- 25 July 2025

- No Comment

- 1448

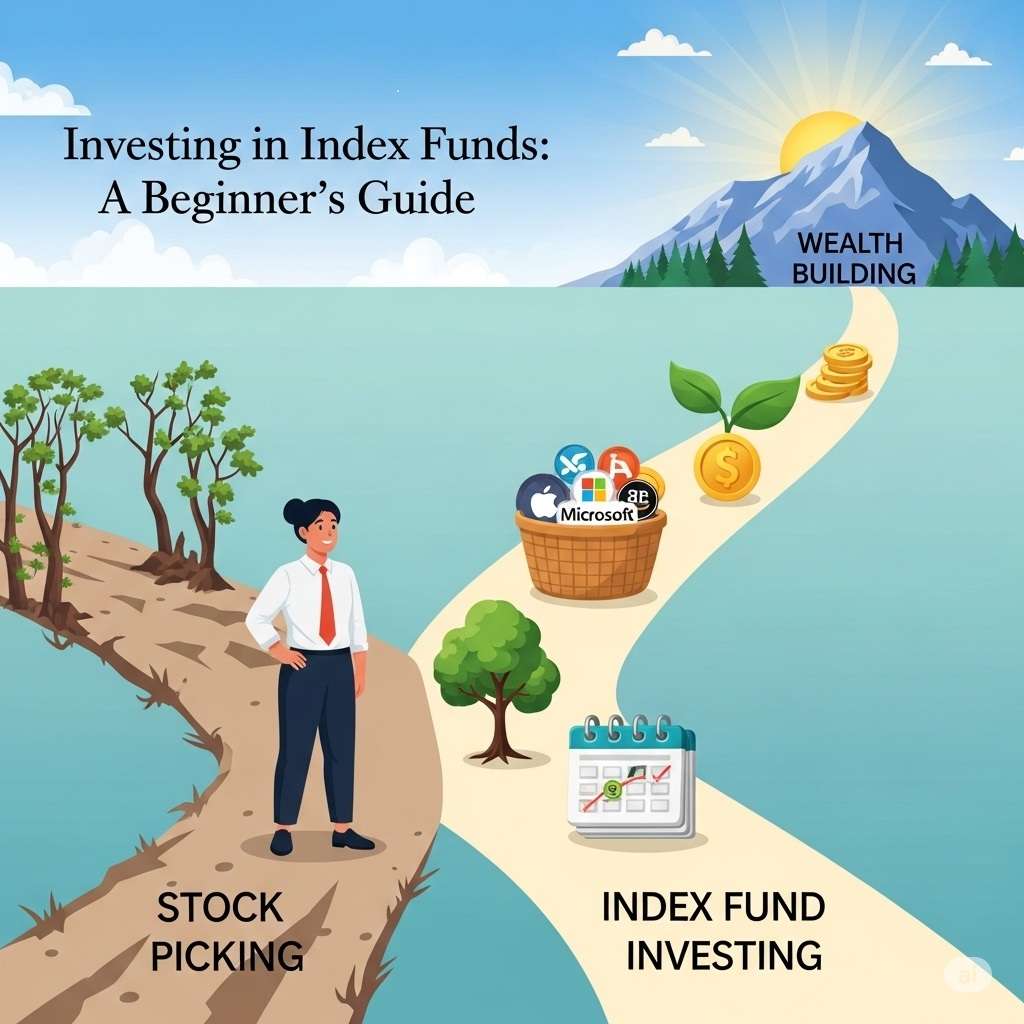

Investing in Index Funds: Best Guide for Beginners

Disclaimer: This is educational content, not financial advice.

“I Want to Invest, But I Don’t Know Where to Start…”

You’re not alone. Thousands of people want to invest but feel overwhelmed by stock tickers, market news, and endless choices. The good news? Index funds turn a confusing buffet of stocks into a simple, balanced “fruit basket” you can buy and hold. In this passive investing guide, I’ll walk you—step by step—through how to invest in index funds with no jargon, no fluff, just straight‑forward advice for long‑term wealth building.

What Is an Index Fund?

Imagine walking into a grocery store and instead of picking only one fruit, you grab a basket with apples, bananas, and oranges. If one fruit spoils, you’ve still got the rest. An index fund is just like that basket, but for companies.

- Index = a list tracking a group of companies

- Fund = a pool of money you invest that buys all those companies

- Example: The S&P 500 tracks 500 large U.S. companies—tech, healthcare, finance, and more.

Why Index Funds Are Perfect for Beginners

1. Low Fees

- Annual expense ratios often range from 0.02% to 0.20%.

