- 25 June 2024

- No Comment

- 1518

Breaking the Barriers: Fintech Adoption in Pakistan

Despite the global Fintech revolution reshaping how we handle money, Pakistan’s financial future is still waiting for its game-changer. Pakistan works to build its own Fintech sector and aims to digitize the financial landscape and ensure financial inclusion for one of the largest unbanked populations in the world.

Research from McKinsey Global Institute indicates that enhancing digital financial inclusion could boost Pakistan’s GDP by $36 billion by 2025.

Currently, only 21% of Pakistan’s adult population uses fintech services. EasyPaisa, launched in 2009 as the country’s first digital payment platform, has grown into a multifaceted financial service with around 9.6 million monthly active users as of April 2024 and transactions amounting to Rs. 7 trillion in 2023. JazzCash, another popular mobile wallet, boasts 17 million active users, highlighting the growing acceptance and adoption of fintech in Pakistan.

Even with this progress, Pakistan’s digital finance sector is grappling with formidable challenges, particularly as it contends with one of the largest unbanked populations globally. The root of this challenge lies in low financial literacy and deeply established misconceptions about the banking system. Adding fuel to the fire are rampant financial scams, it’s become all too common for individuals to receive fraudulent calls from people posing as bankers, threatening account suspensions or card blockages. These scams not only undermine trust but also discourage many from moving into formal banking services.

Additionally, a significant portion of the population, including small retailers and businessmen, prefers dealing in cash due to many reasons like lack of knowledge, a fear of the Federal Board of Revenue (FBR), concerns about direct deductions or account suspensions. This cash-centric approach allows them to bypass regulatory scrutiny but simultaneously excludes them from the digital financial ecosystem.

To address these issues, transitioning from physical currency to digital currency is crucial. By reducing the reliance on physical currency and introducing digital currency, Pakistan can significantly enhance transparency and reduce corruption. Digital transactions can track the complete flow of money, helping prevent crimes such as black money circulation and making illicit activities difficult to sustain.

For instance, after a theft, the thief would find it challenging to sell stolen goods without leaving a traceable digital footprint. Additionally, corrupt officials would have difficulty justifying their luxurious lifestyles without transparent financial records. Digital currency would bring more people into the formal financial system, improve record-keeping, and simplify access to funding especially for SMEs. This transition would not only help prevent various crimes but also stimulate economic growth by integrating more citizens into the formal economy.

According to a report by Boston Consulting Group (BCG) and QED Investors, the global Fintech industry is poised for explosive growth, with revenues projected to skyrocket from $245 billion to an astonishing $1.5 trillion by 2030.

Where does Pakistan fit into this rapidly evolving landscape? Fintech Pakistan’s market is valued at less than $500 million. Unlike other countries, Pakistan lacks participation from major international fintech and e-commerce companies. PayPal, a leading global digital payment platform, has yet to establish operations in Pakistan despite being available in many African countries with lower GDPs.

To fill this gap, Payoneer allows Pakistani users to receive PayPal payments indirectly.

PayPal offers a range of features including a global payment platform, peer-to-peer transactions, online shopping integration, and robust security measures. However, significant concerns around data privacy, money laundering, and fraud, coupled with the absence of a strong regulatory and compliance framework, deter international fintech companies like PayPal from entering the Pakistani market. In contrast, Pakistan’s fintech landscape is dominated by solutions like Easypaisa and JazzCash, which focus on basic financial services such as mobile wallets, bill payments, and money transfers to promote financial inclusion.

In January 2022, the State Bank of Pakistan (SBP) issued No Objection Certificates to five out of twenty applicants for setting up digital banks following the introduction of the Licensing and Regulatory Framework for Digital Banks. This move has paved the way for Neobanks, which operates exclusively online without traditional physical branches, thereby offering more accessible and efficient banking services.

In our ongoing series addressing Pakistan’s critical issues, we move from Digitalization in Pakistan to explore the challenges and opportunities within the Fintech industry. In this article, we will delve into the challenges that currently impede Fintech growth in Pakistan and potential strategies with global successful examples in digital transformation, examining the key factors behind its Fintech success and drawing lessons that could be applicable to Pakistan.

