- 6 February 2026

- No Comment

- 302

AI vs Human Auditor: Jaw-dropping Truth Revealed

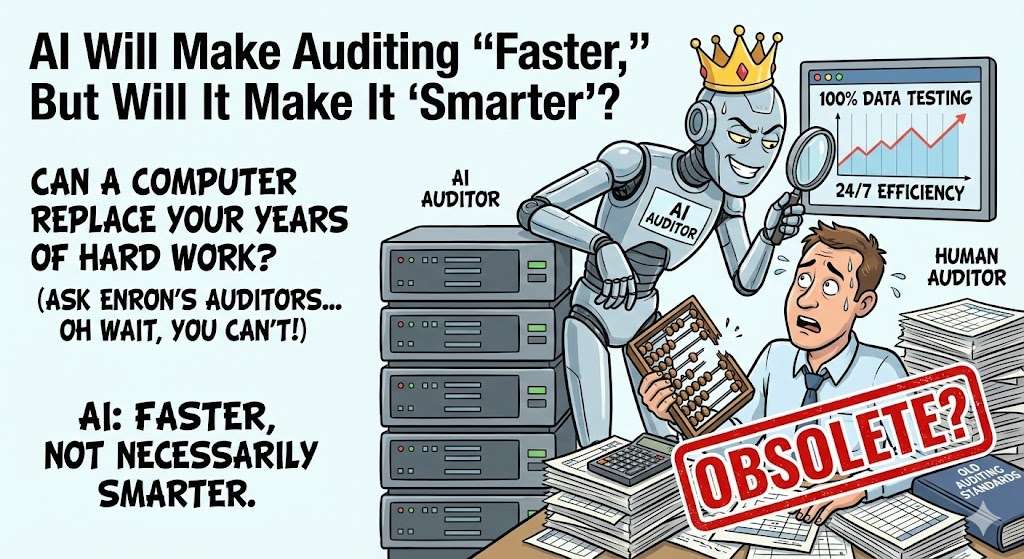

Artificial Intelligence (AI) is all the rage these days. From chatbots to self-driving cars, AI has made its mark in every field. But when it comes to “auditing“, the accounting portion of a company’s accounts, a debate ensues. Can a computer program do what a Chartered Accountant or certified auditor learns over years of hard work?

WHAT IS AUDITING

Auditing isn’t just about checking numbers. Its primary purpose is to determine whether the financial statements (balance sheet, profit and loss) are accurate. This is a trustworthy task. Investors, banks, and governments rely on audit reports to make decisions.

AI AUDITOR

The biggest advantage of AI is its speed. While it might take a human auditor weeks to check thousands of invoices, AI can scan all the data in just a few seconds.

1. 100% Data Testing: Earlier, auditors used to do “sampling” (i.e., check only 50 bills out of 1000). But AI can check 100% of all transactions. This reduces the margin for error.

2. Pattern Recognition: AI recognizes whether a transaction is unusual or not. If there is a sudden expense that hasn’t happened in the last 5 years, AI will immediately raise an alert.

3. Round the Clock: AI never gets tired. It can work 24/7 without a coffee break.

HUMAN AUDITOR

AI lacks the qualities a human possesses. common sense and ethics.

1. Professional Skepticism: An auditor doesn’t just look at data, they also look at people’s intentions. If management is lying, a human can tell from their body language and words, but AI can’t.

2. Judgment Calls: Not everything in business is black and white. Sometimes there are “gray areas” where experience is required to make a decision.

3. Client Relationship: Audits don’t just happen on a computer, there are parties meeting with the client, visiting the factory, and physically counting inventory.

AI VS HUMAN (Psychological and Social Aspect)

A student should also understand that auditing is not just math, it is also a social process.

1. Trust Factor: Shareholders gain trust when they know that a renowned auditor has signed off. An “AI Certified” report may not yet provide the comfort that a human signature does.

2. Fear of Job Displacement: It is true that junior-level jobs (Data Entry, Vouching) are disappearing. However, this is creating “high-level” jobs. Now we need “Audit Technologists” who understand both machines and accounting.

