- 6 September 2023

- No Comment

- 865

Insurance Score Guide: Boost Your Rating for Better Coverage

I am Nabeel Sheikh, a seasoned financial expert with over 17 years of diverse experience in the world of insurance and risk management. In this comprehensive guide, I’ll go into great detail about insurance scores, how they operate, and what you can do to raise yours.

The Insurance Industry in the United States

The insurance industry in the United States, indeed, stands as one of the largest globally, boasting substantial premium volumes, a vast workforce, and impressive revenues for insurance companies. Annually, the U.S. witnesses insurance premiums exceeding a staggering one trillion U.S. dollars. Among these industry giants, MetLife, headquartered in New York, shines as a major player. In 2021, their total revenue from U.S. business operations neared 30 billion U.S. dollars.

Leading Insurance Companies

As the world’s leading insurance market, the U.S. is home to numerous renowned insurance companies. In 2021, industry giants like Berkshire Hathaway, Prudential Financial, and MetLife dominated the scene, primarily in terms of total assets held by each firm. While Prudential Financial offers a spectrum of financial products and investment management alongside insurance services, Berkshire Hathaway operates as a holding company with subsidiary ventures spanning freight rail transportation, energy generation and distribution, manufacturing, retailing, and insurance.

Health Insurance Landscape

Health insurance remains a prominent issue in the United States, particularly since the introduction of Obamacare in 2010, which extended coverage to previously uninsured Americans. Various forms of health insurance are available in the U.S., including both private and public options. In 2021, UnitedHealth Group Inc claimed the top spot as the largest health insurance company, commanding a 15 percent market share in terms of direct premiums written. As of March 2023, MetLife emerged as the leading life insurance company in the U.S., with a market capitalization of approximately 46 billion U.S. dollars.

Understanding Insurance Score

“It’s good to know this: Insurance firms created the first insurance scores during the 1990s. And today, the vast majority of home insurance firms and almost all vehicle insurers utilize insurance ratings to evaluate their policies.”

You’ve probably heard about factors like your driving record, the type of coverage you need, and even your location. But did you know that there’s another important player in the world of insurance? It’s your Insurance Score.

An insurance score is a numerical representation used by insurance companies to assess the likelihood of an individual or entity filing insurance claims and the potential cost of those claims. This score is primarily based on an individual’s credit history and other relevant financial information.

Insurance scores aim to predict risk, helping insurers determine the premiums they charge for insurance policies. A higher insurance score typically suggests a lower risk of filing claims, leading to lower insurance premiums, while a lower score indicates a higher risk and, consequently, higher premiums.

It’s important to note that insurance scores are different from traditional credit scores, such as FICO scores or VantageScores. Insurance scores specifically focus on predicting insurance-related risk.

Why Insurance Score is Important

Insurance scores play a crucial role in the insurance industry by helping insurers assess risk, set appropriate premiums, improve pricing accuracy, and promote fairness in the insurance market. They benefit both insurance companies and consumers by contributing to efficient and competitive insurance markets. Insurance scores are important for several reasons in the insurance industry:

Risk Assessment

Insurance scores help insurers assess the level of risk associated with insuring an individual or entity. By analyzing an applicant’s credit history and other relevant financial data, insurers can predict the likelihood of that applicant filing a claim in the future. This risk assessment is crucial for determining appropriate premium rates.

Pricing Accuracy

Insurance scores contribute to pricing accuracy. By using insurance scores, insurers can set premiums that more accurately reflect the risk profile of each policyholder. This means that individuals with lower risk profiles pay lower premiums, while those with higher risks pay higher premiums. This fairness in pricing benefits both insurers and policyholders.

Reducing Adverse Selection

Adverse selection occurs when individuals with a higher likelihood of filing claims are more inclined to purchase insurance, while those with lower risks opt-out. Insurance scores help mitigate adverse selection by ensuring that premiums align with risk levels. This encourages a broader and more balanced pool of policyholders.

Efficiency

Insurance scores streamline the underwriting process. Instead of relying solely on time-consuming and subjective assessments of an applicant’s risk, insurers can use objective data to make quicker and more accurate decisions. This efficiency benefits both insurance companies and applicants.

