- 6 October 2023

- 1 Comment

- 342

From Oil Barrels to Code: GCC’s Startup Revolution Unveiled

GCC Startup Journey Diverging from the oil-centric narrative, GCC nations are orchestrating a paradigm shift, strategically broadening their economic horizons. Thriving startups in technology, renewable energy, and healthcare are steering the region toward a more diversified and sustainable future.

The Gulf Cooperation Council (GCC), a formidable alliance comprising the UAE, Saudi Arabia, Qatar, Bahrain, Oman, and Kuwait, has emerged as a powerhouse. While the UAE is often hailed as the ‘Silicon Valley of the Middle East,’ collectively, the GCC flaunts vibrant startup ideas, robust investment communities, and a rich tapestry of resources, including workshops, incubators, mentors, and co-working spaces.

However, as we embark on a journey through the GCC’s entrepreneurial landscape, it becomes imperative to address critical gaps – financial, cultural, and talent-related. I’m Nabeel, a seasoned Chartered Accountant weaving through investment banking, management consulting, and entrepreneurship for a remarkable 17 years.

In the dynamic realm of technology and innovation, Silicon Valley has long been the epicenter. However, as the tides of change sweep through 2023, our focus pivots to explore promising startup hubs beyond the conventional. Today, our exploration takes us to the Gulf Cooperation Council (GCC), presenting a burgeoning startup landscape replete with unique opportunities and challenges.

Financial Gaps: Navigating the Investment Terrain

Venture Capital Dynamics

The GCC has witnessed significant strides in venture capital, with the UAE leading the charge. A 2022 report by the Ministry of Economy highlighted the UAE’s record venture capital of AED 4.3 billion for startups, surpassing the $1 billion mark for the first time. The GCC’s entrepreneurial landscape benefits from groups like OQAL in Saudi Arabia and Bahrain, connecting startup founders with seasoned angel investors. However, the region needs more robust angel investment networks akin to those in the UK (Adjuvo), fostering purpose-driven investing.

Global Investor Engagement

While angel investment flourishes, attracting signature global investors remains crucial. The absence of major players like Sequoia and General Atlantic in the GCC underscores the need to entice these giants for sustained growth.

Angel investors are individuals who provide financial support to startup businesses in exchange for ownership or equity in the company. They often play a crucial role in helping early-stage ventures get off the ground by injecting capital and offering guidance and mentorship. Angel investors are typically experienced entrepreneurs or business professionals seeking investment opportunities with high growth potential.

Cultural Shifts: Fostering Innovation Mindsets

Entrepreneurial Culture

Cultivating a culture that embraces risk-taking and innovation is pivotal. Startups, often driven by dynamic startup ideas, require an environment that celebrates creativity and resilience. The rise of startups in the GCC signifies a paradigm shift from traditional business models, and nurturing this shift is essential for sustained success.

Digital solutions offered by startups are not only transforming their own industries but also influencing traditional businesses. The digitalization of services, especially during the pandemic, has prompted traditional businesses to adapt and overhaul their models for greater efficiency.

Role Models and Collaboration

New role models are emerging as success stories unfold. Encouraging collaboration between startups and established businesses can help instill a new culture of entrepreneurship. Teams of founders, an alternative to the traditional solo entrepreneur, can contribute to creating stronger and more resilient companies.

Talent-Related Challenges: Bridging the Skills Gap

Talent Density and Training

The region’s startup success relies heavily on talent density. Enhancing training programs and educational initiatives can bridge the skills gap, ensuring a pool of skilled individuals ready to contribute to the growing startup ecosystem.

Global Talent Attraction

While local talent is vital, attracting global talent remains a challenge. Strategic initiatives, such as visa programs for skilled immigrants, can bolster the GCC’s position as a global talent magnet and create startup jobs.

The GCC’s Startup Surge

Abu Dhabi emerges as a global player, ranking as the sixth fastest-growing ecosystem globally. Fintech, cleantech, agtech, and new food sectors are emerging trends that drive the city’s growth. Factors like the golden visa program and a strategic location enhance its appeal.

Dubai secures the 12th position in global rankings of emerging ecosystems. Favorable scores in access to funding, connectedness, and market reach showcase its global appeal. With an estimated ecosystem value of $21 billion, Dubai stands as a formidable player.

Riyadh undergoes a significant transformation, moving from the 61-70 range to the 91-100 range in emerging ecosystems rankings. The city’s ecosystem value experiences remarkable growth, reaching $10 billion. Riyadh exemplifies the Kingdom’s commitment to fostering innovation.

Ecosystem rankings refer to assessments and evaluations of startup ecosystems within a particular region or industry. These rankings are often conducted by organizations or research entities to identify and compare the vibrancy, growth, and overall health of startup ecosystems. Key factors considered in ecosystem rankings include the availability of funding, the density of startups, access to talent, regulatory support, and the success of existing startups. Higher rankings signify a more favorable environment for startups, attracting attention from investors, entrepreneurs, and other stakeholders.

