- 22 July 2025

- No Comment

- 1313

The $300 Trillion Question: If Everyone’s in Debt, Who’s the Lender?

Imagine you’re in the world’s biggest group chat, and everyone’s talking about how broke they are. The U.S. owes $36 trillion. China? $18 trillion. Japan, Germany, even the countries that usually seem super organized are swimming in debt.

And you’re like, “Hold on… if everyone owes money, who are they borrowing from? Is there some secret money mountain out there no one’s telling us about?”

It’s a great question. But the answer isn’t some rich mystery man hiding in a bunker. It’s way stranger, kind of brilliant, and honestly… a bit scary. Let’s break it down and make sense of this wild $300 trillion global debt story.

What is Debt (Like, It’s Ancient)

Before we start juggling trillions, let’s go way back in time. Like, before money was even a thing. No banks, no coins, no interest rates, just neighbors helping each other out.

That’s debt. Just a promise to return the favor later. No contracts, no calculators—just good old-fashioned trust.

Then came kings, empires, and big dreams.

Castles? Armies? Even more expensive things.

But borrowing from rich nobles wasn’t easy (they were stingy). So, England tried something new in the 1600s:

Sell little IOUs to regular folks.

“Give us some money now, and we’ll pay you back later—with a bonus.”

These IOUs were called bonds—and they totally changed the game.

Suddenly, governments didn’t have to bleed citizens dry with taxes. They could raise huge sums just by borrowing from the public. This idea exploded during the World Wars—countries borrowed like crazy to fund battles, and then borrowed even more to fix everything afterward.

Debt isn’t some modern mess. It’s an old-school tool that built castles, won wars, and (eventually) built highways and hospitals.

Then Came the REALLY Big Shift: Bye-Bye, Gold!

For a long time, global money had an anchor: Gold. The US dollar was the star, and other currencies were tied to it. The dollar itself? Tied to gold in Fort Knox. Seemed solid.

But there was a problem: Gold is limited. Economies need to grow. By the 1970s, the US was spending like crazy (Vietnam War, social programs), flooding the world with dollars. There wasn’t enough gold in Fort Knox (or anywhere) to back all those dollars.

So, in 1971, President Nixon basically said, “Screw it, we’re done with gold.” Poof! The “gold standard” vanished. Money became fiat currency.

Translation: This dollar bill is worth a dollar because the US government says it is. It’s not backed by a shiny rock, just faith and promises.

This was like giving governments a credit card with, well, potentially no limit. And guess what happened next? Yep.

The Debt Explosion: Growth Fueled by Borrowing

From the 1980s onwards, global debt went full rocket ship. Governments realized borrowing wasn’t just for emergencies or wars. It could actually fuel economic growth!

Think about it:

- Need new highways, schools, hospitals? Borrow now, build them, boost the economy later.

- Economy hits a recession? Borrow and spend to keep money flowing, jobs existing.

- Developing nation needs to leap forward? Borrow to build infrastructure fast.

Debt stopped being a last resort and became the primary engine.

Resulting in a $300 TRILLION mountain of global debt. Let that sink in.

- $1 million in $1 bills? Stack it up, it’s as tall as a 30-story building.

- $1 billion? That stack reaches 100 km high – touching the edge of space!

- $300 TRILLION? That stack goes to the MOON AND BACK… 50 TIMES.

Insane, right? So back to our burning question…

Who’s Lending All This Money?

When we hear “US owes $36 Trillion,” it’s easy to picture some supervillain (or maybe just China) holding a giant IOU. China does hold about $750 billion of US debt. But here’s the kicker: China itself owes over $18 Trillion! And who holds their debt? Mostly Chinese banks… who also hold US debt! American banks hold European debt, who hold… you get the picture. It’s a giant, tangled web where everyone owes everyone.

But let’s zoom in on the US, the heavyweight champ of debt. Where does their $36 Trillion come from? The answer is surprising:

1. Americans Themselves (The Big Chunk – ~70%): Yes, you read that right. The US mostly borrows from… itself. How? Government Bonds.

♦ What is a Bond? Super simple. It’s an IOU. The government says, “Lend us $1,000 for 10 years. We’ll pay you a bit of interest every year (say, 4.5%), and give you your $1,000 back at the end.” Low risk, steady return.