Market Competition

Insurance scores enable insurers to compete effectively in the market. By accurately assessing risk and setting competitive premiums, insurers can attract and retain customers. This competition can lead to better options and pricing for consumers.

Consumer Access

While insurance scores are used to assess risk, they are also designed to be fair and transparent. Consumers have the right to access their insurance scores and dispute any inaccuracies. This transparency ensures that individuals are treated fairly and can advocate for themselves in the insurance process.

Compliance

In some regions, insurance scores are regulated to ensure they are used fairly and ethically. Compliance with these regulations helps maintain the integrity of the insurance industry and protects consumers from unfair practices.

How Insurance Scores Are Calculated

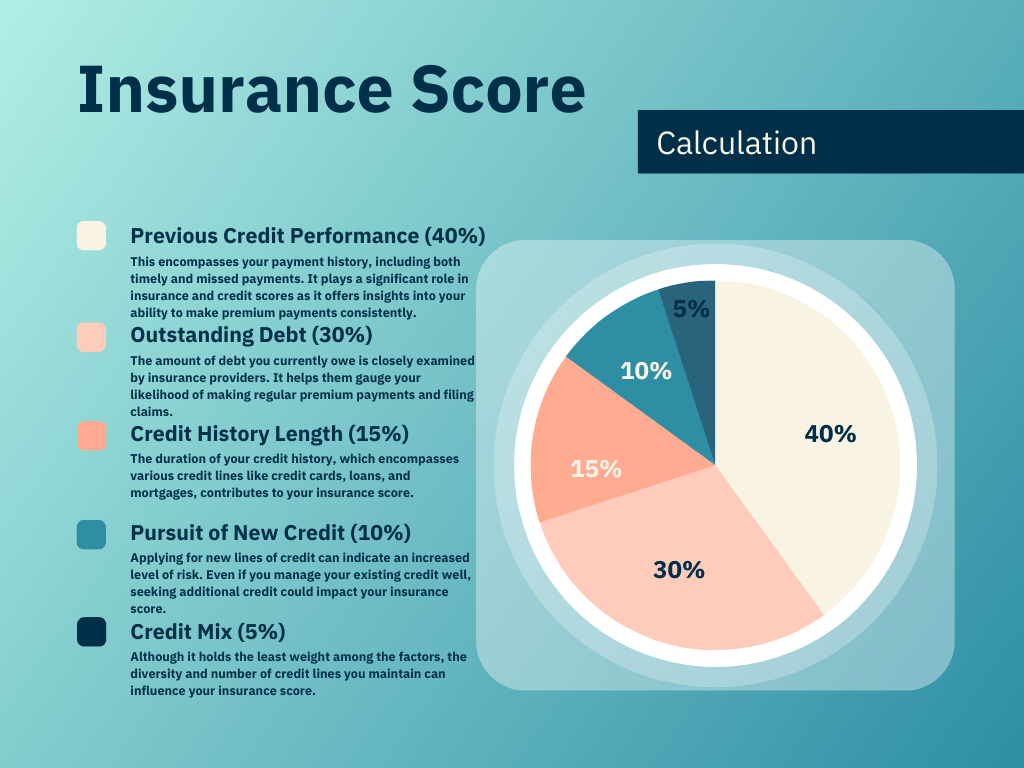

Here’s the information about how an insurance score is calculated presented in a diagram:

Insurers utilize various factors to determine your insurance score, which is a crucial component in assessing your risk profile. These factors are derived from your credit report and are assigned different weights, as indicated above. Understanding how each factor contributes to your insurance score can provide insights into how insurers evaluate your premium payments and risk potential.

