- 3 December 2025

- No Comment

- 176

Everyday Apps Are Slowly Replacing Your Bank

Fintech 2.0: How Embedded Finance Is Quietly Replacing Traditional Banks

The world of finance is transforming in ways that even seasoned experts did not fully anticipate. What once required long queues at bank branches or complex forms is now hidden behind a single tap inside our favorite apps. Ordering food, paying a friend, booking a ride, buying something online, even applying for credit, all of these everyday actions now contain small pieces of banking. This invisible shift is called Embedded Finance, and it is slowly rewriting the rules that traditional banks lived by for a century.

What we are witnessing today is Fintech 2.0, a phase where financial services are no longer standalone—they live inside the digital experiences people use every day. And whether banks like it or not, this shift is already happening at full speed.

What Is Embedded Finance?

Embedded Finance simply means integrating financial services directly inside non-bank apps, so users get the financial features they need without ever switching platforms.

This includes

- Payments inside apps

- Buy Now, Pay Later options

- Instant lending during checkout

- Insurance bundled automatically with purchases

- Digital wallets and micro-savings inside lifestyle apps

The user sees convenience. The business sees higher engagement. But the bank? The bank becomes invisible.

In the past decade, banking was something people intentionally did. In Fintech 2.0, finance happens in the background, deeply woven into digital life.

Why People Don’t Notice the Shift And Why Banks Should Worry

Traditional banks shaped our financial world for generations. They controlled payments, lending, insurance, savings, and every step in between. But consumers today are no longer going to banks. Instead, banks are coming to them, hidden inside the apps they already trust.

People now experience finance through

- Uber rides

- Amazon checkouts

- Careem wallets

- Food delivery apps

- Retail apps offering instant credit

- Online platforms offering travel insurance at checkout

This shift sounds subtle, but its impact is massive, because the customer relationship is moving away from banks and toward tech platforms.

The Silent Takeover of Payments

How Payments Became Invisible

Think about the last time you entered your debit card details manually. Chances are, it was months ago. Digital apps now store payment information, automate processing, and make transactions frictionless.

A few examples

- Ordering on Amazon or Daraz: the card is stored

- Paying for a ride: done automatically when the trip ends

- Subscriptions: renew without user involvement

These conveniences are powered by payment infrastructure companies like Stripe, PayPal, Apple Pay, Adyen, and dozens of regional fintechs.

Banks still handle the money in the backend, but the customer loyalty now belongs to the app.

Why This Hurts Banks

Payments used to be the primary way banks interacted with customers. It helped them gather data, understand spending behavior, and sell more financial products. But with embedded payments, banks lose visibility and control.

They become the “pipe,” not the brand.

