- 20 September 2025

- No Comment

- 561

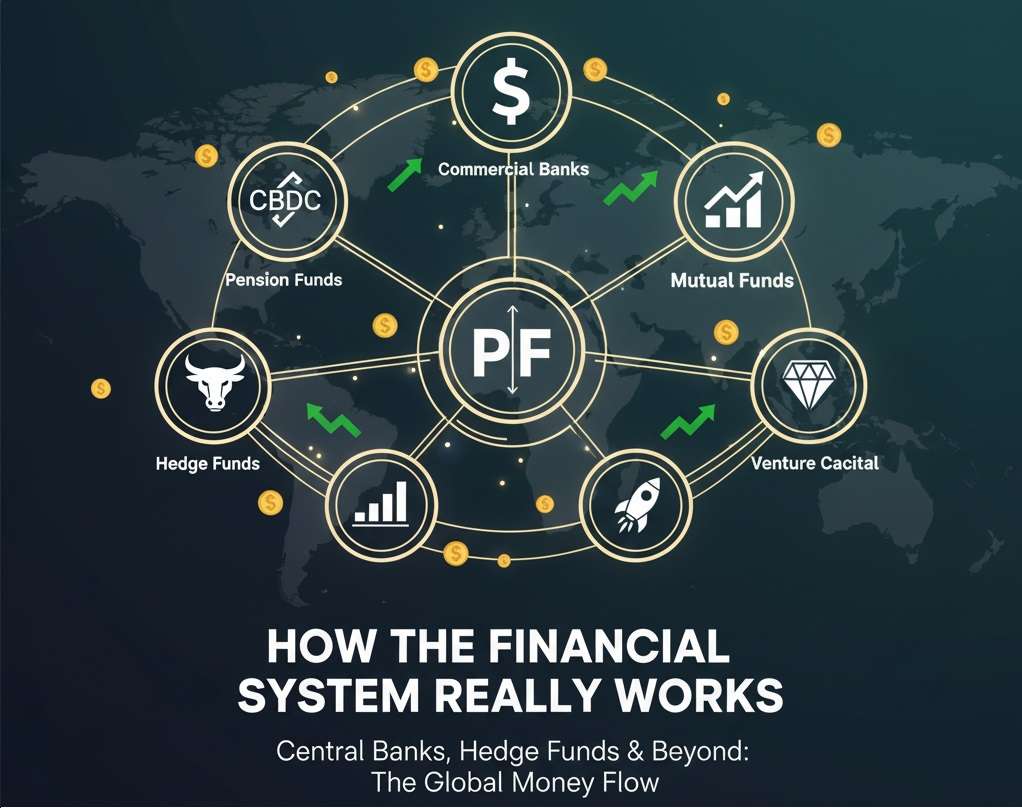

How the Financial Systems Really Works

The Invisible Machine That Moves Money Around the World

Imagine a giant, humming machine hidden beneath the streets of every city. You can’t see its gears, but every paycheck you receive, every mortgage you pay, and every stock you own passes through it. That machine is the financial system, a web of institutions that create money, move it, multiply it, and sometimes destroy it.

If money is the lifeblood of modern life, the financial system is the circulatory system that keeps everything running.

In this article, we’ll walk through the main players, central banks, commercial banks, pension funds, mutual funds, hedge funds, investment banks, private equity, insurance companies, and venture capital. we’ll explain what each does, why they matter, and how they interact to power the global economy. No jargon. Just clear stories, practical examples, and simple metaphors that make a complex system feel human and understandable.

The Engine Room: Central Banks – Who Prints Money and Sets the Rules

Think of central banks as the control room operators of the financial machine. They don’t run stores or invest your savings, they manage the overall flow of money and set the ground rules. In the U.S., it’s the Federal Reserve; in the U.K., the Bank of England; in China, the People’s Bank of China.

What Central Banks Do

- Create money and control the money supply. They decide how much cash and credit should be floating around in the economy.