Understand Insurance Score Ranges

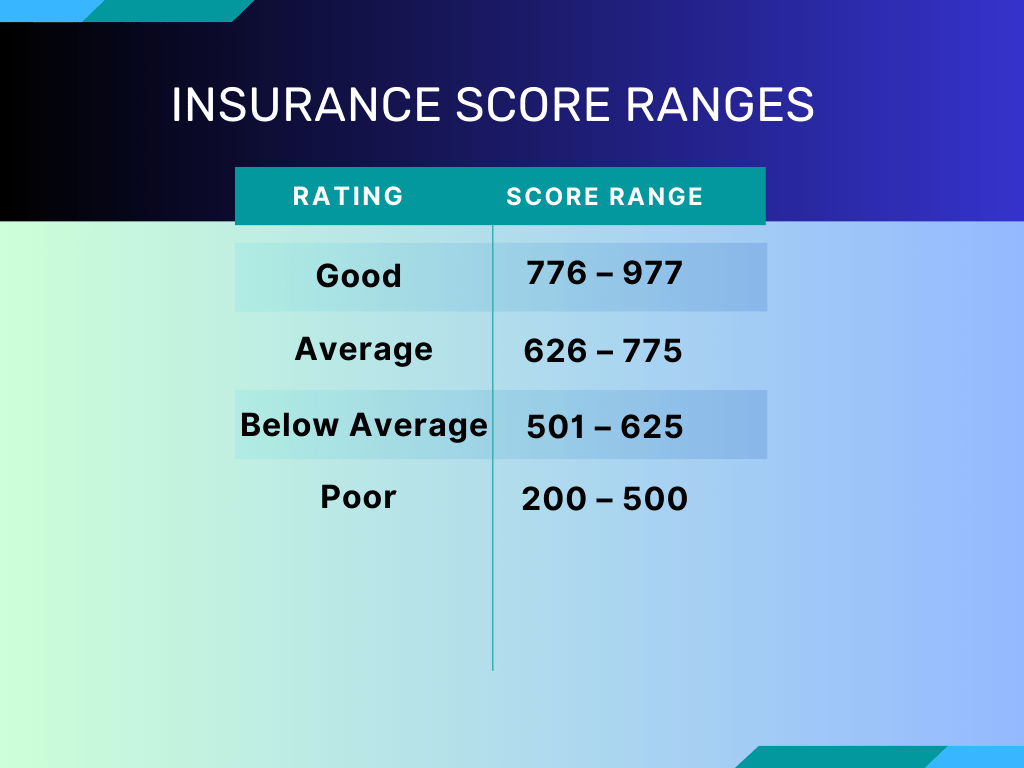

It’s worth noting that insurance score regulations vary by state. Some states have restrictions on how much weight insurers can give to credit history when calculating insurance scores. Be sure to check the regulations in your state to understand how your score may affect your premiums.

Insurance scores are like grades for your insurance trustworthiness. They range from really good to not so great. If your score is high, insurance companies see you as less risky. In some states, these scores help decide how much you pay for insurance.

According to Progressive, insurance scores go from 200 to 997. If you’re below 500, it’s not so great. But if your score is between 776 and 997, you’re doing well.

So, what’s a good insurance score? It’s usually anything above 775. However, remember that each insurance company has its own rules for car and home insurance.

Here’s a simple table to explain:

This table tells you where your insurance score falls and what that means. But keep in mind that different insurance companies might have slightly different rules in your area.

Strategies to Improve Insurance Score

If you’re wondering how to boost your insurance score, there are several effective methods to consider. Improving your credit-based insurance score often involves similar tactics to those used for enhancing your regular credit score. Here are three key approaches to help you on your journey to better insurance scores:

Financial Responsibility Matters

One of the primary steps toward a healthier insurance score is to manage your finances responsibly. This entails:

Timely Bill Payments

Pay your bills on time, every time. Consistent punctuality can significantly impact your insurance score positively.

Maintain a Low Credit Utilization

Aim to keep your credit card balances below 30 percent of your credit limits. High balances can hurt your insurance score.

Prompt Debt Repayment

Work on paying down your debts swiftly, especially those with high-interest rates. Reducing debt demonstrates financial responsibility.

Honor Financial Agreements

Ensure that you meet the terms and conditions of your financial agreements and contracts. This builds trust and helps your insurance score.

Monitor Your Progress

To track your credit and insurance score improvements, follow these steps:

Access Your Credit Reports

Visit www.annualcreditreport.com to obtain free copies of your credit reports. You’ll receive reports from all three primary credit bureaus.

