- 12 January 2024

- No Comment

- 1132

Entrepreneurs Should Know These Everyday Startup Terms

In a world buzzing with innovation and an eagerness to create something new, startups have become as common as your morning coffee order. This thriving startup landscape is witnessing an unprecedented boom, with millions of individuals fueled by a desire to carve their unique paths in the business world where recognizing market gaps and providing solutions feel like finding hidden treasures.

The global count of startups has surpassed 150 million, indicating an astonishing average of 137,000 startups being initiated daily, as reported by Microsoft.

The excitement lies in not just creating businesses of various scales but in understanding the commonly used startup terms that make it all happen.

However, this exciting adventure to entrepreneurial success often comes with a twist – a twist-filled with startup jargon that might sound like a secret language.

Hi, I’m Nabeel Shaikh, a seasoned chartered accountant and a senior buddy in the entrepreneurship world. We understand that these unfamiliar terms can be a bit tricky. That’s why we’ve crafted a guide specifically for entrepreneurs eager to make their mark. Get ready to explore the startup universe with confidence and clarity as we decode the language that fuels innovation and drives success.

Bootstrapped & Crowdfunding: Building Your Dreams, Your Way

In the dynamic world of startups, the first terms you encounter on your entrepreneurial journey are often ‘Bootstrapped’ and ‘Crowdfunding’. Bootstrapping refers to the practice of funding your startup venture with personal savings and revenue. It’s the epitome of self-reliance in the business world.

On the other hand, Crowdfunding involves raising capital from a large pool of individuals who believe in your idea.

Example: Consider the story of MailChimp, a now-massive email marketing platform that started as a bootstrapped venture in 2001. The founders, Ben Chestnut and Dan Kurzius built the company from the ground up, relying on their own funds and revenue generated from the platform.

Pre-Seed Stage: Planting the Startup Seed

What it is: This is the early phase where you’re just planting the seed of your business idea. You might not have a fully developed product yet, but you’re gearing up for the journey.

Example: You’ve got this amazing idea for a new kind of eco-friendly packaging, and you’re just starting to research and plan how it could work. That’s the pre-seed stage—the very beginning.

Seed Funding Round: Watering the Seed

What it is: Seed funding is like giving your startup a good watering. It’s the first official round of funding to help your business grow beyond the initial stages.

Example: After your eco-friendly packaging idea takes shape, you might seek seed funding to develop a prototype and kickstart your business.

Series A Funding: Growing Strong

What it is: Series A is like giving your startup a boost of fertilizer. It comes after your seed stage, and the funding is used to scale up, reach more customers, and make your business even better.

Example: Your eco-friendly packaging business is gaining attention, and Series A funding helps you expand your production, hire more team members, and get your product out to a larger market.

Series B Funding: Branching Out

What it is: Series B is all about spreading your branches. With this funding, your startup is moving from growing strong to reaching new markets and possibly launching new products.

Example: Now, your packaging business has a solid foothold. Series B funding allows you to explore international markets, maybe even introduce a line of eco-friendly office supplies.

Series C Funding: Blooming and Beyond

What it is: Series C is like the blooming stage. Your startup is now a well-established player, and this funding round helps you dominate your market or enter new ones.

Example: Your eco-friendly packaging is a hit globally, and Series C funding allows you to invest in cutting-edge technology, sustainable practices, and perhaps branch into related industries.