Vision 2030

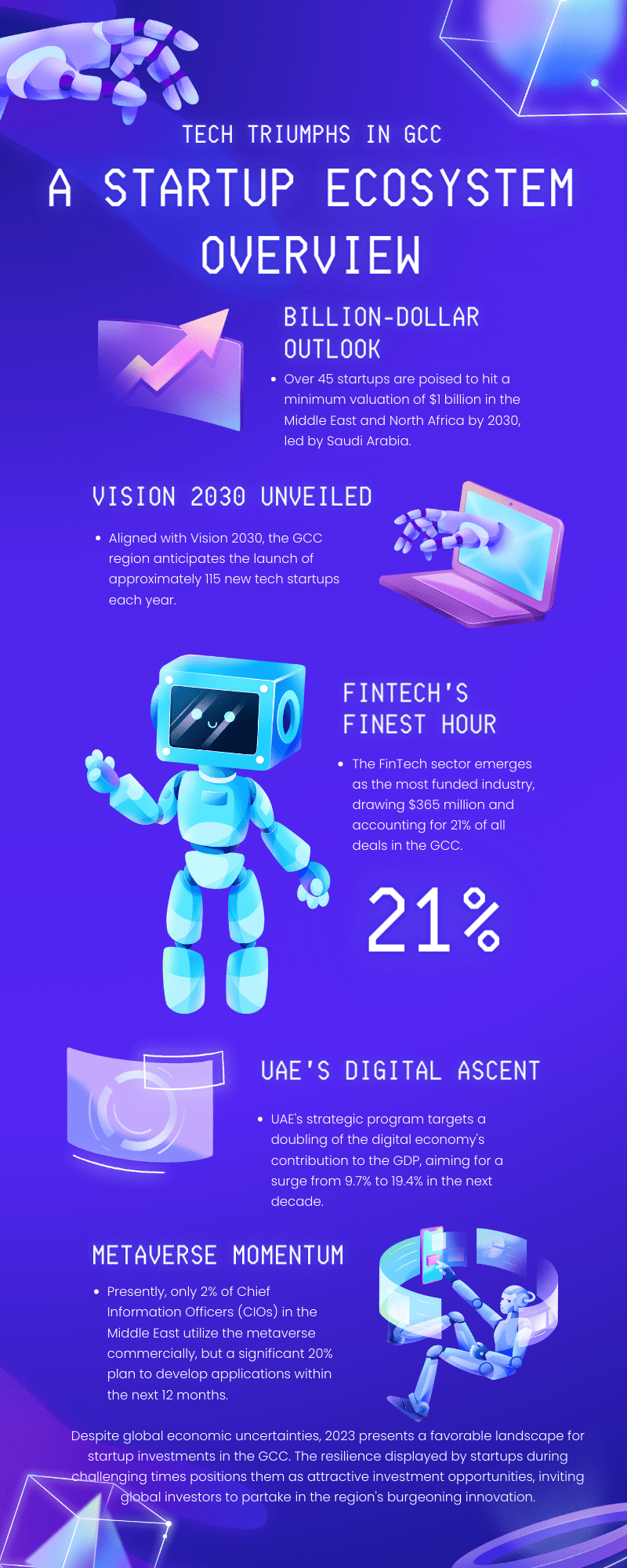

As per Vision 2030, Saudi Arabia aims to open approximately 115 new tech startups per year, showcasing the region’s commitment to fostering innovation and technology-driven growth. A dynamic startup scene reveals in the GCC, with projections of over 45 startups valued at a minimum of $1 billion by 2030. In 2022, MENA’s 50 most-funded startups raised approximately $3.2 billion, signaling a 6.7% increase from the previous year.

Noteworthy is Saudi Arabia’s meteoric rise, with startups raising $972 million in 2022, representing a 1.5x increase from the previous year. The FinTech sector emerges as a frontrunner, attracting $365 million in funding and accounting for 21% of all deals in the GCC.

Nabeel’s Perspective

As a seasoned Chartered Accountant with extensive experience in investment banking and entrepreneurship, I observe the GCC’s startup landscape with great interest. The region’s strides in technology-based entrepreneurship are commendable, offering a promising alternative to conventional business models. The financial support from angel investors and the commitment to fostering tech startups align with global trends. However, attracting renowned global investors is a crucial next step for the GCC to solidify its position on the global startup map.

The Impact of Vision 2030

The profound impact of Vision 2030 is evident in the concerted efforts to transform Saudi Arabia into a knowledge-based economy. The emphasis on innovation, technology, and entrepreneurship as key pillars aligns with global trends, positioning the region as a formidable player in the evolving landscape of startups.

However, the critical next phase involves attracting renowned global investors to firmly establish the GCC on the global startup map.

GCC Governments as Active Architects

Governments throughout the GCC aren’t mere spectators; they actively shape the narrative of the startup ecosystem. Initiatives spanning innovation encouragement, regulatory frameworks, and substantial investments underscore a collective dedication to propelling startup growth. The collaborative dance between the public and private sectors through strategic partnerships injects an additional layer of vitality into the burgeoning ecosystem.

Looking Forward: GCC’s Entrepreneurial Tapestry

The GCC’s ability to bridge financial gaps, adapt to cultural shifts, and tap into diverse talent pools is pivotal for the region’s entrepreneurial evolution. The potential for groundbreaking innovation and swift economic expansion is limitless, contingent on the sustained vibrancy of the startup ecosystem. The prevailing question isn’t solely about the emergence of the next unicorn; it’s also about how the GCC will leverage its startup boom to influence the global entrepreneurial landscape. Positioned beyond Silicon Valley, the GCC is poised to play a significant role in shaping this transformative narrative.

1 Comments

[…] consultant, and entrepreneur with 17 years of experience. In this article, we look at the emerging trends and challenges in the industry. We explore how startups are coming up with clever new ideas and […]