- 29 November 2024

- No Comment

- 378

Think Before You Swipe: The Truth Behind “Buy Now Pay Later” BNPL

We often come across big billboards, banners, receiving pamphlets advertising products like motorcycles or household items on installment plans. These deals typically start with a down payment, while the rest is paid in installments. However, the catch is that the exact rates and terms are rarely disclosed upfront, you often only find out after visiting the seller.

Many buyers, unfamiliar with financial jargon or basic calculations, end up committing to these deals without fully understanding the interest rates or hidden costs involved. Interestingly, most of these installment sellers in Pakistan operate outside the formal financial system. They aren’t licensed financial institutions, and their transactions are conducted entirely in cash, bypassing banking channels and leaving no trace for government oversight.

On the other hand, regulated Buy Now, Pay Later (BNPL) services offer a more transparent and trustworthy alternative.

Now picture this: You’re scrolling through your favorite online store, eyeing that perfect gadget, outfit, or piece of furniture. The price tag makes you pause until you spot the enticing option: “Buy Now, Pay Later” Four easy installments, interest-free. Suddenly, the purchase feels achievable. No hefty credit card bill, no immediate hit to your bank balance. A quick click on “Pay,” and just like that, you’ve bought something that once seemed out of reach.

These platforms provide seamless payment solutions, allowing people to make purchases in 2, 4, or 6 interest-free installments. For a country like Pakistan, where many struggle to afford big-ticket items in a single payment, BNPL services can make a significant difference. They not only offer convenience but also help uplift living standards by enabling people to access essential goods and services more affordably.

Day by day, people are growing more confident in platforms that allow them to buy now and pay later in easy installments. This shift is particularly noticeable among Pakistan’s younger generation, who are increasingly using BNPL services to make purchases they might not otherwise afford. These platforms provide not just convenience but also an opportunity for individuals to manage their finances more flexibly.

BNPL services have the potential to become a game-changer for industrial growth across various sectors. By enabling consumers to access products and services with manageable payment plans, they stimulate demand and drive sales, ultimately benefiting businesses and boosting the economy.

But while these platforms are empowering shoppers, they’re also prompting broader discussions about spending behavior, economic impact, and regulatory challenges.