- Set interest rates. Lower rates make borrowing cheaper; higher rates make borrowing more expensive.

- Stabilize prices and employment. Their twin targets are usually price stability (inflation control) and promoting full employment.

- Use tools like quantitative easing (QE) and tightening. QE pumps money into the system (buying bonds), and quantitative tightening removes money (selling bonds).

Why This Matters to You

When the central bank lowers interest rates, mortgages and business loans get cheaper. People buy more homes or start companies, which creates jobs. When inflation spikes, the central bank raises rates to cool things down, that makes loans costlier, slows housing markets, and lowers spending.

In short: central banks set the tempo. Policymakers, politicians, and markets all watch them closely because their decisions ripple through everything else.

The Workhorses: Commercial Banks – Where Your Money Lives and Gets Lent Out

If central banks are control rooms, commercial banks are the workhorses, the places where your paycheck lands and where people and businesses borrow money to build things.

How Commercial Banks Connect Savers and Borrowers

- Savers deposit money for checking and savings accounts.

- Banks lend that money out to borrowers: homebuyers, entrepreneurs, and companies.

- This lending transforms idle savings into productive investments like mortgages, new shops, and business expansion.

The Money Multiplier – How Banks “Create” Money

Banks don’t just pass deposits straight through. When a bank issues a loan, it often creates a new deposit in the borrower’s account, effectively creating new money. Modern banking works with rules and safeguards (capital requirements, liquidity checks), but at its core the system expands the money supply by turning loans into deposits.

Why Banks Matter to You

A healthy commercial banking system keeps credit flowing. If banks tighten lending (for example, during a crisis), homeowners can’t refinance, small businesses can’t grow, and consumers cut spending. That’s when recessions deepen.

The Long Game: Pension Funds – Quiet Giants Saving Our Future

Pension funds are the steady, patient investors in the background. They manage the retirement savings of millions and collectively control trillions of dollars.

What Pension Funds Do

- Collect regular payments from workers and employers.

- Invest those sums across stocks, bonds, real estate, and private markets to earn steady returns.

- Pay retirements decades later when people stop working.

Why Pension Funds are Powerful

Because they manage enormous pools of capital, pension funds are major backers of private equity, venture capital, and even landmark real estate projects. Their long-term mindset allows risky bets today for steady payouts in the future.

Everyday Investors’ Tool: Mutual Funds – Diversification Made Simple

Mutual funds let regular people pool money and get professional investment management. Think of them as investment clubs you can join.

Types and benefits

- Actively managed funds try to beat the market with stock picking.

- Passive funds (index funds) mirror indexes like the S&P 500 and charge much lower fees.

- Diversification spreads risk: instead of owning a handful of stocks, mutual fund investors get exposure to hundreds or thousands of assets.

Why Mutual Funds are Popular

They give ordinary savers easy access to broad, diversified investments without needing millions or deep expertise.

The High-Risk Playground: Hedge Funds – Big Bets, Big Fees

Hedge funds are private investment pools for wealthy individuals and institutions. They aim to generate high returns through aggressive strategies.

How Hedge Funds Operate

- Accept money from accredited investors (wealthy individuals, pension funds).

- Use leverage (borrowed money), derivatives, short selling, and complex strategies.

- Charge steep fees (commonly “2 and 20”: 2% management fee and 20% of profits).

The Reality

Most hedge funds underperform simple index funds, but the few that outperform can deliver extraordinary gains. The model is “high risk, high reward,” and not suitable for everyday savers.

The Dealmakers: Investment Banks – Making Billion Dollar Deals Happen

Investment banks are the intermediaries that make major transactions possible. They help companies go public, buy other companies, or raise huge amounts of capital.

Three key roles

- IPOs (Initial Public Offerings): Help private companies list on the stock market.

- Mergers & Acquisitions (M&A): Advise on buying, selling, or merging companies.