What Exactly is Fintech?

Fintech, short for financial technology, refers to the integration of technology into financial services to enhance their efficiency and accessibility. Understanding the fintech meaning is essential as this innovative approach is transforming the financial landscape with tools such as mobile banking apps, digital wallets, payment solutions, and automated investment platforms.

According to an Ernst & Young survey conducted in the USA, a staggering 63 percent of respondents had never heard the term “Fintech” before. Among those who had encountered the word, 21 percent admitted to being clueless about its meaning, while only 16 percent could provide a definition.

Challenges and Strategies in Implementing Fintech in Pakistan

Pakistan’s Fintech industry targets both financially educated individuals, such as freelancers and e-commerce businesses, and the unbanked or underbanked population. While Fintech solutions have provided limited access to digital payments, mobile banking, and microfinance for these groups, much work is needed to build credibility and integrate Pakistan into the global Fintech ecosystem. The News (Pakistani newspaper) reported the recent collapse of several Fintech ventures like PayMax, Careem Pay, Checkout, and YAP highlights the significant challenges faced, including data privacy issues, regulatory hurdles, and investor mistrust. Overcoming these obstacles requires Pakistan to enhance its regulatory framework, improve digital literacy, provide financial education, and address cybersecurity concerns.

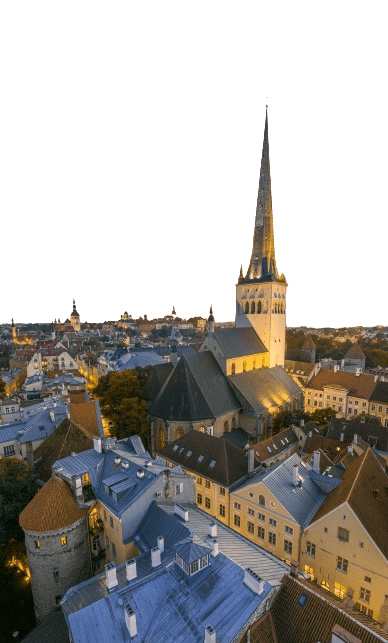

By adopting strategies from successful Fintech ecosystems like Estonia, Singapore; Pakistan can foster innovation, attract international Fintech companies, and achieve broader financial inclusion and economic growth.

Enhancing Digital Literacy and Financial Education in Pakistan

Digital literacy remains a significant challenge hindering the widespread adoption of Fintech in Pakistan. A substantial portion of the population lacks basic digital skills and awareness, which are crucial for effectively leveraging Fintech solutions. To bridge this gap, Pakistan must focus on promoting digital literacy and financial education, particularly among the unbanked and underbanked populations.

Integrating Fintech Education into Schools

One effective strategy is to integrate Fintech education into the secondary school curriculum nationwide. By introducing students to digital financial tools and concepts early on, Pakistan can build a more digitally literate future generation. Examples from other nations can serve as valuable models:

- Estonia: Estonia has successfully integrated digital literacy into its national curriculum. The country includes coding and computer science courses in schools, ensuring that students develop essential digital skills from a young age.

- Singapore: Singapore’s Ministry of Education works closely with Fintech companies to introduce financial literacy programs in schools. These programs cover topics like digital payments, cybersecurity, and personal finance management.

Targeted Awareness Campaigns

In addition to educational reforms, targeted awareness campaigns can play a critical role in promoting digital literacy and financial education among adults. Public service announcements, community workshops, and online tutorials can help demystify Fintech solutions and encourage their use:

- India: The Indian government launched the “Digital India” campaign to educate citizens about digital services, including Fintech. The campaign uses mass media, grassroots outreach, and digital platforms to reach a wide audience.

- Kenya: M-Pesa, one of the most successful mobile money services globally, conducts extensive community outreach programs to teach users how to utilize their platform effectively. Such initiatives have significantly boosted digital financial inclusion.