THE GLOBAL PERSPECTIVE

Global firms like Deloitte, PwC, EY, and KPMG (known as the Big 4) are investing heavily in AI.

1. According to a PwC report, AI will not eliminate the auditor’s job but will enhance it. The report says that AI will take over boring and repetitive tasks (data entry, matching) so that the human auditor can focus on difficult and critical issues.

2. KPMG says that “trust” does not come from AI, trust comes from the auditor’s integrity. AI is just a tool, like first there was the calculator, then came Excel, and now there is AI.

3. EY (Ernst & Young) explained in a report that the purpose of AI is not to replace auditors, but to improve their quality. They say that in the past, audits were reactive, that is, errors were discovered after the year ended. However, with the help of AI, audits have become proactive. Monitoring can now occur in real time

Changes in Auditing Standards

International Standards on Auditing (ISA), which sets the principles of auditing worldwide, are now incorporating AI. Earlier, the auditor only provided “Reasonable Assurance,” meaning “a human feels everything is correct.” But now there is a growing demand for auditors to provide a higher level of precision. While AI allows us to test 100% of data, the goal is still to provide ’Enhanced Reasonable Assurance”, as absolute certainty remains practically impossible due to inherent limitations. Because of AI, we are moving away from “Sampling” and toward “Full Population Testing.” This means that the auditor can no longer say, “I couldn’t see all the receipts,” because AI can see everything.

The International Standard on Auditing (ISA) 315 requires the auditor to understand the “entity and its environment.” The new amendments now mention technology and Automated Tools and Techniques (ATT).

TECHNICAL SIDE OF AI

AI is not magic it runs on algorithms. The main types of AI are being used in auditing.

1. Machine Learning (ML): These are systems that learn by looking at past data. If a transaction was marked “Fraud” last year, ML will immediately detect similar transactions this year.

2. Natural Language Processing (NLP): Auditing involves more than just numbers, but also contracts and legal documents. Through NLP, AI can analyze thousands of pages of contracts and determine which contract carries the highest risk.

3. Deep Learning: These are complex neural networks that think like the human brain. These very rarely find errors in data sets that even an experienced auditor might miss.

4. Anomaly Detection: This is the most important part of auditing. The AI algorithm considers the previous year’s data as “normal”. If any transaction this year goes out of that range, the AI marks it as “Anomaly”. For example, if an employee’s salary in the payroll suddenly goes up by 300%, the AI will highlight it immediately.

5. Predictive Analytics: AI not only tells whathappened, but also tells what could happen. If a company’s expenses are growing faster than its revenue, AI may raise questions about “Going Concern” (will the company survive next year?).

6. Cluster Analysis: In this, AI divides similar transactions into groups (clusters). This makes it easier for the auditor to understand

ESG AUDITING AND AI

These days, just accounting for money isn’t enough. The world is moving toward “sustainability.” Companies now also have to demonstrate their environmental impact and their social role. This is called ESG (Environmental, Social, and Governance) auditing.

1. AI’s role: ESG data is often “unstructured”—that is, carbon emissions reports, satellite images, and labor union complaints. Analyzing such diverse data is difficult for a human. AI can scan satellite imagery to determine whether a company has actually planted as many trees as it claims.

2. Role of Human Auditor: Ethics and morality are very important in ESG. AI cannot understand why labor conditions are poor in a particular area or what impact the people there are having. This is where the auditor’s human empathy and judgment come into play.

where the company’s money is going excessively and whether there is any suspicious activity.

HISTORICAL SCANDALS

If we look at the auditing process, there have been several scandals that shook the entire world. These scandals led to stricter auditing laws. The question is, could AI have prevented these frauds?

1. Enron Scandal (USA)

Enron is considered the world’s largest accounting fraud. Its auditors (Arthur Andersen) colluded with management to conceal billions of dollars in debt.

Human Failure: Here, humans were sold out. Auditors abandoned their integrity.

Benefit of AI: If AI had been around at that time, it would have immediately detected “off-balance sheet” transactions. AI cannot be bribed. It only sees logic, and if money is missing, it raises a red flag.