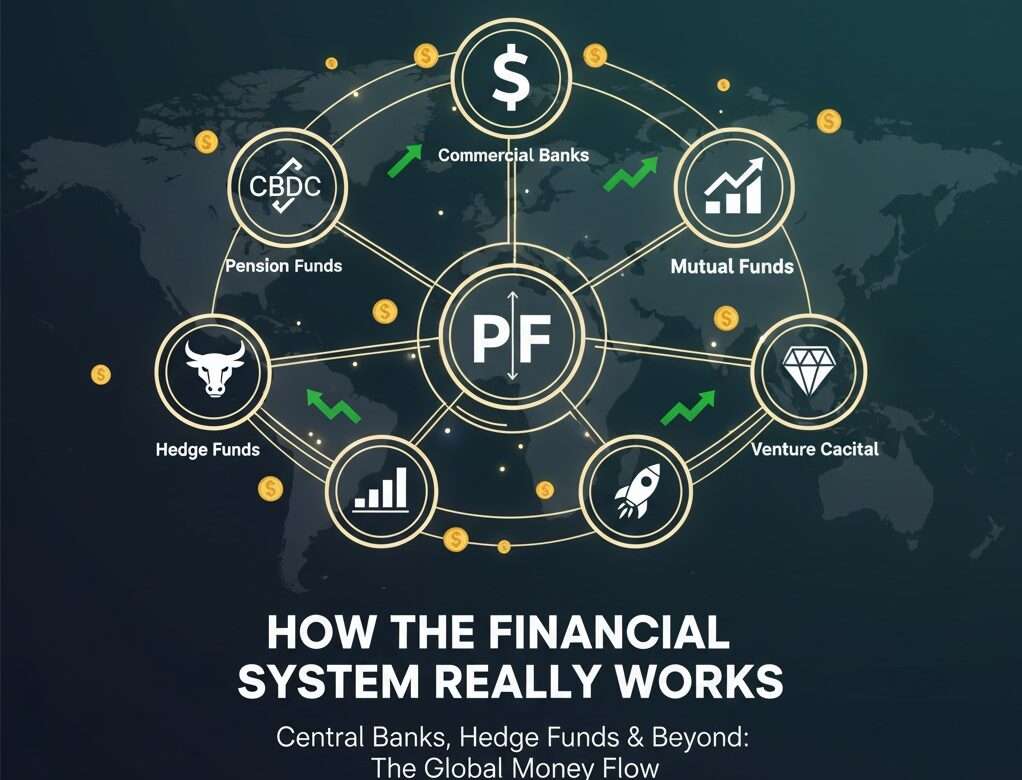

Hedge Funds: Diversifying Your Financial Garden

What it is: Hedge funds are like a mix of different plants in your financial garden. They pool money from various investors and invest it in various assets to make it grow.

Example: Just as a well-tended garden has a variety of plants, hedge funds might invest in stocks, bonds, real estate, and more to keep the financial portfolio diverse and resilient.

Flat Round: Keeping It Level

What it is: A flat round means your startup’s valuation remains the same between funding rounds. It’s like keeping things level without a significant increase or decrease.

Example: If your eco-friendly packaging business goes for a flat round, it means the investors believe your startup’s value hasn’t changed much since the last funding round, and that’s okay. It’s a way to maintain stability.

Angel Investors, VCs & Funding Rounds: Navigating the Investment Landscape

As your startup gains traction, you’ll inevitably encounter the realm of investors, particularly ‘Angel Investors’ and ‘Venture Capitalists (VCs)’.

Angel Investors are individuals who provide financial backing for small startups in exchange for ownership equity. VCs, on the other hand, manage pooled funds from many investors to invest in high-potential startups.

Example: One notable angel investor is Peter Thiel, who provided crucial early-stage funding to Facebook. On the VC side, firms like Sequoia Capital have been instrumental in the success stories of Apple, Google, and LinkedIn.

Valuation: Putting a Price on Your Innovation

Understanding the ‘Valuation’ of your startup is akin to gauging its worth in the eyes of investors. It involves assessing various factors such as revenue, growth potential, and market share. The valuation can significantly impact your ability to secure funding and the terms of investment deals.

Example: When Uber was valued at $60 million in its early days, it was seen as ambitious. Fast forward to today, and it stands as one of the most valuable startups globally, with a valuation in the tens of billions.

Term Sheet: The Blueprint of Investment

When discussions with investors progress, you’ll encounter the ‘Term Sheet’. This document outlines the terms and conditions of an investment, including the percentage of ownership offered, valuation, and any protective provisions.

Example: Airbnb’s early term sheet negotiations played a crucial role in shaping the company’s future. The terms negotiated with Sequoia Capital and Greylock Partners helped Airbnb secure a foothold in the competitive market.

Convertible Note, Pre-money & Post-money

As your startup progresses, understanding financial terms becomes paramount. ‘Convertible Note’ is a debt that converts into equity, typically during a future funding round. ‘Pre-money’ and ‘Post-money’ valuation, on the other hand, refer to the company’s worth before and after external financing.

Example: A startup raising $1 million with a pre-money valuation of $5 million would have a post-money valuation of $6 million after the investment.

Pitch Deck: Crafting a Compelling Narrative

Your ‘Pitch Deck’ is your startup’s visual storybook. It’s a concise presentation that provides potential investors with a snapshot of your business. Think of it as your startup’s elevator pitch in a slide format, capturing attention and interest.

Example: Look at the legendary pitch deck of Airbnb, which played a pivotal role in convincing investors of the platform’s potential. The deck showcased the founders’ vision and the market gap Airbnb aimed to fill.

Intellectual Property: Safeguarding Your Innovation

Protecting your ideas and creations is crucial. ‘Intellectual Property’ (IP) includes patents, trademarks, copyrights, and trade secrets. Securing your IP ensures that competitors can’t replicate your unique offerings.

