- 9 July 2025

- No Comment

- 689

Why Different Currencies Have Different Values: A Simple Guide

Have you ever wondered why a single US dollar can buy you a snack in the States, but in Pakistan, it’s worth over 270 rupees, enough for a decent meal? Or why that same dollar equals about 150 Japanese yen but only 1.3 Singapore dollars?

Why isn’t money the same everywhere?

Why does its value seem to flip-flop depending on where you are?

Well, you’re not alone in wondering this, it’s a question that pops up every time we travel, shop online from another country, or even watch the news about the “strong dollar” or “weak euro.” In this article, we’re going to unravel the mystery of why different currencies have different values. Don’t worry if economics sounds intimidating; we will explain it like we’re chatting over coffee. We’ll use simple examples, fun analogies, and real-life stories to make it all click. By the end, you’ll see why this matters for your next trip, your wallet, or just understanding the world a little better. Let’s dive in!

A Relatable Puzzle to Start With

Picture this: You’re planning a trip. You’ve got $100 in your pocket, and you’re heading to Japan. You check the exchange rate and find out your $100 turns into 15,000 yen. Cool, right? But then you look at Pakistan, and that same $100 becomes 27,000 rupees. Wait-what? How can the same $100 stretch so much further in one place than another? And why does it keep shifting every day?

That’s the magic (and sometimes madness) of currencies and exchange rates. Let’s break it down step by step and figure out what’s going on behind the scenes.

A Quick Look Back: How Money Got Started

Before we get into why currencies differ, let’s rewind a bit. Money wasn’t always the paper or digital numbers we know today. For a long time, it was tied to something solid—like gold. This was called the gold standard. Imagine it like a promise: every dollar or pound was worth a specific amount of gold in a vault somewhere. Countries couldn’t just make more money unless they had the gold to back it up. It kept things pretty steady.

But as the world got bigger—think more trade, more people, more wars—sticking to gold became tricky. By the 1970s, most countries ditched the gold standard for something called fiat money. That’s money with no physical backing—just the government saying, “Trust us, this is worth something,” and all of us agreeing to go along with it.

Here’s the twist: with fiat money, its value depends on supply and demand, like a game of tug-of-war. If lots of people want a currency, its value climbs. If no one does, it flops. That’s why the US dollar stays strong—people want it—while a currency like Venezuela’s bolívar tanked during its economic crisis because, well, no one trusted it anymore. Let’s explore the big players that tug on this rope.