- Raising capital: Structure bond sales, loans, and equity deals.

Why They’re Critical

When a company wants to grow fast or change its ownership structure, investment banks design the blueprint and sell it to investors.

The Corporate House-Flippers: Private Equity – Buying, Fixing, and Flipping Companies

Private equity firms act like house-flippers but for whole businesses. They buy companies, restructure them, then sell them for profit.

How Private Equity Works

- Raise funds from big investors (pension funds, insurance companies).

- Buy businesses with a mix of their own money and a lot of borrowed money (leverage).

- Improve profitability (cut costs, reorganize), then sell or take public.

The Downside

Because private equity often loads companies with debt, workers and long-term innovation can suffer. Famous failures (store bankruptcies, closures) highlight the social cost when short-term profit is prioritized over sustainable health.

The Safety Net and the Investment Pool: Insurance Companies

Insurance firms are professional risk managers. They collect premiums, pool the money, and promise payouts when bad things happen.

What Insurers Do with Premiums

Instead of letting premium money sit idle, insurers invest aggressively, usually in bonds, but also in stocks, real estate, and sometimes private equity.

Why Insurers are Big Investors

Their long-term obligations make them stable, institutional investors, they provide capital to markets quietly and consistently.

The High-Risk Scouts: Venture Capitalists – Betting on the Next Big Thing

Venture capitalists (VCs) fund startups. Their model is to make many bets, know most will fail, but hope a few become home runs.

The Power Law

VC returns rely on rare winners that return hundreds or thousands of times the original investment. A single successful exit can cover the losses of dozens of failures.

Why VCs Matter

They fuel innovation. Without VC money, many tech and biotech breakthroughs would never get the early-stage capital needed to grow.

How These Pieces Fit Together: The Financial System as One Living Organism

All the institutions we just described, central banks, commercial banks, pension funds, mutual funds, hedge funds, investment banks, private equity, insurance, and venture capital, are interlinked gears in one big machine.

- Central banks set the rules.

- Commercial banks move money day-to-day.

- Pension funds and insurers supply huge pools of long-term capital.

- Mutual funds let everyday investors participate.

- Hedge funds and private equity drive high-risk/high-return strategies.

- Investment banks glue the deals together.

- Venture capital fuels the startups that might become the next Amazon or Google.

Every loan you take, every premium you pay, and every stock you buy feeds this ecosystem. Together, these institutions create economic growth, create jobs, and sometimes amplify crises when things go wrong.

When the System Breaks: Crises, Contagion, and the Real-World Costs

When confidence falters or risks are misunderstood, the same mechanisms that multiply money can also multiply losses. Leverage, excessive risk-taking, and poor regulation can lead to boom-and-bust cycles that hurt ordinary people, job losses, foreclosures, and lost savings.

That’s why transparency, proper incentives, and prudent oversight matter. A well-oiled financial system should channel capital to productive uses, not just to speculative bets that leave everyone exhausted when the music stops.

The Big Takeaway: You’re Part of This Story – Even If You Don’t See It

The financial system might sound abstract, but it affects everyday life: interest on your mortgage, job creation in your town, the returns in your retirement account, and whether a promising startup can hire its first engineers.

Understanding this machine gives you practical power:

- Know why interest rates matter and how they affect your budget.

- Appreciate the role of long-term investors like pensions and insurers.

- Understand the difference between diversified mutual funds and high-risk hedge funds.

- Recognize that private equity and venture capital shape industries, for better and worse.

Money Is a Tool: The System Decides How It’s Used

Money alone isn’t success. The financial system is a set of tools and players that decide how money circulates. When those tools work well, they create jobs, innovation, and prosperity. When they fail, they create hardship.

So the next time you see a skyline being built, a startup launching, or a news headline about interest rates, remember: you’re looking at the visible outcomes of an invisible machine. Learn how it turns, and you’ll see how your choices, as a saver, borrower, voter, or investor, move the machine too.