Public-Private Partnerships

Public-private partnerships can also be instrumental in driving digital literacy and financial education. Collaborative efforts between government bodies, educational institutions, and Fintech companies in Pakistan can create comprehensive training programs and resources:

- United States: The United States has numerous public-private partnerships aimed at improving financial literacy. Programs like “Jump$tart Coalition” bring together government agencies, nonprofit organizations, and businesses to promote financial education among youth.

- UK: The UK’s “Tech City UK” initiative collaborates with Fintech startups to offer digital skills training to various demographics, fostering a culture of innovation and digital competency.

Community-Based Learning Centers

Establishing community-based learning centers where people can access resources and receive training in digital and financial literacy is another effective method. These centers can provide personalized assistance and hands-on experience with Fintech applications:

- South Africa: The “SmartCape” project offers free internet and digital skills training at community libraries, helping residents gain confidence in using digital tools.

- Brazil: Brazil’s “Telecentres” provide free access to computers and the internet, along with digital literacy courses, empowering marginalized communities to participate in the digital economy.

Leveraging Technology for Education

Finally, leveraging technology itself can enhance digital literacy. Online courses, mobile apps, and interactive platforms can make learning more accessible and engaging:

- Australia: Australia’s “Be Connected” programme offers online training modules and resources to help older adults improve their digital skills.

- Philippines: The Philippines’ “Digital Thumbprint Programme” provides mobile-based education on digital literacy and safety, reaching a broad audience through accessible technology.

By adopting and adapting these strategies from other nations, Pakistan can significantly enhance digital literacy and financial education. This will not only drive broader adoption of Fintech solutions but also contribute to economic growth and financial inclusion.

Enhancing Financial Inclusion in Pakistan

According to the World Bank, only about 21% of adults in Pakistan have access to formal financial services. This low level of financial inclusion is partly due to socio-economic barriers and a lack of trust in formal banking systems. To address these challenges, Fintech solutions must be tailored to meet the unique needs of underserved populations, build trust, and provide compelling value propositions. Here are several strategies that Pakistan can adopt to enhance financial inclusion, drawing on successful examples from other nations:

Leveraging Mobile Banking

Mobile banking can be a powerful tool for increasing financial inclusion, particularly in areas with limited access to traditional banking infrastructure.

- Kenya: The success of M-Pesa, a mobile money service, has significantly increased financial inclusion in Kenya. It allows users to deposit, withdraw, transfer money, and pay for goods and services using their mobile phones. Similar mobile banking solutions in Pakistan, such as Easypaisa and JazzCash, should be expanded and optimized to reach even more people.

- Bangladesh: bKash, a mobile financial service, provides a range of services including cash-in/cash-out, remittances, and payments, reaching millions of unbanked people. Adopting and localizing such models can help Pakistan extend banking services to remote areas.

Developing Agent Networks

Expanding agent networks can help bridge the gap between Fintech services and rural or underserved areas where direct access to banks is limited.

- India: The “Business Correspondent” model in India involves appointing agents who act on behalf of banks to offer financial services in remote locations. This has facilitated greater financial inclusion across the country.

- Uganda: Uganda’s mobile money agents play a crucial role in providing financial services and helping to overcome geographical barriers. Pakistan can replicate this strategy by training and deploying local agents to serve as conduits for Fintech services.

Creating Trust and Awareness

Building trust and awareness about Fintech solutions is essential for encouraging adoption among the unbanked population.

- Philippines: The Central Bank of the Philippines has run financial literacy campaigns to educate citizens about the benefits of digital financial services and build trust in the banking system. Pakistan can implement similar campaigns to raise awareness and build confidence in Fintech solutions.

- Mexico: Mexico’s National Financial Education Programme focuses on improving financial literacy through workshops, seminars, and media campaigns, fostering trust in financial institutions.

Customized Product Offerings

Fintech solutions must be designed to meet the specific needs of different segments of the population, especially the underserved.

- Brazil: The government-backed “Caixa Tem” app offers digital savings accounts, microloans, and insurance products tailored to low-income individuals. Pakistan can develop similar customized Fintech products to cater to the unique needs of its diverse population.