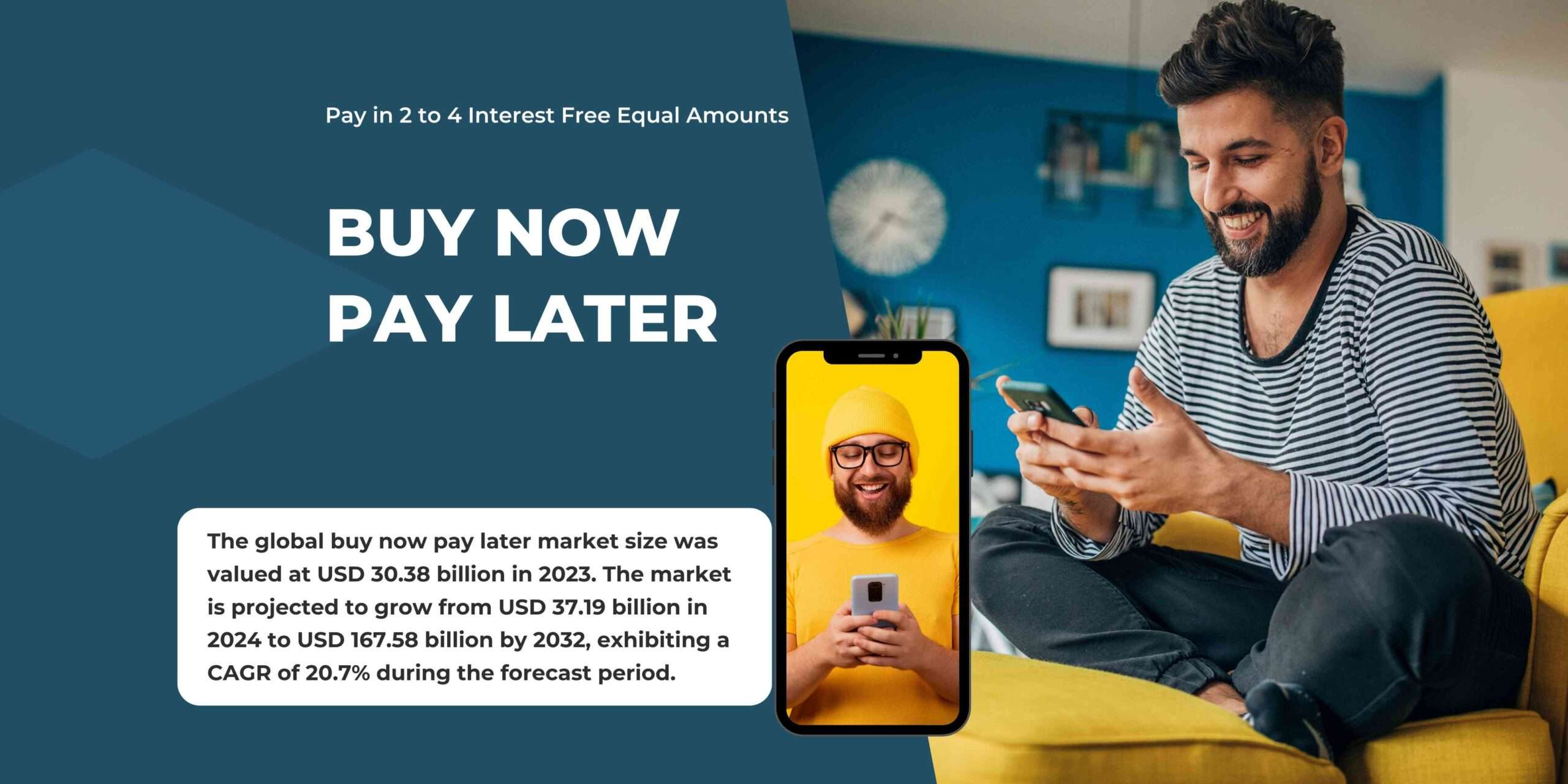

The global Buy Now, Pay Later (BNPL) market was valued at approximately USD 30.38 billion in 2023 and is expected to witness substantial growth in the coming years. By 2032, the market is projected to reach an impressive USD 167.58 billion, with a robust compound annual growth rate (CAGR) of 20.7% from 2024 to 2032.

In the United States, data from the Federal Reserve highlights that current credit card utilization stands at around 21%. If U.S. banks integrate BNPL features into their credit card offerings, they could significantly expand customers’ credit limits, potentially increasing the total from USD 856 billion to a staggering USD 1.27 trillion by 2025.

In this article, we’ll understand why this payment option is transforming how we shop and shed light on how it’s changing purchasing behaviour and driving market trends. We’ll address the potential risks and challenges both users and lenders face. Stick around for a detailed and balanced perspective on this booming payment revolution

The Rise of BNPL: What Makes It So Appealing?

BNPL services emerged as a game-changer in online retail, providing an alternative to credit cards. With no interest (if payments are made on time) and quick approvals, they cater especially to consumers wary of traditional credit or those who want to avoid large upfront payments.

So why are these services so appealing? The answer lies in how they align with human psychology:

- Perception of Control: Splitting payments into smaller chunks makes purchases feel less burdensome. For consumers, it’s no longer about whether they can afford the total cost but whether they can handle the smaller installments.

- Reduced Financial Guilt: Spreading out payments removes the immediate sting of a big expense, making consumers feel less constrained financially.

- Ease of Use: With minimal friction during checkout, BNPL offers an almost seamless purchasing experience compared to traditional credit applications.