Example: Coca-Cola’s recipe, kept secret since the 19th century, is a classic example of safeguarding intellectual property. This secrecy has been a cornerstone of the brand’s success.

B2B, B2C, D2C: Navigating Your Market

Understanding your target market is foundational. ‘B2B’ (Business to Business), ‘B2C’ (Business to Consumer), and ‘D2C’ (Direct to Consumer) represent different business models. B2B involves selling to other businesses, B2C to individual consumers, and D2C involves selling directly to consumers, often facilitated by e-commerce.

Example: Amazon, initially a B2C platform, ventured into D2C with products like AmazonBasics, offering consumers a direct purchasing channel for everyday items.

First Mover Advantage: Racing Ahead in the Market

Being the first to enter a market comes with strategic advantages, known as the ‘First Mover Advantage’. Early entrants can establish brand recognition, and customer loyalty, and often set industry standards.

Example: Google gained a substantial first-mover advantage in the search engine market, becoming synonymous with online searches.

Stay tuned for more insights into essential startup terms. In the upcoming sections, we’ll unravel concepts like ‘SaaS,’ ‘Exclusive Agreements,’ and ‘Beta Version,’ providing you with a comprehensive guide to navigating the startup landscape successfully. Your entrepreneurial journey is about to get even more exciting!

SaaS: Transforming Services into Solutions

In the realm of software, ‘SaaS’ stands tall. Software as a Service is a cloud-based delivery model where applications are hosted and maintained by a third-party provider. It’s a game-changer, allowing startups to offer scalable solutions without the burden of extensive infrastructure.

Example: Salesforce revolutionized customer relationship management (CRM) by offering it as a SaaS solution. This not only reduced costs for businesses but also made CRM accessible to smaller enterprises.

Exclusive Agreements: Forging Strategic Alliances

Strategic partnerships can shape the trajectory of a startup, and ‘Exclusive Agreements’ play a crucial role. These contracts grant exclusivity to one party in a particular market or for a specific product, fostering a competitive edge.

Example: Apple’s exclusive agreement with AT&T for the initial iPhone launch in 2007 created a significant market advantage, driving early adoption.

Beta Version: Testing the Waters

Before the grand unveiling, startups often release a ‘Beta Version’ of their product. This initial release allows a select group of users to test and provide feedback, helping the company identify and rectify issues before the full launch.

Example: Gmail’s beta release in 2004 allowed Google to refine its email service based on user feedback, ultimately shaping it into the widely-used platform we know today.

EBITDA, CAC, LTV, GMV, AOV, PO ESOP: Deciphering Metrics

As your startup matures, metrics become your guiding compass. From ‘EBITDA’ (Earnings Before Interest, Taxes, Depreciation, and Amortization) to ‘LTV’ (Customer Lifetime Value) and ‘CAC’ (Customer Acquisition Cost), understanding these metrics is vital for making informed business decisions.

Example: Uber’s focus on Gross Merchandise Value (GMV) metrics allowed it to track the total value of goods and services transacted on its platform, providing insights into its overall market impact.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization):

This metric gives you a clear picture of your company’s operational performance by excluding non-operational expenses. Essentially, it reflects your earnings potential before certain financial factors come into play.

CAC (Customer Acquisition Cost):

Knowing how much it costs to acquire a customer is fundamental. CAC considers all expenses associated with acquiring a customer, from marketing costs to sales team salaries. Keeping this metric in check ensures a sustainable and profitable customer acquisition strategy.

LTV (Customer Lifetime Value):

Imagine predicting the future value of your customers. LTV does just that by estimating the total revenue a customer is expected to generate throughout their entire relationship with your business. It’s a key metric for understanding the long-term profitability of your customer base.

GMV (Gross Merchandise Volume):

For businesses involved in selling products, GMV is a crucial metric. It represents the total value of goods or services transacted on your platform. For example, if you run an e-commerce site, GMV would capture the total value of all items sold, giving you insights into your platform’s overall market impact.

AOV (Average Order Value):

AOV provides a snapshot of the average value of each customer transaction. It’s calculated by dividing the total revenue by the number of orders. Understanding AOV helps in devising strategies to increase the average value of each sale.

PO (Purchase Orders):

In the world of procurement and sales, a Purchase Order is a document issued by a buyer to a seller, indicating types, quantities, and agreed prices for products or services. Effectively managing purchase orders is crucial for maintaining a smooth supply chain and financial workflow.

ESOP (Employee Stock Ownership Plan):

Attracting and retaining talent is a priority for any startup. ESOP is a benefit plan that offers employees an ownership stake in the company. It aligns the interests of employees with the overall success of the business, fostering a sense of ownership and motivation.