Regular Monitoring

Consistently check your credit reports to see how your scores are changing. Positive trends in your credit score often translate to improvements in your insurance score.

Increased Access

Due to the pandemic, you can now access your credit reports weekly through this site, instead of the previous annual limitation.

Stay Informed and Empowered

Knowledge is power when it comes to managing your finances and insurance scores. Stay informed about your credit and insurance matters by utilizing resources like:

Educational Materials

Seek out financial literacy resources and workshops to enhance your understanding of responsible credit card usage and budgeting techniques.

Secure Credit

Consider applying for a secured credit card, which requires a cash deposit as collateral. Responsible use of such cards can boost your insurance score.

By following these strategies and keeping a watchful eye on your credit reports, you can take significant steps toward improving your insurance score and securing better insurance rates. Remember, responsible financial management is the key to success.

Some Useful Hacks to Improve Insurance Score

Here are some of the most useful and practical insurance hacks to help increase your scores:

Bundle Your Insurance Policies

Bundling multiple insurance policies, such as auto and home insurance, with the same provider often results in discounts. It not only saves you money but also shows insurers that you are a loyal customer, potentially leading to better scores.

Maintain Continuous Coverage

Avoid gaps in your insurance coverage, as they can raise red flags for insurers, and continuously maintaining insurance coverage demonstrates responsibility.

Avoid Filing Minor Claims

Resist the temptation to file small insurance claims for minor losses or repairs. Frequent claims, even for small amounts, can negatively impact your insurance scores. Cover minor expenses out of pocket to maintain a clean claims history.

Overcoming Insurance Score Challenges: A Medical Insurance Case Study

Background

Mark Reynolds, a 42-year-old dedicated family man and a middle-aged professional, had always prioritized his family’s well-being. He understood the importance of having robust medical insurance, especially as he had a wife and two children to care for. However, Mark faced a significant obstacle – his insurance score was far from ideal.

Challenge

Mark’s insurance score was adversely affected by several factors, including:

Medical Debt

Mark had incurred substantial medical debt due to a recent surgery for a major health issue. His outstanding bills had put a strain on his finances, causing his insurance score to plummet.

Late Payments

In the midst of dealing with his health crisis, Mark had overlooked some medical bill payments, resulting in late payment notations on his credit report.

Limited Credit History

Mark had a limited credit history, which also contributed to his low insurance score. He had never taken out loans or applied for credit cards, making it challenging for insurers to assess his creditworthiness.

Importance of Insurance Score

Having a low insurance score posed a significant dilemma for Mark. It meant that he would likely face higher premiums, reduced coverage options, or even insurance denials, precisely when he needed medical insurance the most. Mark was aware that he needed to address these issues to secure the coverage his family deserved.

Solution

Determined to improve his insurance score and secure medical insurance, Mark embarked on a systematic journey of financial recovery:

Medical Debt Negotiation

Mark contacted his healthcare providers and negotiated reduced payment plans for his outstanding medical bills. This helped alleviate his financial burden and prevented further damage to his credit.

Timely Payments

Mark committed to making timely payments for all his medical expenses moving forward. He set up reminders and automated payments to ensure he never missed a due date again.

Credit Building

Understanding the importance of a positive credit history, Mark applied for a secured credit card, which required a cash deposit as collateral. He used this card responsibly, making small purchases and paying the balance in full each month.

Credit Monitoring

Mark regularly monitored his insurance score and credit reports. Tracking his progress helped him stay motivated and address any discrepancies promptly.

Outcome

Mark’s unwavering determination and diligent efforts bore fruit over time:

- His insurance score gradually improved from “poor” to “fair” and eventually reached the “good” range.

- With his improved insurance score, Mark successfully secured comprehensive medical insurance for his family. This coverage provided peace of mind and access to the healthcare services they needed.

- The financial knowledge and responsible credit habits Mark acquired during this journey would serve him well throughout his life, ensuring a stable financial future for his family.

Like What You Read?

- Connect with us, Here.

- Have a question? Ask us.

- Read more, check out: Decoding Credit Scores: A Comprehensive Guide for Every Consumer