2. Satyam Scandal (India):

The chairman of Satyam showed fake cash in manipulated reports. Fake bank certificates were created.

Benefits of AI: Today’s AI can connect directly to bank servers (via API). It can immediately confirm whether the money is in the bank or not. It is easy to deceive a human, but finding discrepancy between two computer systems is a matter of seconds for AI.

CHALLENGES OF AI

There are some obvious issues in fully integrating AI into auditing.

1. Data Privacy: Companies fear giving their sensitive data to AI software, fearing it might be leaked.

2. Cost of Implementation: Purchasing and operating AI software is a very expensive task for most auditing firms.

3. Standardization: Every company stores its data differently. Integrating AI with various systems (SAP, Oracle, Quickbooks) is a difficult task.

CHALLENGES IN DEVELOPING COUNTRIES

We’ve discussed everything, but is this possible in countries like Pakistan or India?

1. Unorganised Data: Many of our companies still operate on registers or outdated accounting software. AI requires “clean data.” Unless data is digital, AI will fail.

2. Lack of Training: In our countries, students are still subjected to outdated auditing methods. Data science is not included in the curriculum.

3. Resistance to Change: Older Chartered Accountants and managers are afraid to adopt technology. They feel they will lose their grip.

CAN AI REPLACE HUMAN AUDITOR

Today’s world is a world of technology. With each passing day, we see machines taking over human jobs. First came machines in agriculture, then robots in factories, and now Artificial Intelligence (AI) has taken over white-collar jobs like accounting and auditing. As students, when we start CA or other graduation, the first question that comes to our mind is: “Will machines have taken over my job by the time I graduate?”

THE ANSWER

No, at least not today, at least not for the next few decades. The reason is that auditing is a legal requirement. If AI makes a mistake, you can’t jail the machine or fine it. The responsibility always lies with the human who signs the audit report. As students, we must understand that the future belongs to those who know how to use AI. If you’re an auditor and don’t know how to use AI, you might be left behind. But if you make AI your partner, you can become a “Super Auditor.”

FUTURE OF AUDIT

We currently conduct a “Year-End Audit” (at the end of the year). In the future, there will be “Continuous Auditing.” AI will be connected to the company’s systems at all times. As soon as a mistake is made, an email will be sent to the foreign auditor. This will prevent frauds before they cause any significant damage.

COMMON MYTHS

Myth 1: AI never makes mistakes. The truth is that if there’s a mistake in the algorithm, AI will make millions of mistakes in a second. This is what they call “Garbage In, Garbage Out.”

Myth 2: Auditor jobs will be eliminated. The truth is that auditor jobs will be “shifted,” not eliminated. Auditors will now move from “Data Entry” to “Decision Maker.”

Myth 3: AI is very expensive. Initially, it’s expensive, but in the long run, it saves companies millions of rupees by preventing mistakes

CONCLUSION

The biggest truth of this whole discussion is that AI will not replace Chartered Accountants, rather a CA using AI will replace the CA who runs away from technology.

Partner, Not Competitor: AI is not our enemy but a “Super Assistant”. It will take care of boring and tiring tasks (vouching, verification) so that we can focus our minds on complex decisions and “Professional Skepticism”.

The Power of Signature: Machines can only provide data, but only a human can provide legal responsibility and “Trust” for that data. As long as the law needs a responsible person, the profession is not facing extinction, but an evolution.

Adaptability is Key: For students like us, the key is not to be limited to old books. The future belongs to those who understand both Accounting and Data Analytics.

Integrity and Ethics: Fraud is not just about numbers, but about intentions. AI cannot discern intentions; it can only see patterns. Therefore, human ethics will always be the foundation of auditing.

Final Word: AI will make auditing “faster,” but it is the auditor who will make it “smarter.” We shouldn’t fear AI; we should ride it and “future-proof” our careers.

Author: Syed Asim Raza

Level: CAF (ICAP)

This article is submitted by the author as part of the Nashfact National Writing Competition. Views expressed are the author’s own.