- 30 January 2024

- No Comment

- 1405

Guide to Peer-to-Peer (P2P) Exchanges: Important Things to Know

Imagine a world where you can trade, lend, and transact directly with others without the need for big banks or traditional financial middlemen. That’s the magic of Peer-to-Peer (P2P) Exchanges!

These platforms use a technology called blockchain to make sure everything happens securely and transparently.

Now, P2P exchanges aren’t just for trading cryptocurrencies. They’re like a financial playground, offering all sorts of services.

Ever thought about borrowing or lending money directly without dealing with the usual credit hassle? That’s P2P lending for you! You can also trade various assets, from houses to digital stuff, all in a decentralized way.

But, hold on! As with any new adventure, there are challenges. The rules and regulations are still figuring out how to deal with this P2P exchange universe. They want to encourage innovation while making sure everyone stays safe.

What Exactly are P2P Exchanges?

Well, they’re like the superheroes of online platforms, bringing people together to trade and do business without any middlemen getting in the way.

Like you want to swap or do a deal with someone directly.

That’s what P2P exchanges are all about! Sure, they’re famous for crypto trades, but they’re not one-trick ponies. These platforms also cover a bunch of other money-related activities.

Breaking Down P2P Exchanges and How They Roll:

- Direct Transactions:

P2P exchanges are like matchmakers for buyers and sellers. Imagine you want a specific cryptocurrency or some digital asset. With P2P, you can connect directly with someone selling it. It’s like having full control over your deals!

- Decentralization:

P2P exchanges operate on fancy decentralized networks using blockchain tech. What does that mean? Your transactions are super safe, transparent, and resistant to anyone trying to mess with them. Think of the blockchain like an unbreakable diary of everything that happens.

- Diverse Asset Trading:

These exchanges aren’t just for crypto. You can trade all sorts of stuff – not just digital money but real things like houses, stocks, and even digital treasures. It’s like a marketplace for everything!

- P2P Lending:

Beyond trading, P2P exchanges are also lending hubs. You can lend your money and earn interest or borrow from others, all without dealing with those big, traditional lending hubs.

- User Autonomy:

P2P exchanges are like giving you the keys to your financial kingdom. You set the rules – your prices, your partners, and how you manage your assets. No need for someone else to do it for you!

- Regulatory Considerations:

Just a heads up – the rules for P2P exchanges change depending on where you are. Some places love them, others have a few rules to keep things in check. It’s a bit like each region having its own set of trading cards.

Types of P2P Exchanges

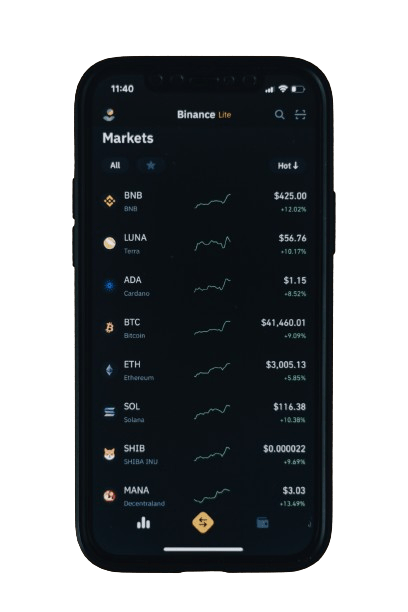

1. Cryptocurrency P2P Exchanges

Cryptocurrency Trading Platforms: Ever heard of Binance or Paxful? These are hotspots for trading cryptocurrencies directly with other users.

Cryptocurrency Lending Platforms: Fancy earning some crypto interest? These platforms let you lend or borrow digital currencies without any big guys in between.

2. P2P Lending and Borrowing Platforms

P2P Personal Loans: Skip the banks and borrow or lend money directly from/to pals. Platforms like LendingClub and Prosper are your go-to pals for this.

P2P Business Loans: Got a business dream? Get the cash directly from individual investors. Check out Funding Circle for your entrepreneurial journey.

3. P2P Real Estate Platforms

Real Estate Crowdfunding: Want a piece of the real estate pie? Pool your funds with others on platforms like RealtyMogul and Fundrise to invest in property projects.

Property Rental: Need a place to crash? Some platforms connect renters with property owners for direct negotiations.

