interest rates

The UK housing market reacts strongly to interest rate fluctuations. The Bank of England cut the base rate to 0.1% in March 2020, and has kept it at that level since then. This has made borrowing cheaper and more attractive for home buyers, especially those with large deposits or equity.

Property transaction tax holiday

The government introduced a temporary property transaction tax holiday in July 2020, which raised the threshold for paying stamp duty land tax (SDLT) in England and Northern Ireland, land and buildings transaction tax (LBTT) in Scotland, and land transaction tax (LTT) in Wales.

This has stimulated demand and boosted sales, as buyers rushed to complete transactions before the deadline of March 2021. However, this may have also brought forward some purchases that would have otherwise occurred later, creating a temporary spike in activity that may not be sustained after the tax relief ends.

Changing consumer preferences

The behavioral changes from the COVID-19 pandemic, like remote work and more home time, might have shifted property preferences, emphasizing space, especially outdoors, and lessening the importance of being close to offices. This may have led to a shift in demand from urban to rural areas, from flats to houses, and from smaller to larger properties.

UK rental prices have also increased in the past year, but at a slower pace than house prices. The average private rental price rose by 4.4% in the 12 months to January 2023, up from 4.2% in December 2022. This is the highest annual percentage change since this series began in January 2016. The rental price growth was driven by increased demand for rental properties, especially outside London, where supply was limited.

Demand for rental properties

The demand for rental properties increased as some potential buyers were priced out of the housing market or delayed their purchases due to economic uncertainty or the end of the tax holiday . Some renters also sought more spacious or better quality accommodation as they spent more time at home during the pandemic .

Supply of rental properties

The supply of rental properties was constrained by several factors, such as landlords selling their properties to take advantage of high house prices, reduced investment in buy-to-let properties due to tax changes and regulatory reforms, and lower availability of short-term lets due to travel restrictions or conversion to long-term lets . However, there was an oversupply of rental properties in London, where demand fell sharply as some tenants moved out of the city or returned to their countries of origin due to the pandemic or Brexit .

London vs non-London housing market

There are significant differences between the housing market in London and the rest of the UK. London has historically had higher house prices and rents than other regions, reflecting its economic strength, population density, cultural diversity, and global attractiveness. However, London has also experienced lower house price growth and higher rent falls than other regions since the onset of the pandemic. This may reflect a combination of factors, such as lower demand from international buyers and tourists, reduced migration and commuting flows, higher exposure to economic shocks, and greater affordability constraints.

House prices

In June 2023, the average house price in London was £506,000, which was £218,000 higher than the UK average. However, London had the lowest annual house price inflation of all regions, at -0.6%, compared with 1.7% for the UK as a whole. London house prices have been falling since July 2022, after reaching a peak of £518,000.

The decline in London house prices may reflect lower demand from international buyers, who have been deterred by travel restrictions, Brexit uncertainty, and higher taxes . It may also reflect lower demand from domestic buyers, who have been affected by the economic downturn, the end of the tax holiday, and the changing preferences for more space and less commuting.

Rents

In January 2023, the average private rental price in London was £1,620 per month, which was £1,054 higher than the UK average. However, London had the lowest annual rental price inflation of all regions, at 4.3%, compared with 4.4% for the UK as a whole. London rents have been increasing since October 2022, after falling for 18 consecutive months since March 2020.

The fall in London rents may reflect lower demand from tenants, who have moved out of the city or returned to their countries of origin due to the pandemic or Brexit . It may also reflect higher supply of rental properties, as some landlords switched from short-term to long-term lets due to travel restrictions or sold their properties to take advantage of high house prices .

Future of housing market

The outlook for the UK housing market is uncertain and depends on various factors, such as the evolution of the pandemic and its economic and social impacts, the policy responses from the government and the Bank of England, and the consumer behaviour and expectations. Some possible scenarios are:

Scenario 1

Strong recovery is the scenario here. The pandemic gets controlled. How? Through successful vaccines and tests. The economy bounces back fast. Lockdowns ease and people become confident again.

