- 11 August 2023

- No Comment

- 1034

How CBCV Strategy Increased a Company’s Valuation by 89% in One Day

What is CBCV? CBCV is a valuation method, which is a way of estimating the worth of a company or a business. CBCV stands for customer-based corporate valuation, and it is a method that uses customer metrics, such as retention, lifetime value, and referral rates, to assess the future cash flows and profitability of a company.

- CBCV A Customer-Centric Method of Business-Driven Valuation

- CBCV A Valuation Method Based on Future Cash Flows from Customers

- CBCV: A Method of Capturing the True Value of Customers for Online Platforms

- How CBCV Can Improve the Long-Term Profitability and Sustainability of Customer-Centric Companies

A Customer-Centric Method of Business-Driven Valuation

There are various methods of business-driven valuation, such as discounted cash flow (DCF), relative valuation, market multiples, and customer-based corporate valuation (CBCV). Each method has its own advantages and limitations, depending on the type, size, industry, and stage of the company. In this article, we will explore one of the most innovative and customer-centric methods of business-driven valuation: CBCV.

A Valuation Method Based on Future Cash Flows from Customers

CBCV is a method that uses customer metrics to assess a firm’s underlying value. The premise behind CBCV is simple: The value of a company is determined by the future cash flows it can generate from its existing and potential customers. Therefore, by analyzing customer behavior and loyalty patterns, such as acquisition, retention, churn, lifetime value, and referral rates, we can estimate the future revenue and profit streams of the company.

A Method of Capturing the True Value of Customers for Online Platforms

CBCV is especially useful for companies that have a large and diverse customer base, such as e-commerce platforms, subscription services, social media networks, and online marketplaces. These companies often face challenges in measuring their performance and value using traditional financial metrics, such as revenue growth, margins, and earnings. For example, a company may have a high revenue growth rate but a low retention rate, which means that it is spending more money on acquiring new customers than on retaining existing ones. This can lead to a negative cash flow and a low valuation in the long run.

How CBCV Can Improve the Long-Term Profitability and Sustainability of Customer-Centric Companies

CBCV can help these companies overcome these challenges by providing a more accurate and holistic picture of their value creation potential. By focusing on the customer lifetime value (CLV), which is the net present value of the future cash flows from a customer over his or her relationship with the company, CBCV can capture the long-term profitability and sustainability of the company. Moreover, by segmenting the customers into different cohorts based on their behavior and characteristics, CBCV can identify the most valuable and loyal customers and target them more effectively.

Case Study: How Revolve Group Used CBCV to Increase Its Valuation by 89% in One Day

To illustrate how CBCV works in practice, let us look at an interesting case study: Revolve Group, an online fashion retailer that specializes in premium apparel and accessories for young women. Revolve Group went public in June 2019 with an initial public offering (IPO) price of $1.2 billion. However, on its first day of trading, its stock price soared by 89%, making it one of the best first-day IPO performances of 2019. The spike brought the company’s valuation to roughly 4.5 times its revenue over the previous 12 months—five times the multiple of its apparel-retailing peers and more akin to that of a technology company.

What made Revolve Group so attractive to investors?

The answer lies in its strong customer-unit economics: Revolve Group not only acquired its customers profitably but retained them for many years, which meant that its longer-term profit potential was larger than its revenue growth to date had implied. Revolve Group used CBCV to measure and communicate its value proposition to the market. By analyzing its customer data, Revolve Group was able to show that:

- The company had a loyal and engaged customer base of over 1.4 million active customers who placed an average of 2.8 orders per year with an average order value of $279.

- It had a high retention rate of 63%, which indicates that 63% of its customers who made a purchase in one year also made a purchase in the following year.

- The company also had a high CLV of $1,500 per customer, which was significantly higher than its customer acquisition cost (CAC) of $65 per customer1.

- It had a high referral rate of 40%, which means that 40% of its new customers came from word-of-mouth recommendations from existing customers.