BNPL’s Impact on Consumer Spending

New research analyzed the purchasing behavior of over 275,000 consumers and found that BNPL does more than just facilitate purchases, it drives them. Here’s how:

- Increased Purchase Likelihood: Consumers are more likely to buy when BNPL is available, as the reduced immediate financial burden lowers resistance to spending.

- Bigger Basket Sizes: The research found that consumers using BNPL often spend 10% more on average compared to those using other payment methods. This trend is especially pronounced among consumers who traditionally make smaller purchases.

By spreading payments over time, BNPL makes discretionary purchases feel more attainable. This shift is particularly impactful for younger generations, like Millennials and Gen Z, who often shy away from credit cards but still seek flexibility in managing their finances.

Yet, this sense of financial empowerment comes with challenges. Critics argue that BNPL could encourage impulsive spending, leading to financial strain for consumers who struggle to keep up with installments. As usage grows, regulators worldwide are scrutinizing the industry to ensure it doesn’t become a modern-day debt trap.

BNPL is a double-edged sword for retailers

For retailers, these insights are golden. BNPL drives higher conversion rates and larger sales volumes, making it an attractive offering. However, it comes at a cost; on the other hand, the fees charged by BNPL providers can significantly reduce profit margins, particularly for small businesses.

Despite these costs, many retailers feel compelled to offer BNPL to remain competitive in an increasingly digital-first marketplace. The convenience and appeal of BNPL make it hard to ignore, especially when consumer demand for flexible payment options continues to rise.

Understanding the Risks and Challenges for Consumers and Lenders

While Buy Now, Pay Later (BNPL) services provide a convenient and relatively low-cost alternative to traditional financing options, they also come with unique challenges that pose risks to both consumers and lenders. Understanding these challenges is essential for businesses, financial institutions, and users to ensure responsible usage and mitigate potential downsides. Here’s an in-depth look at the key challenges BNPL services face:

1. Regulatory Challenges

One of the primary concerns with BNPL services is the lack of clear and consistent regulatory frameworks in many regions.

- Limited Oversight: In many countries, BNPL providers are not subject to the same strict regulations as traditional credit lenders, such as banks or credit card companies. This can result in gaps in consumer protection, leaving borrowers vulnerable to unfair terms or practices.

- Compliance Risks: BNPL lenders may unintentionally violate prohibitions against unfair, deceptive, or abusive acts and practices (UDAAPs) due to the lack of standardized disclosure requirements.

- Future Uncertainty: As regulators worldwide scrutinize BNPL models, providers may face stricter compliance obligations, which could increase operational costs and potentially limit their growth.

2. Lack of Transparency

Transparency is a significant issue in the BNPL space, as users often struggle to fully understand their repayment obligations.

- Unclear Terms: BNPL providers frequently use promotional language, downplaying interest, fees, or penalties. This can obscure the true cost of borrowing and lead to consumer harm.

- Disclosure Gaps: The absence of standardized disclosure language can make it difficult for consumers to compare BNPL loans with other financing options or even among BNPL providers.

- Return Policies: Merchandise returns and disputes with merchants add another layer of complexity. In many cases, consumers may remain responsible for payments during unresolved disputes, further complicating the repayment process.

3. Fraud and First Payment Default Risk

Fraud and default risks are particularly elevated in the BNPL sector due to its highly automated processes.

- First Installment Default Fraud: BNPL providers face significant risks of default fraud, where borrowers intentionally fail to pay the first installment after receiving goods or services.

- Operational Weaknesses: The reliance on instantaneous credit decisions and limited borrower vetting increases the likelihood of fraudulent activity slipping through the cracks.

- Third-Party Risks: Many BNPL providers partner with third-party platforms for credit assessments or payment processing. This reliance can expose lenders to additional operational risks and fraud if those third parties lack robust controls.

4. Risks Associated with BNPL Lending

BNPL services can also create risks for both lenders and consumers that go beyond fraud and transparency issues.

