- 13 September 2025

- No Comment

- 555

What is Private Equity: The Hidden Power Behind Big Brands

Imagine walking from a Lego castle to the lobby of a luxury hotel, then typing your family tree into a website. Sounds like three very different businesses, right? Now imagine they’re all owned by the same invisible hand. That’s not fiction. Firms like Blackstone quietly buy, reshape, and sell whole industries. Welcome to the world of Private Equity, one of finance’s most powerful, least understood forces.

In this article, we’ll tell the story of private equity, how it makes money, the strategies it uses (from leveraged buyouts to venture bets), and why its activity matters to workers, consumers, and everyday investors. We’ll explain the mechanics behind the headlines so you can see the bigger picture.

The Short Answer: What is Private Equity?

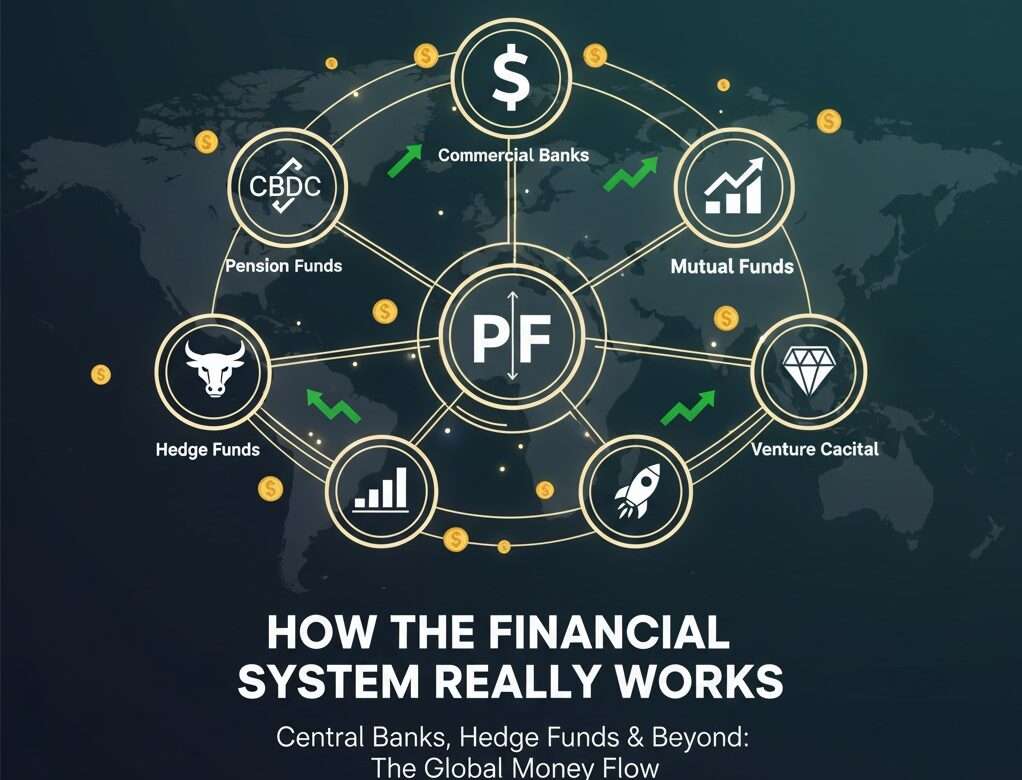

Private equity (PE) is a way for wealthy investors and institutions to buy parts or all of companies that aren’t traded on public stock markets. Instead of raising money from everyday stock buyers, PE firms raise capital from large investors (pension funds, endowments, wealthy individuals) and use those pools to buy businesses. The goal isn’t long-term ownership. It’s to buy, change, and sell for a profit.

Most private equity deals follow a four-step rhythm:

- Raise capital from outside investors into a fund.

- Buy companies with that fund (sometimes borrowing heavily to do so).

- Improve profitability through management changes, cost cuts, growth strategies, or new technology.

- Exit the investment, selling it via IPO, to another company, or to a different PE firm, ideally at a much higher price.

That simple loop, raise, buy, fix, sell, is what turned private equity into a multitrillion-dollar engine that shapes many daily products and services.

A Quick History of Private Equity: from Rockefeller Deals to Silicon Valley Checks

Private equity didn’t pop up overnight. The idea of outsiders pooling money to buy companies goes back to the early 1900s, when financiers like JP Morgan and the Vanderbilts bought and merged firms to create empires.

A key turning point came after World War II. In 1946, Harvard professor Georges Doriot helped found the American Research and Development Corporation (ARDC), one of the first true venture-capital firms. ARDC’s small bet of roughly $70,000 into a then-obscure company called Digital Equipment Corporation (DEC) turned into hundreds of millions when DEC went public decades later. That success proved investors could back promising companies early and make enormous returns.

Through the 1980s the focus shifted. Instead of only backing startups, financiers started buying established companies, often using large amounts of borrowed money and restructuring them to extract value. That gave rise to the famous leveraged buyout (LBO) era and the big, dramatic deals that populate the business pages.

By the 1990s and 2000s, private equity had broadened: pension funds and endowments poured money into funds, regulation after the 2008 financial crisis nudged firms toward operational improvements over pure cost-cutting, and today firms like Blackstone, KKR, and Apollo manage sums of money that affect real estate, technology, media, and infrastructure.

The Main Playbooks Private Equity Uses

Different deals look different. Private equity isn’t a single strategy but a family of approaches:

-

Leveraged Buyouts (LBOs) – the headline-grabbing tactic

In an LBO, the PE firm buys a company using a small portion of its own equity and a lot of borrowed money. The target company’s assets and future earnings often secure the loans. If the turnaround works, returns can be huge because the firm’s personal cash investment was small relative to the total purchase price.