How CBCV Showed the Value and Opportunity of Revolve Group in the Online Fashion Industry

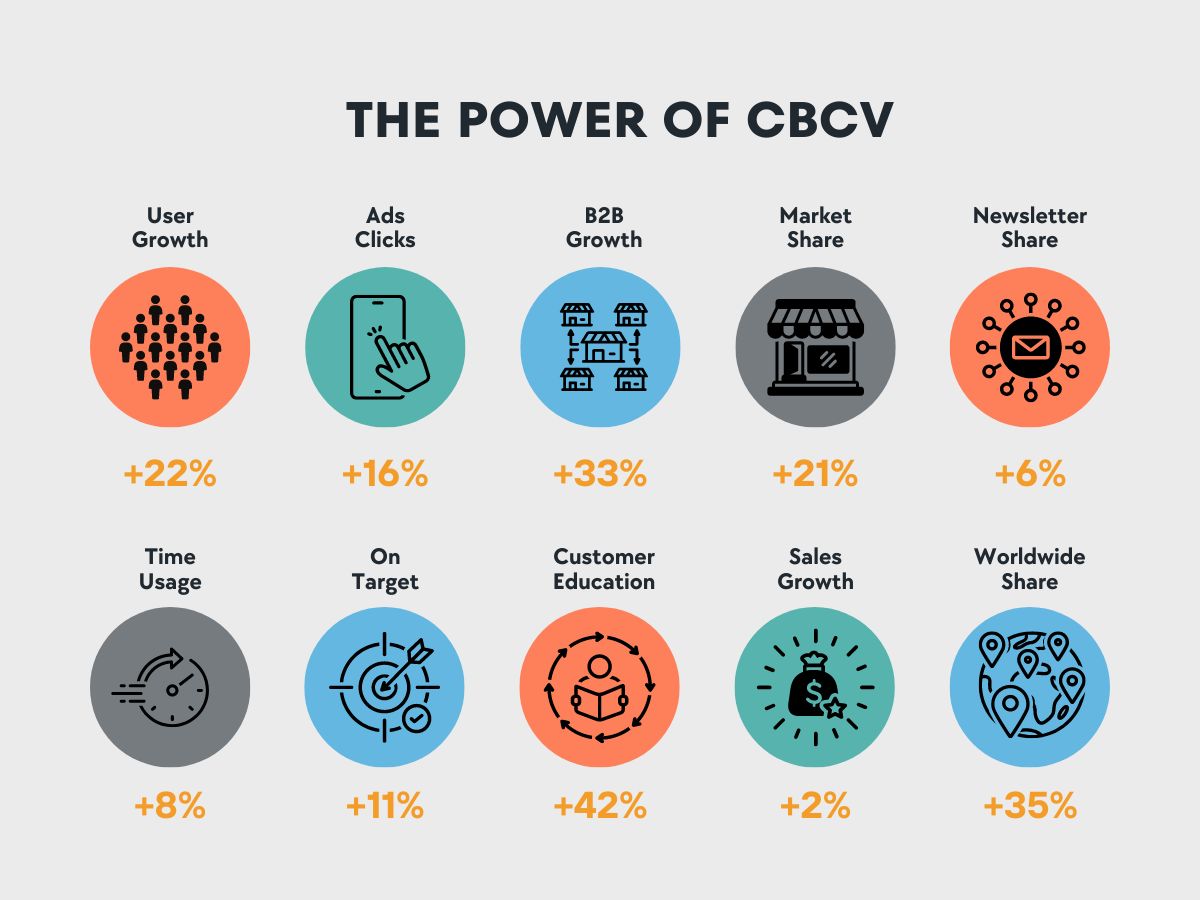

By using these customer metrics, Revolve Group was able to demonstrate that it had a sustainable competitive advantage in the online fashion industry. It also showed that it had a large growth opportunity in expanding its customer base both domestically and internationally. Revolve Group’s success story shows how CBCV can help companies leverage their customer data to create value for themselves and their stakeholders.

In conclusion, business driven valuation is an important tool for companies to assess their worth and potential in the market. Among the various methods of business driven valuation, CBCV is one of the most innovative and customer-centric ones. By using customer metrics to estimate the future cash flows from existing and potential customers, CBCV can provide a more accurate and holistic picture of the value creation potential of a company.

CBCV can also help companies communicate their value proposition to the market and attract more customers, partners, and talent. CBCV is not only a valuation method but also a strategic mindset that puts the customer at the center of the business.