- Overextension of Borrowers: Consumers often overestimate their ability to manage multiple BNPL loans, leading to financial strain. Missed repayments can result in secondary fees, such as overdraft or non-sufficient funds (NSF) fees, compounding the financial burden.

- Lack of Credit Visibility: Since BNPL transactions are not always reported to credit bureaus, lenders often lack insight into an applicant’s existing BNPL obligations. This can make it difficult to accurately assess creditworthiness and can lead to borrowers taking on more debt than they can handle.

- Merchandise Disputes: Short loan terms and ongoing disputes with merchants over product returns or quality can leave borrowers stuck with repayment obligations even when issues are unresolved.

- Reputational Risk for Lenders: Banks partnering with BNPL providers may face reputational damage if customers perceive unfair treatment, such as excessive fees or poor resolution processes for disputes.

- Operational Risks: The heavy reliance on automation and third-party integrations increases the potential for technical errors, data breaches, or service interruptions, all of which can harm consumers and lenders alike.

5. Perception of the Debt Trap

A growing concern surrounding BNPL is its potential to create a “debt trap” for consumers.

- Psychological Spending Triggers: The ease of splitting payments into smaller installments encourages impulsive spending, leading users to accumulate debt they might not otherwise take on.

- Hidden Costs: Late fees, penalties, and secondary charges like overdraft fees can significantly increase the cost of purchases, leaving consumers in a cycle of debt.

- Financial Literacy Gap: Many consumers lack the financial literacy to understand how BNPL repayment obligations affect their overall financial health, compounding the risk of falling into debt.

Expert Advice from Nabeil Schaik

As a seasoned Chartered Accountant, investment banker, and wealth manager with over 18 years of experience across the UK, GCC, and Pakistan, I’ve witnessed the evolution of financial services and consumer behaviours firsthand. The rise of Buy Now, Pay Later (BNPL) services reflects a significant shift in how consumers manage their finances and make purchasing decisions. However, this convenience comes with responsibilities and risks that must be navigated carefully.

For Consumers:

BNPL can be a powerful tool for managing cash flow and accessing goods you might not otherwise afford. However, it’s essential to approach this payment option with a clear plan. Before committing, always read the terms carefully, including any hidden charges or late fees. Assess your repayment ability and ensure that your purchases align with your financial goals, rather than encouraging impulsive spending. Remember, financial discipline is key to avoiding debt traps and maintaining a strong credit profile.

For Lenders and Financial Institutions:

The BNPL model presents a compelling opportunity to expand customer engagement and drive growth, but it also demands robust risk management and transparency. Financial institutions must implement clear, standardized disclosures to ensure consumers fully understand their repayment obligations. Strengthening fraud detection mechanisms and credit assessment processes can minimize risks like first-installment defaults. Additionally, integrating BNPL data with credit reporting systems can provide a more accurate picture of borrowers’ financial behavior, fostering trust and stability in the lending ecosystem.

As the BNPL market grows, striking a balance between accessibility and responsibility will be critical. By embracing innovation while prioritizing ethical practices, we can ensure that BNPL services benefit both consumers and the broader economy, creating a win-win scenario for all stakeholders.

Key Players in BNPL Pakistan

Team Nashfact

Nabeel Shaikh (aka Nabeil Schaik), founder of Nashfact, is a seasoned chartered accountant and serial entrepreneur who leverages his extensive experience to help businesses optimise their financial, technological, and operational strategies. He specializes in helping companies and individuals optimize their relocation strategies to Saudi Arabia and other GCC countries, ensuring compliance with local laws, visa requirements, and regulatory frameworks. His deep understanding of KSA’s business environment has successfully assisted numerous clients in securing work permits, visas, and smooth transitions into the Kingdom.

Ubaid ur Rehman, Editor at Nashfact, brings a wealth of editorial expertise and a keen eye for detail, ensuring that the content delivered is both insightful and well-researched. Together, Nabeil and Ubaid have combined their expertise to craft informative articles, providing valuable insights on the topic.

_edited.png)