Both the government and the Bank of England step in. They keep supporting families and firms with financial boosts. What’s the result? Housing demand stays high. Buyers benefit from low interest rates and good loan terms.

There’s more housing available too. New building projects rise and more homes are for sale. The outcome? The housing market thrives. Both house prices and rents see moderate growth everywhere.

Scenario 2

Slow recovery is another scenario. Here, the pandemic lingers. Reasons? New variants and vaccine doubts. The economy’s rebound is sluggish. Why? Extended or renewed lockdowns. Consumer confidence also dips.

The government and the Bank of England pull back. They reduce support to people and businesses. This is due to tighter fiscal and monetary limits. What happens next? Housing demand drops. Buyers grapple with high prices and lower incomes.

Housing supply is also limited. New builds face hurdles like lack of workers and high material costs. Fewer homes are up for sale. This is due to less movement in the market or homes being underwater. The result? The housing market slows. Prices and rents either stay flat or decrease in most areas.

Scenario 3

Uneven recovery is a possible scenario. Here, the pandemic’s impact varies by region. Some areas control it well, others don’t. This is due to differences in vaccination and testing. The economy’s bounce-back is also patchy. Some regions see relaxed lockdowns, others face stricter rules. This depends on local situations. Consumer confidence also differs by region.

The government and the Bank of England step in. They offer specific support to the hardest-hit areas. This is done through fiscal and monetary measures.

Housing demand isn’t consistent. In some regions, it’s high; in others, it’s low. This is because buyers have different needs and opportunities. Housing supply is also inconsistent. Factors like local planning rules and population shifts play a role. As a result, the housing market shows varied trends. Some areas see price and rent hikes. In contrast, others experience drops.

Investment advice

Based on my analysis, I would advise potential investors to be cautious and selective when considering investing in the UK housing market. There are risks and opportunities in different segments of the market, depending on location, property type, price range, and rental yield. Some general tips are:

Location

Investors should look for areas that have strong fundamentals such as economic growth potential, population density, transport links, amenities, and quality of life. They should also consider how these areas may be affected by future trends such as remote working, environmental sustainability, social cohesion, and technological innovation. For example, some investors may prefer rural areas that offer more space and natural beauty, while others may favour urban areas that offer more convenience and diversity.

Property type

Investors should look for properties that suit their target market and budget. They should also consider how these properties may appeal to changing consumer preferences and expectations. For example, some investors may prefer houses that offer more space and privacy, while others may favour flats that offer more convenience and security.

Price range

Investors should look for properties that are within their financial capacity and offer a reasonable return on investment. They should also consider how these properties may be affected by market fluctuations and policy changes. For example, some investors may prefer low-priced properties that have more room for growth, while others may favour high-priced properties that have more stability and prestige.

Rental yield

Investors should look for properties that generate a steady and sufficient income from rent. They should also consider how these properties may attract and retain tenants in a competitive and dynamic rental market. For example, some investors may prefer properties that have high rental yields, while others may favour properties that have low vacancy rates and maintenance costs.

Conclusion

The UK housing market in 2023 reflects a mix of economic, social, and political influences. The pandemic brought unique challenges, but government actions and changing consumer habits also played a role. Rising house prices benefited some, but also sparked affordability worries. Looking forward, investors and homeowners must stay updated and flexible. The market’s direction is still uncertain.

Yet, one fact stands out: the UK housing market remains a focal point for many due to its adaptability and strength. In these uncertain times, making informed and cautious decisions is key.

I encourage you to share this wisdom. Bring your friends and followers along on this insightful journey by passing along this article. Your opinions, questions, and feedback are truly appreciated; feel free to leave them in the comments below. Also, to never miss out on any valuable information, ensure you’re subscribed to NashFact.com.