4. P2P Marketplace Platforms

Goods and Services Exchange: Looking to buy or sell stuff directly? Craigslist and Facebook Marketplace are your virtual flea markets.

Digital Collectibles and NFTs: Dive into the world of digital treasures! These platforms let you trade unique digital items like art and music, with no physical stuff required.

How P2P Exchanges Make Things Happen

- Platform Registration: – Start your P2P journey by signing up on your favorite platform. Just like joining a club, you might need to share a bit about yourself to keep things safe and sound.

- Listing and Posting: – Sellers or lenders play matchmaker by putting up listings. They spill the details about what they’re offering – it’s like setting up shop with all the cool stuff they’ve got.

- Search and Match: – Buyers or borrowers become treasure hunters, scrolling through the listings to find their perfect match. Think of it like shopping online but for anything, you can imagine.

-

Initiating Transactions: – Found something you like? Shoot a message to the seller or lender. It’s like sliding into DMs, but for business.

- Negotiation and Agreement: – It’s time to haggle a bit. Negotiate the terms – the price, how you’ll pay, where it’ll be delivered – all the important stuff. Some platforms even have built-in chat systems for smooth talks.

- Escrow Services: – Now, here’s where the platform acts like a trusty friend. They hold onto the money while the seller gets ready to hand over the goods. Once everyone’s happy, the cash is released.

- Transaction Execution: – Do the deed! Whether it’s transferring digital stuff, exchanging real things, or providing services, this is where the magic happens.

- Payment Processing: – Time to settle the bill. Platforms handle payments using all sorts of methods – from old-school bank transfers to futuristic cryptocurrencies.

- User Ratings and Reviews: – After the show, everyone gets a chance to give their two cents. Did the other party rock or flop? It’s like leaving a review for your favorite restaurant, but for business pals.

- Dispute Resolution: – If things get messy, the platform plays referee. They help sort out disagreements, making sure everyone leaves happy.

- Transaction Completion: – Once it’s a wrap, both parties can pat themselves on the back and leave feedback. Think of it as the virtual high-five after a successful deal.

- Withdrawal and Settlement: – If there’s money in limbo (like in escrow), it’s time for the grand release. Sellers get their cash, and both parties can walk away with their treasures.

Safety Cautions

- Platform Vigilance: – Choose your P2P platform wisely. Check reviews, do your research, and make sure it has a good reputation. Not all platforms are created equal.

- Identity Shield: – When registering, guard your personal info like a secret treasure. Only share what’s necessary, and make sure the platform uses robust security measures.

- Communication Caution: – Keep all negotiations and discussions within the platform’s messaging system. Avoid sharing sensitive details outside this secure space.

- Small Steps First: – If you’re new to P2P, start with small transactions. Get comfortable with the process before diving into big deals.

- Rating Check: – Before sealing the deal, peek at the ratings and reviews of your potential trading buddy. It’s like getting references before hiring someone.

- Escrow Embrace: – Prefer deals with escrow services. It’s like having a trustworthy friend holding onto the money until everyone’s happy.

- Beware of Too Good to Be True: – If an offer seems too good to be true, it might be. Trust your instincts and double-check the details.

- Secure Payment Methods: – Opt for secure payment methods supported by the platform. Cryptocurrencies, digital wallets, or other trusted options add an extra layer of safety.

- Public Spaces for Transactions: – Whenever possible, conduct transactions in public spaces. Safety first – especially when dealing with physical goods.

- Keep Records: – Keep a record of all transactions, messages, and agreements. It’s your virtual paper trail for any unforeseen issues.

- Report Anything Fishy: – If something smells fishy, report it to the platform. They’re there to ensure a safe environment for everyone.

- Stay Informed: – Keep yourself updated on the latest P2P safety tips. Knowledge is your best defense against potential risks.

In a Nutshell: The P2P Revolution

Peer-to-Peer (P2P) exchanges have unleashed a whole new world of do-it-yourself transactions. Forget the old ways – these platforms let you connect directly with others, cutting out the middlemen.

Whether you’re into cryptocurrency trades, lending, or real estate adventures, P2P exchanges put the power in your hands. They’re like the superheroes of the financial world, giving you the freedom to make decisions on your terms.

So, dive in, explore, and enjoy the ride! P2P exchanges are all about you, your choices, and a future where transactions are as easy as a friendly handshake.