- Ghana: Ghana’s “Qwikloan” offers instant, short-term loans via mobile money platforms, addressing the immediate financial needs of users. Fintech companies in Pakistan can introduce comparable microfinance products to support financial resilience.

Government and Policy Support

Strong government support and conducive policies are critical in promoting financial inclusion through Fintech.

- China: The Chinese government’s favourable policies and regulatory environment have supported the rapid growth of digital financial services like Alipay and WeChat Pay, significantly enhancing financial inclusion. Pakistan can work towards creating a supportive policy framework that encourages Fintech innovation and reduces barriers to entry.

- Indonesia: Indonesia’s Financial Services Authority (OJK) has implemented regulations to promote inclusive finance, including Fintech innovations. A similar approach in Pakistan could facilitate the growth of a more inclusive financial ecosystem.

By adopting these strategies and learning from the successes of other nations, Pakistan can significantly enhance financial inclusion. Tailored Fintech solutions, robust agent networks, trust-building initiatives, and supportive policies will help integrate more people into the financial system, driving economic growth and improving livelihoods across the country.

Improving Access to Funds for SMEs

Access to funds or loans remains a significant challenge for Small and Medium-sized Enterprises (SMEs) in Pakistan. Despite contributing substantially to the country’s economy, these businesses often face hurdles when it comes to securing financial support from traditional banks. The main issues include stringent lending criteria, extensive documentation requirements, and the lack of collateral, which many small businesses cannot provide. As a result, SMEs are frequently unable to meet the rigid requirements set by traditional banks, leaving them without essential financial support.

This problem is compounded by the geographical distribution of Pakistan’s population, with a large portion living in rural areas where access to banking services is even more limited. Traditional banks often do not have branches in these remote locations, making it nearly impossible for rural SMEs to apply for loans or financial services.

To address these issues, it is crucial to consider transitioning from physical currency to digital currency. By stopping the use of physical currency and introducing digital currency, Pakistan can bring more people into the formal financial system, enhance transparency, and reduce corruption. To encourage the shift from cash to digital transactions, the government can introduce incentives for both consumers and businesses. Tax benefits, discounts, and rebates for using digital payment methods can spur adoption.

Digital currency can facilitate easier transactions, improve record-keeping, and make it simpler for SMEs to access funding.

- Limited Access to Traditional Banking Services: Leveraging fintech platforms can revolutionize the lending landscape for SMEs. Online lending platforms and peer-to-peer (P2P) lending solutions can facilitate easier access to funds by streamlining the application process and offering more flexible terms. For instance, Funding Circle has demonstrated significant success in providing quick and flexible funding options for SMEs. Funding Circle connects SMEs directly with investors, allowing businesses to access loans at competitive rates without the need for traditional bank intermediaries. And in Pakistan platforms like Finja provide digital financial services tailored to SMEs, enabling them to secure loans without the traditional barriers imposed by banks.

- High Risk Perception: Fintech companies can employ alternative data sources such as transaction history, social media activity, and other digital footprints to assess the creditworthiness of SMEs. This approach can help bridge the gap left by traditional credit scoring models.

Overcoming Regulatory Hurdles in Fintech Pakistan

Navigating the regulatory landscape is one of the most significant challenges for Fintech in Pakistan. Outdated rules and cumbersome compliance requirements create barriers for new entrants and stifle innovation. Furthermore, the lack of a clear framework for emerging technologies like blockchain and cryptocurrencies complicates the environment.

However, by learning from Estonia’s successful strategies, Pakistan can overcome these hurdles and foster a vibrant Fintech ecosystem.

Estonia’s proactive government support established clear, forward-thinking regulations that provide a stable environment for Fintech companies. Pakistan can adopt this approach by establishing dedicated bodies focused on Fintech innovation and updating regulations to accommodate new technologies and business models.

