- 19 August 2023

- No Comment

- 211

How to Deal with the Social Pressure and Emotional Triggers that Cause Poor Spending Habits

Introduction

Many people struggle with spending more than they can afford, especially in today’s consumerist society. There are many factors that can influence our poor spending habits, such as social pressure, emotional triggers, advertising, and lack of financial literacy. However, there are also ways to overcome these challenges and develop healthier spending habits that can help us achieve our financial goals and live more fulfilling lives.

Identify the Factors that Influence Your Spending Habits

We need to identify what makes us spend poorly. This is the first step. Social pressure can come from different people. They may have different expectations, values, or lifestyles than us. We may buy costly things for different reasons. We may want to fit in, impress, or please them. Emotional triggers can come from our feelings. They can be negative or positive. We may spend money to cope with bad feelings or reward good ones

To identify these factors, we can do two things. First, we can keep a spending journal or use a budgeting app. These tools can track our expenses and categorize them by needs and wants. Second, we can reflect on our feelings and values. We can do this before, during, and after each purchase. We can also see if it aligns with our goals. By doing these two things, we can learn more about our spending patterns and motivations. We can also recognize the situations or emotions that make us overspend.

How to Challenge the Social Pressure and Emotional Triggers that Cause Poor Spending Habits

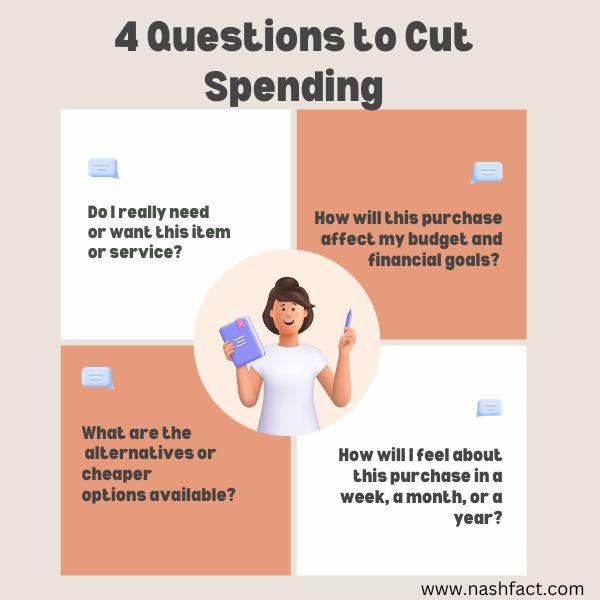

The next step is to challenge and change these factors. To challenge the social pressure and emotional triggers that cause poor spending habits, we can ask ourselves some questions, such as:

- Do I really need or want this item or service?

- How will this purchase affect my budget and financial goals?

- What are the alternatives or cheaper options available?

- How will I feel about this purchase in a week, a month, or a year?

- Am I buying this because of someone else’s opinion or influence?

- Am I buying this because of how I feel or want to feel?

By asking these questions, we can evaluate the pros and cons of each purchase and make more rational and informed decisions. We can also avoid impulse buying by following the 24-hour rule, which means waiting for a day before making a purchase and seeing if we still want it after some time has passed.

How to Change the Social Pressure and Emotional Triggers that Cause Poor Spending Habits

- To change the social pressure and emotional triggers that cause poor spending habits, we can also take some actions, such as:

- Setting realistic and specific financial goals and tracking our progress regularly

- Creating and following a realistic budget that covers our needs and allows for some discretionary spending

- Saving money for emergencies and big purchases

- Seeking professional help or joining a support group if we have a serious spending problem

- Learning more about personal finance and investing.

- Finding healthy and inexpensive ways to cope with our emotions, such as exercising, meditating, reading, or talking to someone

- Finding hobbies or activities that bring us joy and fulfillment without spending money.

- Surrounding ourselves with positive and supportive people who share our values and goals

By taking these actions, we can develop healthier spending habits that can help us achieve our financial goals and live more fulfilling lives. We can also reduce the social pressure and emotional triggers that cause poor spending habits by being more confident in ourselves and our choices.

Conclusion

Spending money is not inherently bad or good. It is a tool that we can use to meet our needs, express ourselves, and enjoy life. However, when we spend money in ways that are influenced by social pressure or emotional triggers that do not align with our values and goals, we may end up harming ourselves financially and emotionally. Therefore, it is important to identify, challenge, and change these factors that cause poor spending habits and develop healthier ones that can help us achieve our financial goals and live more fulfilling lives.

If you want to stay updated on the latest news, trends, and insights on the crypto market, the stock market, the forex market, and more, you can subscribe to our website NashFact.com. There, you will also find various blogs and articles that cover different financial and investment related topics. You will also get tips and advice on how to improve your financial literacy and make smart investment decisions. Whether you are a beginner or an expert, you will find something useful and informative on our website. So, don’t miss out and subscribe to NashFact.com today!