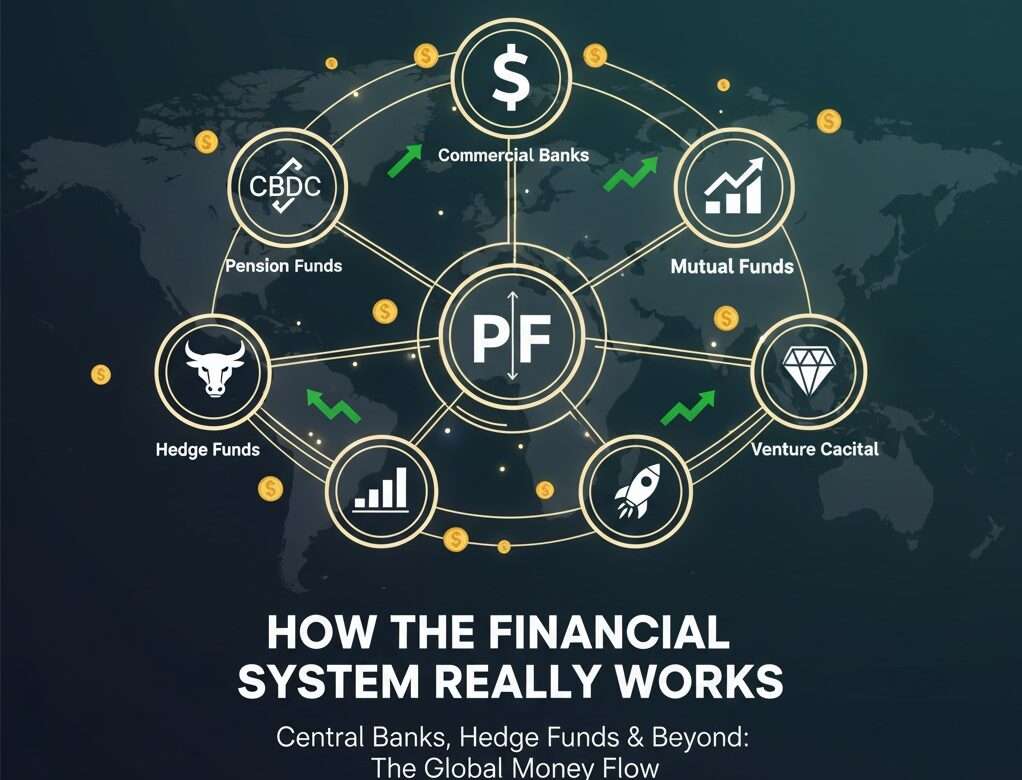

♦ Who Buys These Bonds? YOU (probably indirectly), and big pools of money:

- Your Bank: When you deposit money, they don’t stuff it in a vault. They invest it to earn interest (so they can pay you interest). A huge chunk goes into super-safe US Treasury bonds. US banks hold nearly $1.8 TRILLION worth – that’s triple Canada’s entire economy!

- Your Pension Fund: Saving for retirement? Your pension fund manager is putting a big slice (about 25%) into bonds for safety and steady growth.

- Insurance Companies: Need predictable returns to pay out claims? Over 60% of their assets are often in bonds.

- Investment Firms & Wealthy Individuals: Anyone with cash looking for a safe(r) place to park it.

♦ The Domestic Loop: So, your savings -> go to your bank/pension fund -> they buy US government bonds -> the government spends that money (maybe on salaries for teachers, contracts for construction companies) -> those people deposit their money in banks or pensions -> and the cycle repeats!

Money flows from savers (you/companies) to borrowers (government) and back into the economy, over and over. Interest payments just keep this merry-go-round spinning.

2. The Rest of the World (~30%): Foreign governments (like China, Japan, UK), their central banks, their pension funds, and their commercial banks also park spare cash in US bonds because they’re seen as ultra-safe and liquid.

The International Loop:

- Japan saves -> buys Dutch bonds.

- The Dutch save -> buys Brazilian bonds.

- Brazil saves -> buys US bonds.

- The US pays interest -> money flows back out… and often finds its way into bonds again somewhere else.

The Big Revelation: Global debt isn’t mostly one country owing another. It’s a vast, interconnected network of circular flows. Money constantly moves from savers to borrowers (governments, companies, sometimes other countries) and back again, lubricated by interest payments.

Most of the money never really “leaves” the global financial system; it just changes hands and keeps circulating.

The Trillion $ Elephants in the Room: Why Can’t We Just STOP?

If debt is such a burden, why does every country keep piling it higher? Why not just… quit? Go cold turkey?

Because the modern economy would crash. Hard. Debt isn’t just numbers on a screen; it’s the fuel in the engine.

♦ Growth Depends on It: When the government borrows and spends (on infrastructure, welfare, salaries), that money flows into businesses and workers’ pockets. They spend it at shops, who hire more people, who spend more… It’s a growth feedback loop. Cut off the borrowing? The loop reverses. Spending drops, businesses fail, jobs vanish, recession deepens.

- The Numbers Don’t Lie: In China, roughly 19% of government spending comes from borrowed money. In the US? It’s about $1 out of every $4 spent. That’s equivalent to all spending on education and welfare combined! Imagine just… turning that tap off.

♦ Crisis Management 101: When disaster strikes (like COVID in 2020), people stop spending. Businesses freeze. The economy grinds to a halt. The only way to prevent total collapse is for the government to step in and spend massively to keep money flowing. Where does that money come from? Borrowing! In 2020 alone, the US borrowed a mind-blowing $3.8 Trillion. Everyone else did too. It wasn’t optional; it was essential survival.