Estonia’s e-Residency program allows global entrepreneurs to establish and manage an EU-based company entirely online. Similarly, Pakistan can simplify administrative procedures and explore digital residency initiatives to attract international Fintech entrepreneurs. Estonia has also invested heavily in digital infrastructure, including the X-Road platform for secure data exchange. By investing in robust digital infrastructure, Pakistan can support secure and scalable digital transactions, enhancing overall efficiency.

By the end of 2022, Estonia had 264 registered Fintech companies, marking a 23% increase from 2020. Despite many being in their nascent stages, the income generated by these Fintech firms reached €400 million in 2022, a 42% increase from the previous year. Nearly all transactions in Estonia are conducted digitally, facilitated by widespread access to digital ID cards and high-quality internet connectivity.

Estonia was an early adopter of blockchain technology, integrating it into public services for enhanced transparency and security. Pakistan can embrace blockchain technology for public services to improve transparency and create a reliable regulatory framework. Continuous collaboration between the Estonian Financial Supervisory Authority and Fintech companies ensures that regulations evolve with technological advancements. Pakistan should foster ongoing dialogue between regulators and Fintech firms to identify pain points and develop supportive regulations. Additionally, Estonia’s introduction of regulatory sandboxes allows startups to test products in a controlled environment under regulatory supervision. Implementing regulatory sandboxes in Pakistan will enable Fintech startups to experiment and innovate within a safe framework.

If we remember the tragic incident of 2023 in Pakistan, where a man named Muhammad Masood borrowed Rs13,000 from an online lender only to find himself in the deteriorated situation as he faced threatening calls from lenders, leading him to borrow from multiple apps until his debts exceeded one million rupees. The threats and blackmail ultimately drove him to suicide. A robust regulatory system could also prevent such predatory lending practices by ensuring fair lending rates, monitoring compliance, and providing a mechanism for redressal.

Estonia’s regulatory framework offers valuable lessons here. The country’s Financial Supervisory Authority works closely with Fintech companies to monitor compliance and prevent predatory lending practices. Estonia also mandates transparent lending terms and fair interest rates, protecting consumers from excessive debt burdens.

By adopting these proven strategies and implementing strong regulatory frameworks similar to Estonia’s, Pakistan can modernize its regulatory environment, balance innovation with oversight, and create a thriving Fintech ecosystem. This approach will not only attract international Fintech companies and support homegrown innovations but also protect consumers from exploitative practices, driving financial inclusion and economic growth.

Overcoming Cybersecurity and Infrastructure Challenges in Pakistan’s Fintech Sector

Cybersecurity and robust digital infrastructure are critical components for the successful deployment and operation of Fintech solutions. In Pakistan, these aspects present significant challenges that need to be addressed to ensure the safety, reliability, and scalability of financial technologies. Cybersecurity threats loom large as Fintech platforms handle sensitive financial data, making them prime targets for cybercriminals.

Inadequate cybersecurity measures can lead to data breaches, financial loss, and erosion of user trust. Additionally, limited internet penetration, inadequate digital payment systems, and unreliable connectivity hinder the widespread adoption of Fintech solutions. A lack of comprehensive cybersecurity regulations and standards further exacerbates the problem, leaving Fintech companies vulnerable to attacks and compromising user data protection.

Drawing on global examples offers viable solutions to these issues. The European Union’s General Data Protection Regulation (GDPR) mandates stringent data protection protocols, ensuring robust security frameworks across industries. Pakistan can implement similar comprehensive data protection laws mandating strong cybersecurity practices, while encouraging Fintech companies in Pakistan to adopt industry-standard encryption, multi-factor authentication, and regular security audits. Public-private partnerships, akin to the United States National Cybersecurity Center of Excellence (NCCoE), can establish a national cybersecurity centre dedicated to Fintech, facilitating knowledge sharing, threat assessments, and secure guidelines.