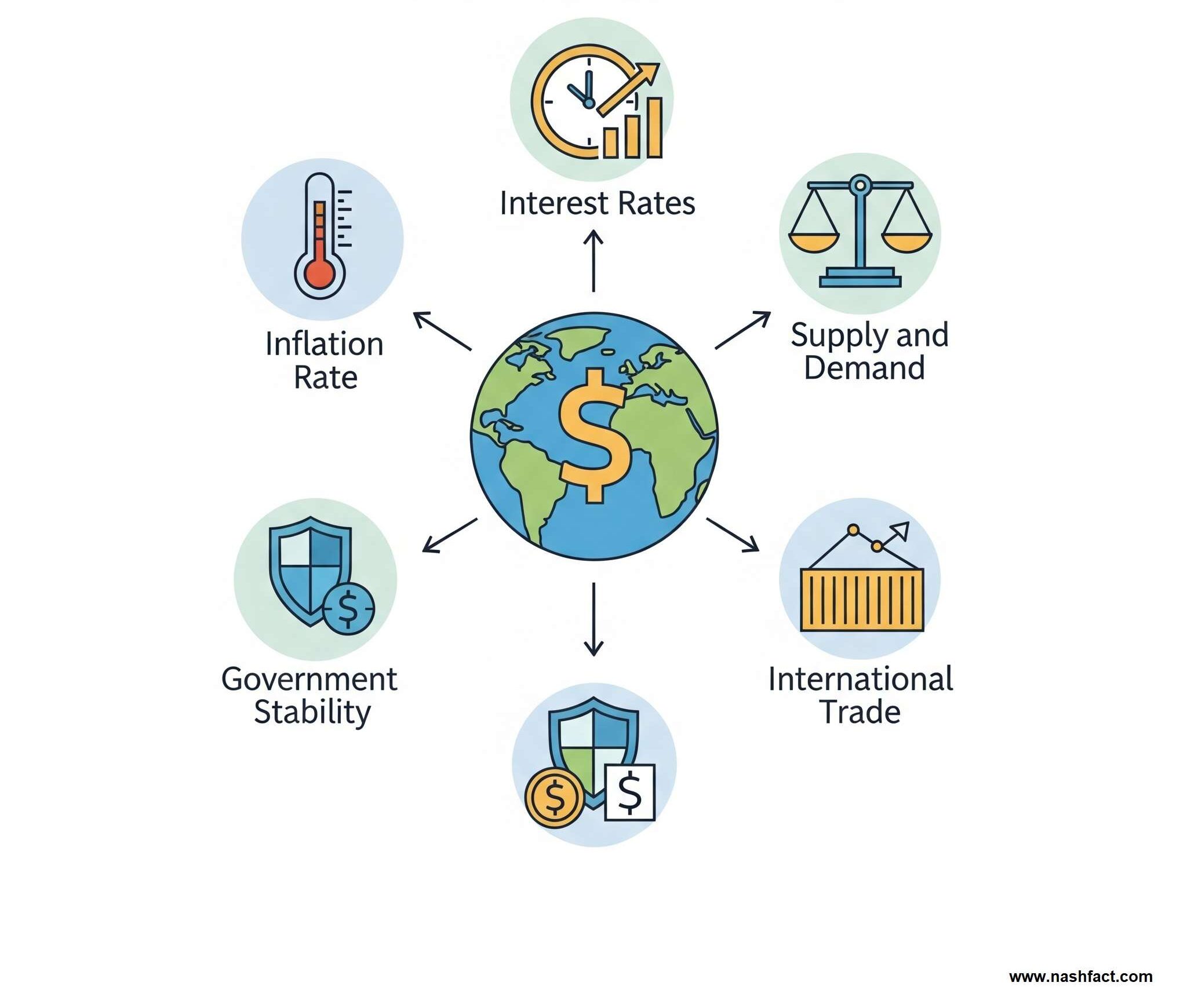

What Makes Currencies Worth More or Less?

So, why isn’t 1 dollar equal to 1 yen or 1 rupee? It comes down to a handful of factors that shape a currency’s value. Let’s unpack them one by one.

Inflation: When Money Loses Its Punch

Imagine you’ve got $10, and it buys you a couple of burgers today. Fast forward a year, and thanks to inflation, those same $10 only get you one burger. What happened? Inflation is when there’s too much money floating around compared to the stuff you can buy with it—like too many tickets for too few prizes at a fair. Prices go up, and your money’s value goes down.

- Why it matters: When inflation gets out of control, people don’t want to hold that currency—it’s like a melting ice cream cone. Less demand means a weaker currency.

- Real-life example: Take Zimbabwe. Back in the 1980s, 1 Zimbabwean dollar was worth more than a US dollar—about 1.35 USD. But then came bad policies, corruption, and printing money like it was confetti. By the 2000s, 1 US dollar equaled 600,000 Zimbabwean dollars. It got so bad they ditched their own money and started using US dollars instead!

Analogy: Think of money like a rare trading card. If there’s only one, everyone wants it, and it’s super valuable. Print a million copies, and suddenly it’s not worth much. Inflation is like flooding the market with extra cards.

Interest Rates: The Reward for Stashing Cash

Ever heard of interest rates? It’s what you pay to borrow money—or what you earn when you lend it. Countries’ central banks (like the Federal Reserve in the US) set these rates, and they’re a big deal for currency value.

- How it works: High interest rates are like a sweet deal for investors. Say the US offers 5% interest on savings while Germany offers 2%. Investors will swap their euros for dollars to get that better return, boosting demand for dollars and making it stronger.

- The flip side: High rates can make borrowing expensive at home. Fewer people take out loans for houses or businesses, slowing things down. It’s a tightrope walk for countries.

Real-life example: If US interest rates rise while Japan’s stay low, people might ditch yen for dollars to invest in US bonds, pushing the dollar’s value up.

Analogy: Interest rates are like a sale sign at your favorite store. A big discount (high interest) pulls in more shoppers (investors), making the store’s “currency” more popular.

Country Stability: A Safe Place to Park Your Money

Think of a country like a playground. If it’s safe, clean, and the rules don’t change, kids (investors) want to play there. But if it’s chaotic—protests, corruption, or shaky laws—everyone runs away.