Example: Hilton: When Blackstone bought Hilton for around $26 billion, they appointed new leadership, shifted the business model toward brand and franchise management, and invested capital (roughly $800 million) to strengthen operations. Years later, when Hilton went public again, Blackstone earned sizable profits, a textbook LBO success.

But LBOs have risks: the debt load sits on the company’s balance sheet. If performance slips, it can be crippling.

-

Growth Equity – the steady scalpel

Growth equity sits between venture capital and buyouts. Firms invest in already profitable, fast-growing companies that need capital to scale. These deals often involve minority stakes and little to no leverage. Growth equity fuels expansion without handing over full control.

Example: TikTok’s parent: Large growth investors gave the company resources to scale globally. This type of deal is less about taking a company apart and more about supporting rapid expansion.

-

Venture Capital – high risk, high reward

Venture capital backs early-stage startups. The payoff can be massive (think Google, Airbnb), but many bets fail. VC firms accept that a handful of winners must cover many losses.

-

Distressed Investing – buying trouble at a discount

Some firms buy struggling or bankrupt companies cheaply, then try to revive them or sell off assets. This can create value, but sometimes the result is aggressive asset-stripping that leaves communities worse off.

Example: mixed results: In some cases (like a successful restructuring of Game UK) firms increased value dramatically after buying distressed assets. In other cases, deep cost cuts and asset sales have worsened outcomes for employees and customers.

How Private Equity Actually Makes Big Money

There are several income streams built into the PE model:

- Management fees: PE firms typically charge about 2% of assets under management each year, even if a particular investment underperforms. That’s steady income for running the fund.

- Performance fees (carried interest): Usually around 20% of profits when investments are sold. This is where enormous payouts come from.

- Leverage: By using high levels of debt on purchased companies, a PE firm can amplify returns on the small equity portion it contributes. If the company’s value rises, those gains compound against a small equity base.

- Interest tax effects: The interest on the loans used in an LBO is often tax-deductible for the company, lowering taxable income and increasing cash flow, which can further boost returns.

Because PE firms typically contribute a fraction (often ~10%) of the purchase price from their own pockets, the combination of fees, carried interest, and leverage turns successful deals into outsized profits.

Real Consequences: the Winners and the Losers

Private equity can generate huge wealth and revive underperforming companies, but it can also have painful side effects.

Wins:

- Capital for growth (new products, market expansion).

- Professionalized management and improved operations.

- Sometimes better long-term sustainability, especially when firms invest in technology and efficiency rather than just cuts.

Losses and controversies:

- Heavy debt loads can squeeze a company’s ability to invest, hire, or innovate.

- Cost-cutting can lead to layoffs and store closures, a painful legacy in cases like Toys “R” Us. After a leveraged buyout in 2005, the company struggled under debt and fees and eventually closed many stores and filed for bankruptcy.

- Distressed investing can turn into aggressive asset sales, harming communities or long-term business health.

- Critics point out that PE firms often collect significant fees even when portfolio companies decline, which raises questions about incentives.

In short: private equity can revitalize or hollow out businesses. The difference often comes down to strategy, execution, and whether firms are willing to inject capital for long-term growth versus extracting short-term returns.

How Should Ordinary People Think About Private Equity?

Even if you don’t work in finance, private equity affects you: through your pension fund, the brands you buy, or jobs in your town. Here are practical ways to understand its impact:

- As an investor: Many large institutional investors allocate to private equity for higher potential returns, but these investments are illiquid and high-fee. Some public vehicles (like ETFs or listed alternative asset managers) give retail investors indirect exposure, but they differ from direct PE fund investing.

- As an employee or consumer: PE ownership may bring operational improvements or cost cuts. Watch for changes in investment, customer experience, and employment conditions after acquisitions.

- As an entrepreneur or buyer of businesses: The PE playbook shows how to scale or restructure companies, and there are paths (partnering with investors, seller financing, or forming syndicates) to buy businesses even without huge capital.

The Big Ethical and Economic Questions

Private equity raises important debates about how capitalism should work:

- Short-term extraction vs. long-term stewardship: Are firms building companies or extracting value?

- Transparency and accountability: PE deals are often opaque, with complicated financing structures that make public oversight difficult.

- Societal impact: Large-scale layoffs, store closures, or asset sales affect communities and employment, and raise the question of who benefits from corporate restructuring.

These tensions have led to more scrutiny from regulators, pension funds asking tougher questions, and sometimes a move toward operational improvement strategies that balance returns with sustainability.

Why this Matters and Where to Learn More

Private equity is more than a finance buzzword. It’s a system that can transform brands and industries, for better or worse. Firms like Blackstone can own theme parks, hotels, and genealogy services at the same time, and their decisions ripple through towns, markets, and retirement accounts.

If you want to dig deeper, study these topics: leveraged buyouts, carried interest, growth equity, venture capital, and distressed investing. Read case studies, Hilton’s turnaround and Toys “R” Us’s collapse are instructive and look at how different strategies produced different outcomes.

For entrepreneurs and aspiring buyers, there are practical lessons in structuring deals, raising capital, and negotiating with other people’s money. If you’re curious about learning the PE playbook in a hands-on way, seek courses or mentorship that focus on deal-making, due diligence, and operations, not just theory.

A Question to Leave You With

Does private equity make capitalism more efficient, or does it prioritize returns at social cost?

The answer is complicated and depends on each deal. But one thing’s clear: as private equity gets larger and more influential, understanding how it works is no longer optional. It affects how companies grow, how jobs are created or cut, and how wealth is generated and distributed.

Read more: Lehman Brothers Collapse: Story of the 2008 Financial Crisis

158 years old and boasting some $639 billion in assets—filed for Chapter 11 protection, marking the largest corporate collapse in U.S. history.