Investment in digital infrastructure is crucial. China’s widespread investment in 5G technology has significantly enhanced its digital infrastructure, supporting a range of Fintech innovations. Pakistan can follow suit by improving internet penetration and connectivity, especially in rural areas, partnering with telecom companies to expand 4G and 5G networks, and ensuring reliable high-speed internet access for all. Cybersecurity training and awareness are also vital. Singapore’s Cyber Security Agency (CSA) conducts nationwide awareness programmes and professional training to build a skilled cybersecurity workforce. Pakistan can launch similar campaigns targeting businesses and consumers, and develop training programmes and certifications for cybersecurity professionals.

The adoption of blockchain technology can further bolster security and transparency. Estonia uses blockchain to secure its e-governance services, ensuring data integrity and transparency. Pakistan can integrate blockchain into Fintech solutions, promoting the use of decentralized ledgers for secure transactions and data storage. Regulatory sandboxes provide another layer of innovation and security. The UK’s Financial Conduct Authority (FCA) offers regulatory sandboxes for testing innovative cybersecurity solutions in a controlled environment. Pakistan can establish a similar sandbox focused on refining cybersecurity solutions for Fintech, enabling companies to innovate while ensuring compliance with regulatory standards.

By implementing these strategies, Pakistan can strengthen its cybersecurity measures and infrastructure, creating a resilient and trustworthy Fintech ecosystem. This approach will not only protect consumers and businesses but also build confidence in the Fintech sector, driving economic growth and financial inclusion.

Roadmap for Implementation

Policy Development:

- Draft and enact comprehensive data protection and cybersecurity regulations.

- Mandate compliance with international cybersecurity standards for Fintech companies.

Infrastructure Investment:

- Allocate funds for expanding internet coverage and upgrading digital payment systems.

- Partner with telecom providers to roll out 4G and 5G networks nationwide.

Capacity Building:

- Launch cybersecurity awareness campaigns and training programmes.

- Establish cybersecurity certification courses in collaboration with educational institutions.

Industry Collaboration:

- Create a national cybersecurity center focused on Fintech through public-private partnerships.

- Facilitate regular industry forums and workshops to share best practices and emerging threats.

Technology Adoption:

- Promote the integration of blockchain and other advanced technologies for secure Fintech operations.

- Encourage Fintech startups to participate in regulatory sandboxes to test cybersecurity innovations.

By following this roadmap and learning from global examples, Pakistan can effectively address its cybersecurity and infrastructure challenges. Strengthening these areas will not only protect consumers and businesses but also build a resilient and trustworthy Fintech ecosystem that drives economic growth and financial inclusion.

Addressing these challenges requires a multifaceted approach involving educational initiatives, robust cybersecurity measures, regulatory reforms, and infrastructure development. Only then can Pakistan fully realise Fintech’s transformative potential in driving economic growth and financial inclusion.

Next in This Series: Regtech

In the next article, we will discuss about something called Regtech. This stands for “Regulatory Technology.” It’s an exciting area that uses advanced tools like Artificial Intelligence (AI) and machine learning to help with regulatory compliance. In simpler terms, Regtech helps ensure that organizations follow all the rules and regulations more efficiently.

By using these smart technologies, Regtech can make it easier and cheaper for the government to keep track of things and ensure everyone plays by the rules. This means fewer chances for fraud and mistakes and more streamlined processes. We’ll explore how Pakistan can use Regtech to solve its regulatory problems and create a better, more transparent public sector.

Stay tuned to find out how these innovative solutions can significantly improve the management of regulations in Pakistan, making life easier for everyone involved!

Read our previous article in this series: Pakistan’s Digital Dilemma: Unmasking the Staggering Gap Between Lunar Dreams and Ground Realities.

Team Nashfact:

Nabeel Shaikh (aka Nabeil Schaik), Founder of Nashfact, is a seasoned chartered accountant and serial entrepreneur who leverages his extensive experience to support businesses in optimising their financial, technological, and operational strategies. He has been instrumental in turning around numerous businesses.

Ubaid ur Rehman, Editor at Nashfact, brings a wealth of editorial expertise and a keen eye for detail, ensuring that the content delivered is both insightful and well-researched. Together, Nabeil and Ubaid have combined their expertise to craft this series of articles, providing valuable insights on the topic.