Understanding these metrics empowers you to make informed decisions that drive the success of your startup. For instance, Uber’s focus on GMV provided valuable insights into its market impact, demonstrating how metrics can be strategic tools for growth. As you navigate the entrepreneurial landscape, consider these metrics as your compass, guiding you toward sustainable and prosperous business practices.

Burn Rate: Managing Finances Wisely

Every entrepreneur must comprehend their startup’s ‘Burn Rate.’ This metric reveals how quickly a company is spending its capital. A high burn rate may indicate aggressive expansion, but careful financial management is crucial to avoid running out of funds.

Example: During the dot-com era, several startups burned through their funding rapidly, leading to the infamous dot-com bubble burst. Learning from history, today’s entrepreneurs emphasize sustainable growth.

OEM: Empowering Through Outsourcing

‘OEM’ (Original Equipment Manufacturer) refers to a company that produces parts and equipment that are then marketed by another company. Outsourcing manufacturing to an OEM can be a strategic move, allowing startups to focus on innovation and core competencies.

Example: Apple, known for its design prowess, collaborates with OEMs like Foxconn for the manufacturing of iPhones, leveraging specialized production capabilities.

SKUs: Diversifying Your Offerings

‘SKUs’ (Stock Keeping Units) are codes used to track inventory and manage stock. As your startup expands its product or service range, understanding and effectively utilizing SKUs become essential for efficient operations.

Example: For a clothing startup, each color and size variant of a specific item would have a unique SKU, streamlining inventory management.

Stay tuned for the continuation of our journey through essential startup terms. In the upcoming segments, we’ll explore ‘Pivot,’ ‘Conversion Funnel,’ ‘Cap Table,’ ‘Acquihired,’ and ‘Retention Rate.’ These concepts are the building blocks that can propel your startup to new heights. Get ready to deepen your entrepreneurial knowledge!

Pivot: Navigating Change for Growth

In the dynamic startup landscape, the ability to ‘Pivot’ can be a game-changer. This term refers to a strategic shift in a startup’s direction, product, or target market in response to changing circumstances. Pivoting is about adaptability and finding the right path to success.

Example: Slack, initially a gaming company named Tiny Speck, pivoted to become the widely-used team collaboration platform we know today. This shift was driven by a reevaluation of market needs and opportunities.

Conversion Funnel: Guiding Users to Success

Understanding the ‘Conversion Funnel’ is crucial for optimizing user journeys. This term describes the stages a user goes through, from initial awareness to becoming a customer. By analyzing and optimizing each stage, startups can enhance user experience and drive conversions.

Example: For an e-commerce startup, the conversion funnel would include stages like website visit, product view, add to cart, checkout, and finally, purchase. Analyzing this funnel helps identify areas for improvement.

Cap Table: Mapping Ownership Structure

A ‘Cap Table’ (Capitalization Table) is a fundamental document that outlines the ownership structure of a startup. It details the equity ownership of founders, investors, and other stakeholders. Understanding your Cap Table is crucial for making informed decisions about equity distribution.

Example: When a startup raises funding, the Cap Table is updated to reflect the new ownership distribution. This transparency is vital for maintaining healthy relationships with investors.

Acquihired: Merging Talent for Success

‘Acquihired’ refers to the scenario where a company is acquired primarily for its talent pool rather than its products or services. This strategic move allows the acquiring company to gain skilled individuals who can contribute to its own growth and innovation.

Example: When Google acquired Android Inc. in 2005, the primary motivation was to tap into the expertise of Android’s team in mobile operating systems. This move led to the development of the Android OS, now a dominant player in the mobile industry.

Retention Rate: Building Long-Term Relationships

A successful startup not only attracts customers but retains them over time. ‘Retention Rate’ measures the percentage of customers who continue using a product or service over a specific period. High retention rates indicate customer satisfaction and loyalty.

Example: Subscription-based services like Netflix focus on maintaining a high retention rate by consistently delivering valuable content, ensuring subscribers continue their memberships.

Congratulations! You’ve navigated through essential startup terms. Armed with this knowledge, you’re better equipped to steer your entrepreneurial journey.

Each term unveils a layer of the intricate startup landscape, providing insights that can shape your business strategy. Remember, learning is a continuous process in the dynamic world of startups. Stay curious, stay informed, and embrace the exciting challenges that come your way!

Read More: How a 10 Rupees Tea Cup Dominating Coffee Culture | Story of India’s Largest Tea Chain Startup

How did a simple tea shop turn into India’s largest tea chain?