- On $1,000 invested, you might pay just $0.20–$2 per year.

- Little fees → More money compounding over time.

2. Built‑in Diversification

- Your dollars spread across hundreds (or thousands) of companies.

- A downturn in one company is balanced by gains elsewhere.

3. Passive Management

- An algorithm, not an expensive fund manager, keeps the fund aligned with its index.

- Passive investing often outperforms many active funds over the long term.

4. Compound Interest

- Historically, major indexes grow 8%–10% annually (past performance is no guarantee of future results).

- $200/month at 8% yields ≈ $310,000 in 30 years—all without stock‑picking.

Step‑by‑Step Guide: How to Invest in Index Funds

Step 1: Clarify Your Goals

- Short‑Term vs. Long‑Term: Do you need cash in 1–5 years? Consider safer options (e.g., money market).

- Retirement & Beyond: If your horizon is 10+ years, index funds can be a powerful engine for long‑term wealth building.

Step 2: Open a Brokerage Account

Look for:

- Low or zero commissions on index fund trades

- Ease of use (mobile app, clear interface)

- Reputation (Vanguard, Fidelity, Schwab, Robinhood, etc.)

- Pro tip: Some platforms waive fees if you invest a minimum monthly amount.

Step 3: Choose the Best Index Funds

- Broad U.S. Funds: S&P 500 funds (e.g., Vanguard’s VFIAX, Schwab’s SWPPX)

- International Funds: For global exposure (e.g., FTSE All‑World, MSCI EAFE)

- Sector Funds: Healthcare, technology, energy (higher risk, more focused)

Look at:

- Expense ratio (lower is better)

- Tracking error (how closely the fund matches its index)

- Fund size & liquidity

Step 4: Decide Your Investment Amount & Schedule

- Dollar‑Cost Averaging: Invest a fixed amount (e.g., $100–$500) every month.

- Smooths out market ups & downs

- Takes emotion out of timing the market

- Lump‑Sum vs. Periodic: If you have a windfall, you can invest all at once or split it up.

Step 5: Place Your Order

- Mutual Fund vs. ETF

(90% of new investors wish they knew earlier. Here's where to go next → "Which Fund is Right For You")

- Mutual Funds: Priced at end‑of‑day NAV; orders fill after market close.

- ETFs: Trade all day like a stock; you get the current market price.

- NAV Explained: Net Asset Value = (Total assets − Liabilities) ÷ Shares outstanding.

Tip: If you’re indifferent to intra‑day price, mutual funds work fine.

Step 6: Reinvest Dividends

- Accumulation Funds automatically reinvest dividends—great for compounding.

- Distribution Funds pay dividends in cash—useful if you need income.

- Tax note: In many countries, distributions are taxable the year received.

Step 7: Monitor & Rebalance

- Check in annually (or semi‑annually) to ensure your asset mix matches your risk tolerance.

- Rebalance by shifting new contributions or selling/buying between funds.

Common Mistakes to Avoid

- Chasing Hot Performers: Avoid switching to the “flavor of the month.” Stick with low‑cost, broadly diversified funds.

- Ignoring Fees: A 0.50% fee vs. 0.05% cuts tens of thousands off your ending balance.

- Market Timing: Trying to “buy the dip” often leads to missed opportunities.

- Emotional Reactions: A sharp drop can feel terrifying; remember dips are part of the growth cycle.

- Neglecting Your Plan: Skipping contributions or stopping too soon slows your progress drastically.

Stay Consistent and Patient

“Wealth is built one brick at a time.”

- Treat investing like a habit: Automate transfers so you never miss a month.

- Celebrate small wins: Seeing your balance grow by even $50 feels good!

- Keep learning: Read a short article or watch a quick video each week.

- Visualize your future: Imagine funding a dream vacation or retiring comfortably.

- Join a community: Share progress with friends or online groups to stay motivated.

Investing in index funds is like planting a forest instead of a single tree. You may not see tall oaks overnight, but with time, consistency, and patient watering, you’ll watch your portfolio flourish.

Take a deep breath, choose your first fund, and schedule that first automatic transfer. Building long‑term wealth is a marathon, not a sprint. Lace up your shoes—and start running today.

Upgrade your strategy with this next guide on Dividend vs Growth Stocks

Dividend stocks are the “safe and steady” path, while growth stocks are the “get rich quick” rocketship. But what if that common wisdom is dangerously oversimplified? What if both strategies could either build your wealth… or quietly bleed it dry, depending on how you use them?