- Why it matters: Stable countries attract foreign investment, which means more people need their currency. More demand = stronger currency.

- Real-life example: When China opened up in the 1970s, companies poured in to build factories. They needed Chinese yuan to do it, driving up demand and making the yuan stronger.

Analogy: Investing in a country is like picking a vacation spot. You’d rather book a hotel in a calm, sunny town than one where storms (or coups) might hit any minute.

Exports and Imports: Trading Goods, Trading Currencies

When a country sells stuff—like Japan with its cars or Saudi Arabia with its oil—buyers need that country’s currency to pay. That’s exports boosting demand.

- How it works: Japan exports Toyotas, so buyers need yen. More yen demand = stronger yen. Imports work the opposite way—buying foreign goods means selling your currency, which can weaken it.

- Cool fact: The US struck a deal with oil-rich countries to sell oil only in dollars (the petrodollar system). Since everyone needs oil, they need dollars, keeping the greenback king.

Analogy: Exports are like running a lemonade stand. If your lemonade’s a hit, everyone trades their cookies (other currencies) for it, making your lemonade more valuable.

Fixed Exchange Rates: Tying Your Currency to a Big Shot

Some countries say, “Forget the ups and downs!” and peg their currency to a stronger one, like the US dollar or Singapore dollar.

- How it works: Brunei’s dollar is pegged 1:1 to Singapore’s—same value, no fuss. Belize sets its dollar at 2:1 with that of the US—2 Belize dollars = 1 USD. It’s stable but ties their fate to the bigger currency.

- Real-life example: If the US dollar dips, Belize’s dollar dips too. They’re like dance partners—when one stumbles, so does the other.

Analogy: Pegging is like hitching your little boat to a giant cruise ship. You’ll sail smoothly as long as the ship does, but if it hits an iceberg, you’re in trouble too.

Why Not Just Use One Global Currency?

Okay, so why don’t we all use a “World Dollar” and skip the exchange rate mess? It sounds dreamy—no more math at the airport! But hold up—it’s not that easy.

- The Euro experiment: Europe’s Euro works great for travel, but it means countries lose control. When Greece crashed in 2009, it dragged the whole Eurozone into drama, and Germany wasn’t thrilled.

- Big risk: One global currency means one country’s mistake could sink everyone. Imagine your savings shrinking because a far-off nation printed too much cash.

Analogy: A single currency is like a giant shared piggy bank. Handy until someone smashes it—or spends it all.

Should Every Country Make Its Currency Super Strong?

Not really! It depends on what a country needs.

- Importers love strong currencies: Singapore buys tons from abroad, so a strong dollar keeps costs low.

- Exporters prefer weaker ones: China keeps its yuan lower to make its goods cheap for the world, boosting sales.

Real-life example: China’s been accused of devaluing its currency on purpose—a weaker yuan means more exports, but it makes imports pricier for its people.

Why This Matters to You

So, what’s in it for you? Understanding currency values isn’t just trivia—it’s practical! It can help you:

- Travel smarter: Know when to swap cash or use a card abroad.

- Follow the news: “Weak yen” or “strong pound” won’t sound like gibberish anymore.

- Think bigger: Whether you’re saving, shopping, or dreaming of a trip, you’ll see how money connects the world.

Next time you’re at an exchange counter or scrolling through global headlines, you’ll spot the forces at play— inflation, trade, stability—all shaping those numbers.

Let’s Wrap It Up: Your Money, Your World

Money might look simple—just coins, bills, or digits—but it’s tied to a web of global action. From how much Japan sells to how steady a government stands, it all decides why your dollar stretches further in Vietnam than in London. Knowing this doesn’t just make you money-savvy; it opens your eyes to how countries trade, grow, and sometimes stumble.

So, next time you’re swapping currencies or planning a trip, think about the story behind those exchange rates. Ask questions, dig deeper, and see the world a little differently. After all, understanding money is understanding power—and that’s a pretty cool skill to have!

Read more: Which Fund is Right For You

Millions of people face this same dilemma every day. What’s the difference between an index fund and a mutual fund?

What makes ETFs so popular? And are hedge funds really just for the super-rich? If these questions have ever crossed your mind, you’re in the right place.

This article breaks it all down to simple explanations, so even if you’re just starting your financial journey, you’ll walk away feeling informed and empowered.