Lending Has Moved to the Checkout Page

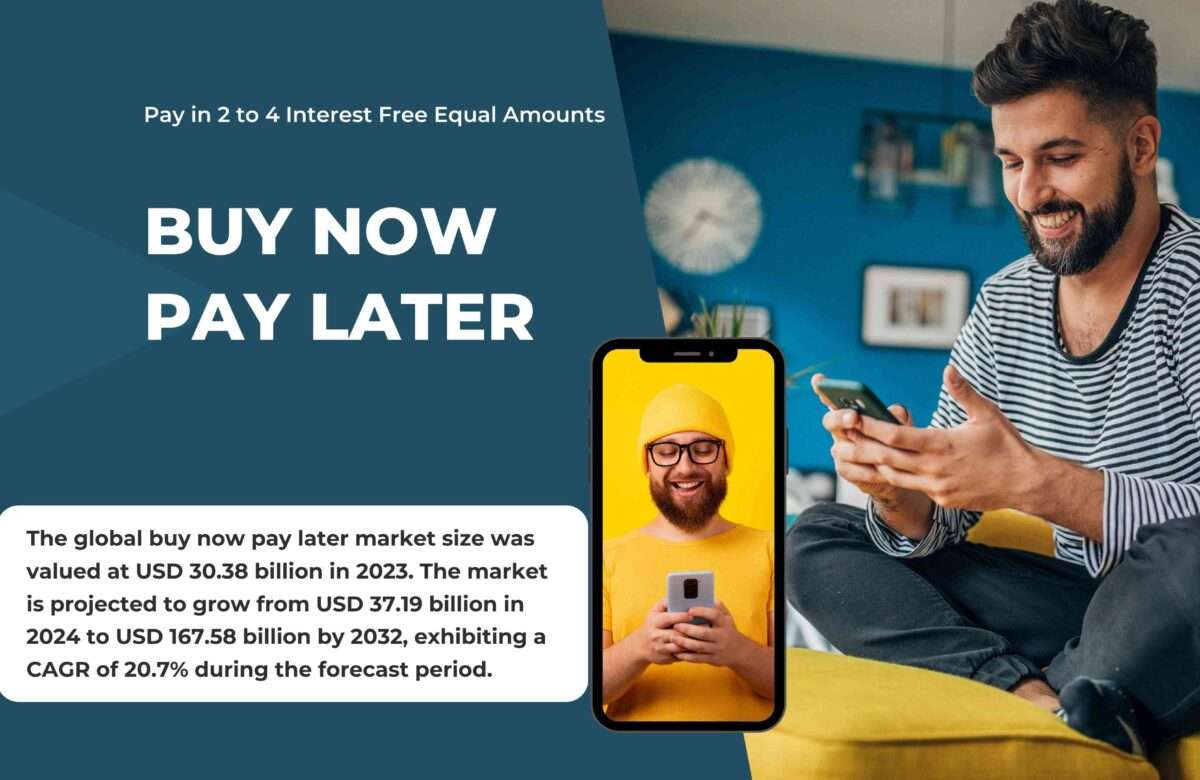

Buy Now, Pay Later Changed the Game

A few years ago, taking a loan required visiting a bank or applying online with lengthy checks. Today, apps offer micro-loans instantly.

Examples

- Buy Now, Pay Later options at checkout

- E-commerce apps offering installment plans

- Ride-hailing apps offering driver loans

- Retail apps offering credit for electronics

- Social apps offering micro-credit to sellers

Companies like Afterpay, Klarna, and Affirm pioneered this model, but now even Apple and Amazon have jumped in.

How This Impacts Banks

Banks never imagined that retail stores and tech apps would become lenders. But now brands that understand their customers more intimately than banks do are offering financing at exactly the right moment.

Banks are being pushed out of the lending relationship.

And once again, the bank becomes the silent partner in the background.

Insurance, Now Sold Without the Insurance Company

Embedded Insurance Is Becoming the New Default

Insurance is naturally complicated. Nobody wakes up excited to buy it. However, when insurance is bundled inside a purchase, it suddenly makes sense.

For example

- Travel insurance added while booking a flight

- Gadget insurance included with mobile purchases

- Car insurance options inside ride-hailing apps

- Shipping insurance included during online ordering

Consumers do not feel like they are buying insurance, but they are.

What This Means for Traditional Insurers

Insurers spent decades acquiring customers directly. But embedded insurance shifts that relationship to digital platforms, from airlines to e-commerce apps. Old insurance companies now struggle to keep their direct connection with customers.

Once again, the traditional financial institution becomes a backend utility.

Why Fintech 2.0 Works: The Power of Seamless Experiences

People do not wake up thinking about banking. They wake up thinking about convenience, speed, and efficiency.

Embedded Finance succeeds because

- It removes friction

- It reduces steps

- It blends finance into daily life

- It gives users what they need, exactly when they need it

Traditional banks may have trust, but embedded finance apps have relevance, and in the modern world, relevance wins.

How Legacy Banks Are Responding

Most traditional banks know they are losing ground. Their biggest challenge is not technology but culture. Banks are slow, heavily regulated, risk-averse, and designed for caution. Tech companies are fast, innovative, and customer-obsessed.

Some banks are trying to catch up by

- Partnering with fintech startups

- Offering their APIs to developers

- Creating digital-only branches

- Building Banking-as-a-Service platforms

These efforts show promise, yet many banks remain reluctant to fully accept that their role is shrinking.

In Fintech 2.0, banks that refuse to adapt will eventually become utilities providing raw financial infrastructure while apps own the customer relationship.

Will Banks Disappear?

Banks will not fully disappear. They will evolve. But the front end of finance, the part people see and interact with, is moving into the hands of apps, platforms, and ecosystems.

Future trends are already taking shape

- Embedded payroll inside gig-worker apps

- Micro-investing inside social platforms

- Savings pockets inside shopping apps

- Instant credit inside gaming ecosystems

- Insurance claims processed directly by AI assistants

In this future, the apps we use daily will become our financial partners, whether we notice it or not.

The Quiet Revolution of Embedded Finance

Fintech 2.0 is not loud. It arrived without billboards, without big announcements, and without traditional banks fully realizing what was happening.

It grew through

- convenience

- culture

- digital dependence

- mobile habits

- and deep user behavior

The banks that survive will be the ones that understand that finance is no longer about physical branches, separate apps, or complicated interfaces. The future belongs to seamlessness, and seamlessness belongs to embedded finance.

The question every legacy financial institution must now ask is simple:

If customers no longer need a bank app, will they still need the bank?