♦ The Political Reality: Try winning an election on the platform: “Let’s slash spending, fire public workers, cut your services, and plunge the economy into recession to pay down debt!” Spoiler: You won’t. Voters want growth and services now. Politicians want to get re-elected. The path of least resistance? Keep borrowing.

So, How Do They Pay Back the Old Debt? Brace yourself… They borrow new debt to pay off the old debt, plus the interest. It’s called “rolling over” the debt. Sounds sketchy, right? It can be. But for countries seen as stable (like the US, Germany, Japan), lenders are usually happy to keep playing musical chairs because the bonds are considered super safe. The interest rates stay low, making the roll-over manageable.

When the Music Could Stop (Or Just Get Really Scary)

This system works beautifully… until it doesn’t. The debt spiral has real risks lurking beneath the surface:

- The Interest Monster: As the total debt grows, so do the interest payments. A bigger and bigger chunk of the government budget just goes to paying old lenders, not to new schools, hospitals, or roads. It’s like only being able to pay the minimum on your credit card every month – the principal never shrinks.

- Lender Panic & Rising Rates: What if lenders lose confidence? Maybe inflation spikes, or a government seems unstable, or the debt just looks too big. Suddenly, they demand much higher interest rates to take the risk. This makes rolling over the debt WAY more expensive, squeezing the budget even harder. Ask Greece (circa 2010): When lenders panicked and stopped buying Greek bonds, the government couldn’t borrow. They had to slash spending brutally. Result? 1 in 4 public workers fired, wages down 30%, economy shrunk by 25%. Ouch.

- The Printing Press Temptation: “Hey,” thinks a desperate government, “Why not just print more money to pay our bills?” DANGER ZONE. Printing money without economic growth backing it up causes inflation. More money chasing the same goods = prices shoot up. Your savings buy less. Venezuela (late 2010s) is the nightmare scenario: They printed so much money that prices doubled every few weeks. A loaf of bread cost millions. Life savings vanished. Even moderate inflation hurts.

- The Double Whammy for Developing Nations: Many poorer countries borrow in foreign currencies (like US dollars) because lenders demand it. But if their own currency loses value (maybe due to inflation or economic trouble), paying back that dollar debt becomes MUCH harder in local money. This can quickly spiral into a debt trap – borrowing just to pay the interest on past loans, never getting ahead. (Sri Lanka and Pakistan are recent cautionary tales).

- The Unthinkable: Default: When a country literally can’t pay and says, “Sorry, we’re bust.” This is economic Armageddon. No one wants to lend to you anymore. Your currency crashes. Imports vanish. The country is financially paralyzed. It takes years to recover.

So… Can This Really Go On Forever?

When faith in the debt-based fiat system wavers, people (and big institutions) often flock to “real” assets like gold.

- Gold doesn’t rely on a government promise.

- It can’t be printed infinitely.

- It’s historically held value during turmoil.

Seeing record gold prices and big banks predicting even higher prices reflects underlying anxiety about inflation, currency devaluation, and the sheer scale of global debt. It’s a hedge, a safety net.

Can the debt cycle spin forever? Honestly? Nobody really knows. Economists argue fiercely. But here’s the uncomfortable truth:

- For stable, wealthy countries: The system can likely keep chugging along for a very long time, as long as confidence holds and their economies keep growing (even slowly). The circular flow keeps working. Debt-to-GDP ratios that would have caused heart attacks decades ago (like the US nearing 100%) are now just… normal.

- For vulnerable countries: The risks are much higher, much sooner. Debt traps, currency crises, and defaults are constant threats.

- For everyone: The risks of inflation, rising interest rates, and money being diverted from useful things to just servicing old debts are very real and growing concerns.

It’s a Giant, Necessary, Terrifying Circle

So, who is the $300 trillion owed to? It’s owed to… well, mostly ourselves, in a dizzying, global game of financial tag.

- Governments borrow by selling bonds (IOUs).

- We (through banks, pensions, funds) and other countries buy them because they’re safe-ish and pay interest.

- Governments spend that money back into the economy (keeping things running and growing).

- The interest payments flow back to the bondholders (us/other countries), who often… buy more bonds.

It’s a giant, self-reinforcing loop. Debt isn’t just a burden; it’s the grease in the gears of the entire modern global economy. Stopping it isn’t an option without catastrophic consequences. Managing it, keeping confidence high, and ensuring the borrowed money fuels real growth – that’s the perpetual, high-stakes balancing act every country is playing.

The real question isn’t “Who’s it owed to?” anymore. It’s “How long can we keep this incredibly complex, slightly terrifying, but utterly essential game going before something really wobbles?”

And honestly? Keep an eye on that gold price. It might be trying to tell us something. What do you think happens next?